Answered step by step

Verified Expert Solution

Question

1 Approved Answer

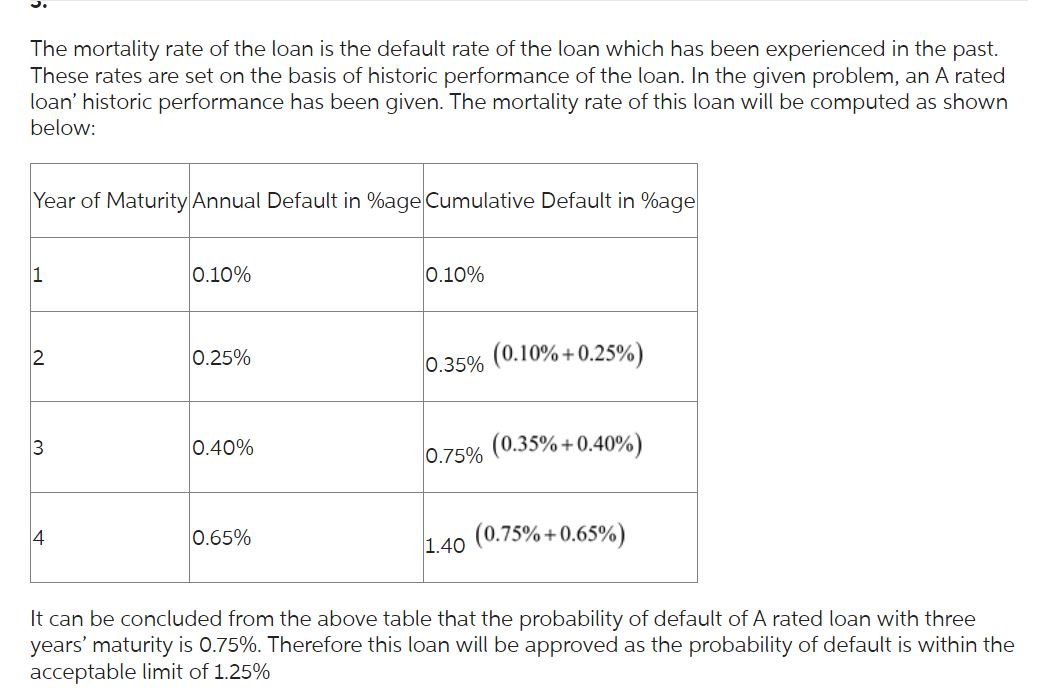

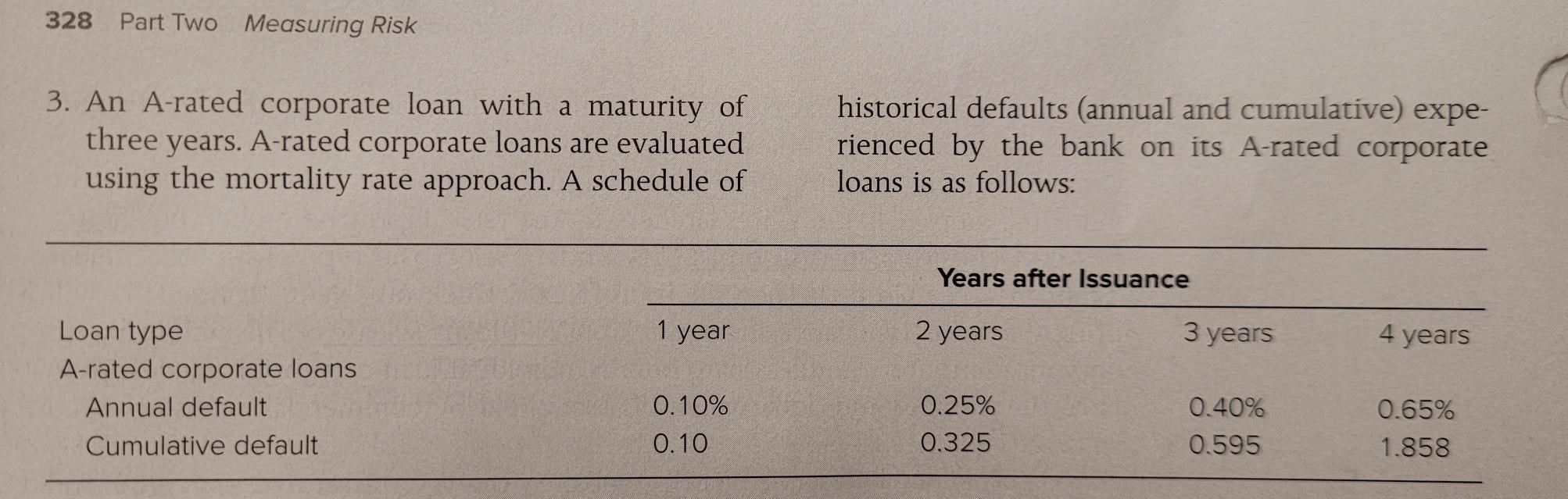

Working on Financial Institutions Management (10th ed) Mini case for chapter 10. For question 3 I have values printed in the book than what are

Working on Financial Institutions Management (10th ed) Mini case for chapter 10. For question 3 I have values printed in the book than what are given in the Chegg-supplied answer. I don't understand how these numbers reconcile. The numbers from the text (second photo) in the cumulative row don't seem to sum as the answer supplied by Chegg indicate they should. Please help!

Working on Financial Institutions Management (10th ed) Mini case for chapter 10. For question 3 I have values printed in the book than what are given in the Chegg-supplied answer. I don't understand how these numbers reconcile. The numbers from the text (second photo) in the cumulative row don't seem to sum as the answer supplied by Chegg indicate they should. Please help!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started