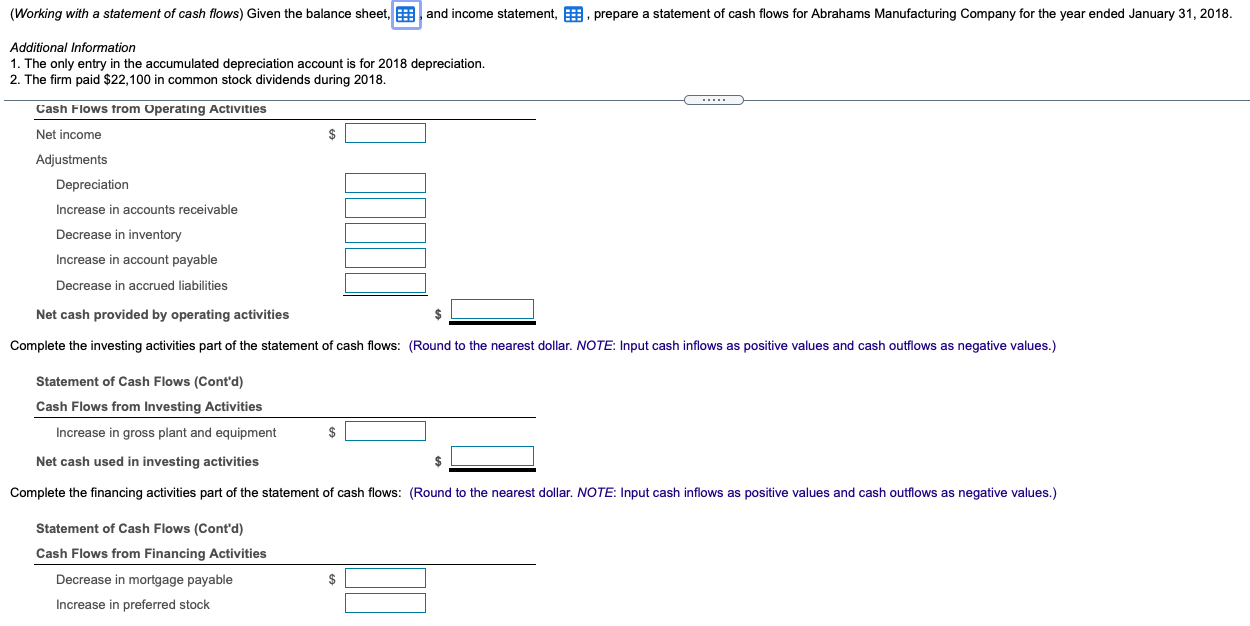

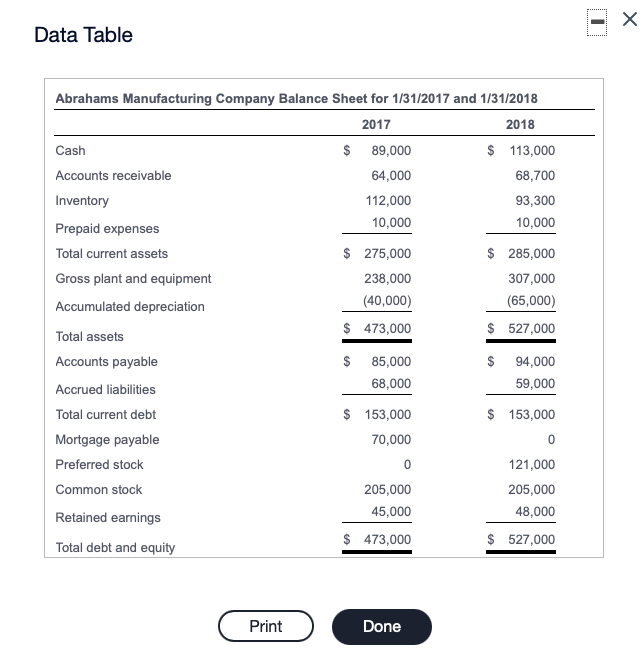

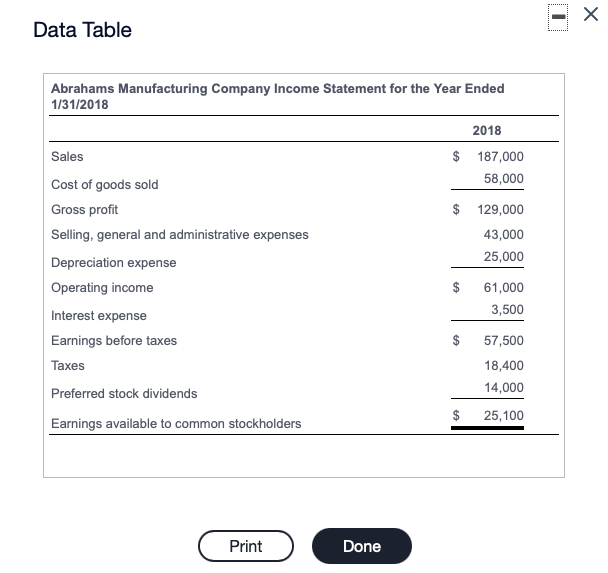

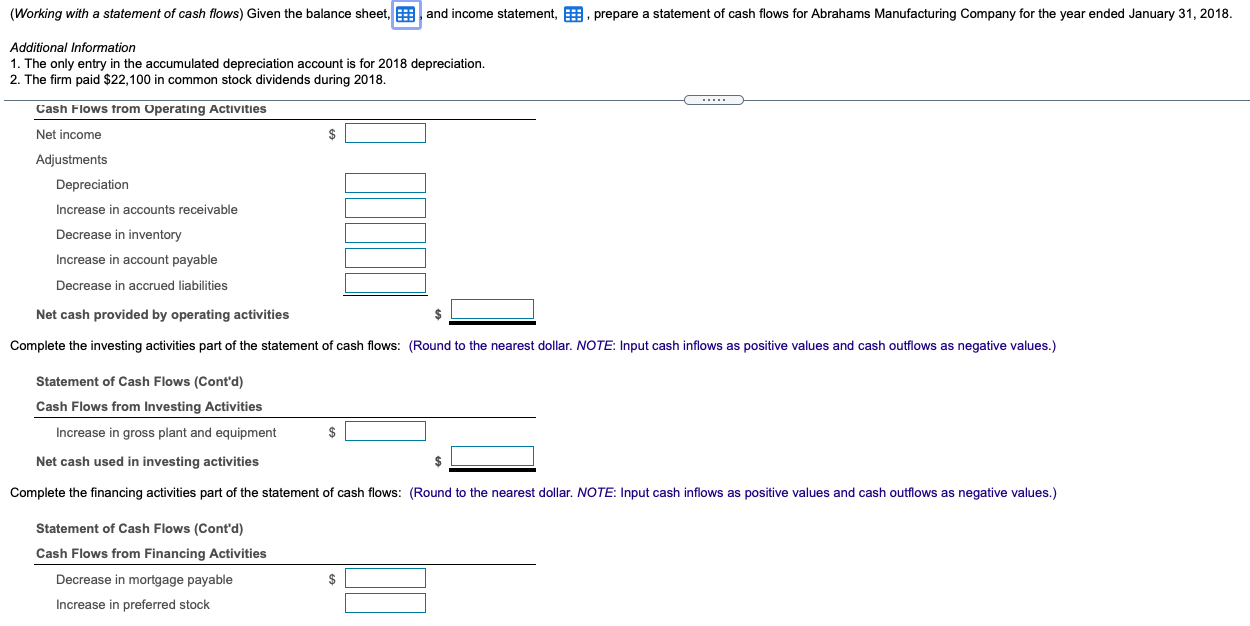

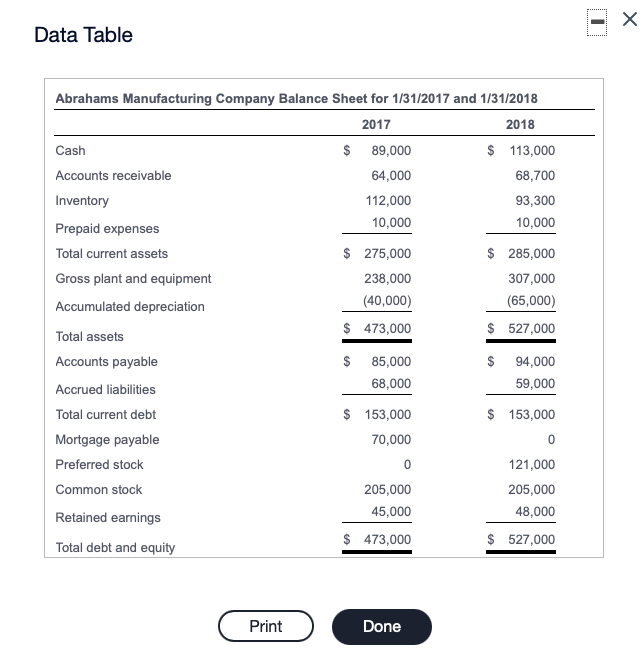

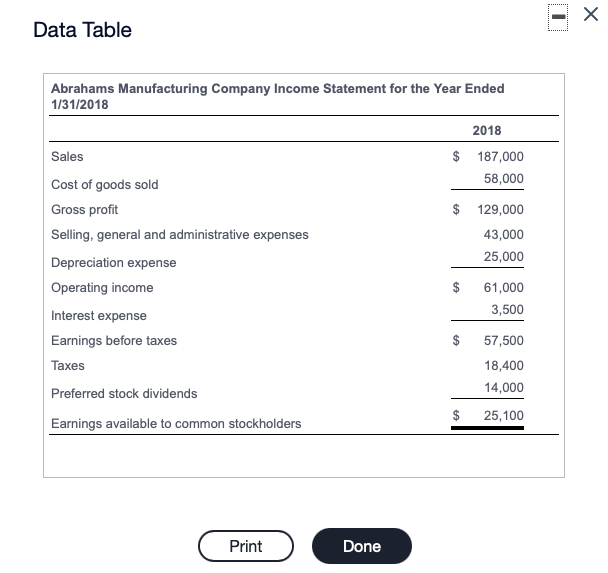

(Working with a statement of cash flows) Given the balance sheet, and income statement, prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended January 31, 2018. Additional Information 1. The only entry in the accumulated depreciation account is for 2018 depreciation. 2. The firm paid $22,100 in common stock dividends during 2018. Cash Flows from Operating Activities Net income $ Adjustments Depreciation Increase in accounts receivable Decrease in inventory Increase in account payable Decrease in accrued liabilities Net cash provided by operating activities Complete the investing activities part of the statement of cash flows: (Round to the nearest dollar. NOTE: Input cash inflows as positive values and cash outflows as negative values.) Statement of Cash Flows (Cont'd) Cash Flows from Investing Activities Increase in gross plant and equipment $ Net cash used in investing activities $ Complete the financing activities part of the statement of cash flows: (Round to the nearest dollar. NOTE: Input cash inflows as positive values and cash outflows as negative values.) Statement of Cash Flows (Cont'd) Cash Flows from Financing Activities Decrease in mortgage payable Increase in preferred stock $ Data Table Abrahams Manufacturing Company Balance Sheet for 1/31/2017 and 1/31/2018 2017 2018 Cash $ 89,000 $ 113,000 Accounts receivable 64,000 68,700 Inventory 112,000 93,300 Prepaid expenses 10,000 10,000 Total current assets $ 275,000 $ 285,000 Gross plant and equipment 238,000 307,000 Accumulated depreciation (40,000) (65,000) $ 473,000 $ 527,000 Total assets Accounts payable $ 85,000 $ 94,000 Accrued liabilities 68,000 59,000 Total current debt $ 153,000 $ 153,000 Mortgage payable 70,000 0 Preferred stock 0 121,000 Common stock 205,000 205,000 Retained earnings 45,000 48,000 $ 473,000 $ 527,000 Total debt and equity Print Done - Data Table Abrahams Manufacturing Company Income Statement for the Year Ended 1/31/2018 2018 Sales $ 187,000 Cost of goods sold 58,000 Gross profit $ 129,000 Selling, general and administrative expenses 43,000 Depreciation expense 25,000 Operating income $ 61,000 Interest expense 3,500 Earnings before taxes 57,500 Taxes 18,400 Preferred stock dividends 14,000 $ 25,100 Earnings available to common stockholders $ Print Done