Answered step by step

Verified Expert Solution

Question

1 Approved Answer

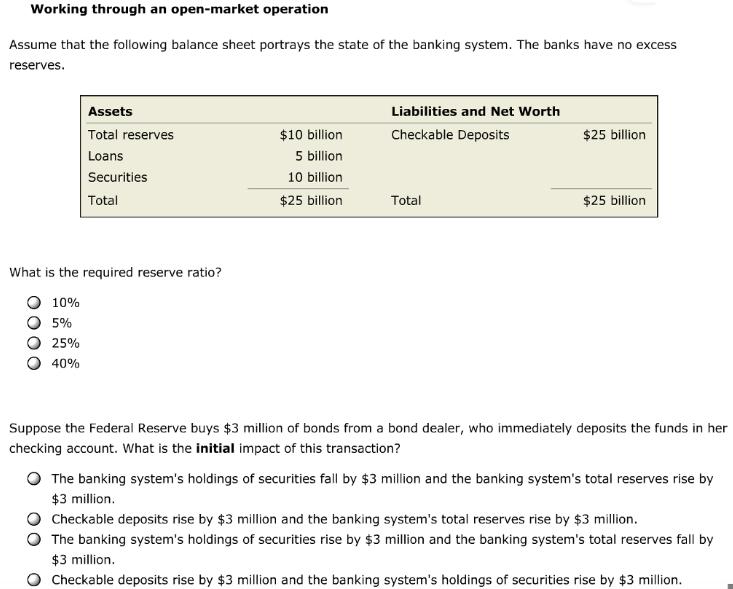

Working through an open-market operation Assume that the following balance sheet portrays the state of the banking system. The banks have no excess reserves.

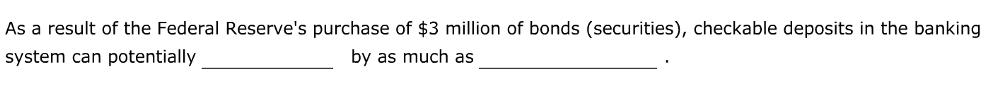

Working through an open-market operation Assume that the following balance sheet portrays the state of the banking system. The banks have no excess reserves. Assets Total reserves Loans Securities Total What is the required reserve ratio? 10% 5% 25% 40% $10 billion 5 billion 10 billion $25 billion Liabilities and Net Worth Checkable Deposits Total $25 billion $25 billion Suppose the Federal Reserve buys $3 million of bonds from a bond dealer, who immediately deposits the funds in her checking account. What is the initial impact of this transaction? The banking system's holdings of securities fall by $3 million and the banking system's total reserves rise by $3 million. Checkable deposits rise by $3 million and the banking system's total reserves rise by $3 million. The banking system's holdings of securities rise by $3 million and the banking system's total reserves fall by $3 million. Checkable deposits rise by $3 million and the banking system's holdings of securities rise by $3 million. As a result of the Federal Reserve's purchase of $3 million of bonds (securities), checkable deposits in the banking system can potentially by as much as

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The required reserve ratio can be calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started