Answered step by step

Verified Expert Solution

Question

1 Approved Answer

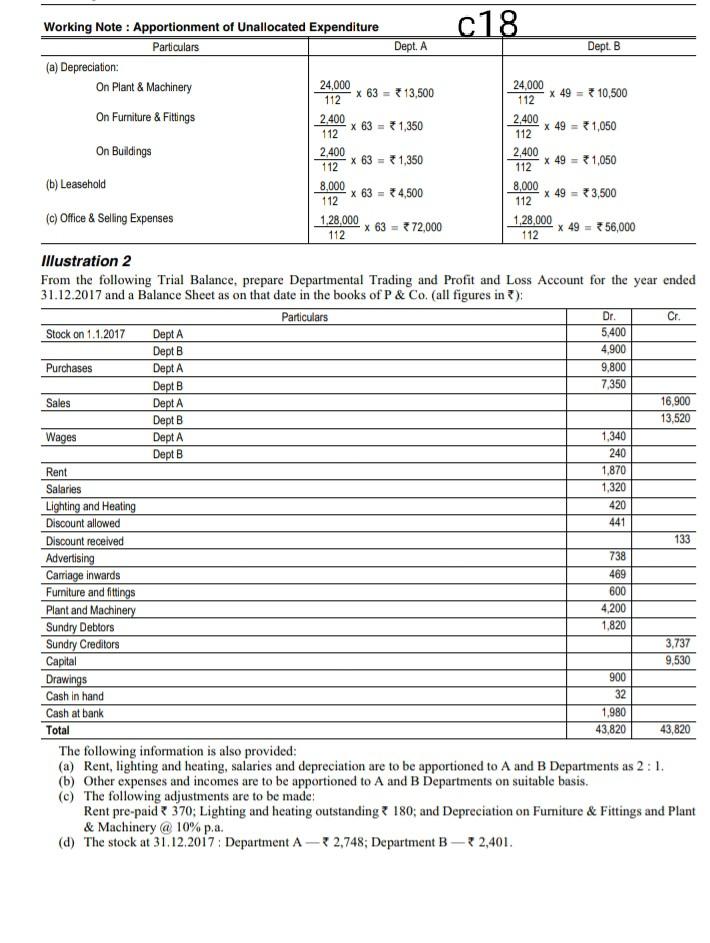

Working Note : Apportionment of Unallocated Expenditure c18 Particulars Dept. A Dept. B (a) Depreciation: On Plant & Machinery 24,000 24,000 112 x 63 =

Working Note : Apportionment of Unallocated Expenditure c18 Particulars Dept. A Dept. B (a) Depreciation: On Plant & Machinery 24,000 24,000 112 x 63 = 13,500 x 49 = 10,500 112 On Furniture & Fittings 2.400 2,400 x 63 = 1,350 * 49 = 1,050 112 112 On Buildings 2,400 2,400 112 x 63 = 1,350 * 49 = 1,050 112 (b) Leasehold 8.000 8,000 x 63 = 4,500 x 49 = 3,500 112 112 (c) Office & Selling Expenses 1,28,000 1,28,000 112 x 63 = 372,000 x 49 = 56,000 112 Illustration 2 From the following Trial Balance, prepare Departmental Trading and Profit and Loss Account for the year ended 31.12.2017 and a Balance Sheet as on that date in the books of P & Co. (all figures in ): Particulars Dr. Cr. Stock on 1.1.2017 Dept A 5,400 Dept B 4,900 Purchases Dept A 9,800 Dept B 7,350 Sales Dept A 16,900 Dept B 13,520 Wages Dept A 1,340 Dept B 240 Rent 1,870 Salaries 1,320 Lighting and Heating 420 Discount allowed 441 Discount received 133 Advertising 738 Carriage inwards 469 Furniture and fittings 600 Plant and Machinery 4,200 Sundry Debtors 1,820 Sundry Creditors 3,737 Capital 9,530 Drawings 900 Cash in hand 32 Cash at bank 1,980 Total 43,820 43,820 The following information is also provided: (a) Rent, lighting and heating, salaries and depreciation are to be apportioned to A and B Departments as 2:1. (b) Other expenses and incomes are to be apportioned to A and B Departments on suitable basis. (c) The following adjustments are to be made: Rent pre-paid 370; Lighting and heating outstanding 180; and Depreciation on Furniture & Fittings and Plant & Machinery @ 10%p.a. (d) The stock at 31.12.2017: Department A -2,748; Department B-22,401

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started