Answered step by step

Verified Expert Solution

Question

1 Approved Answer

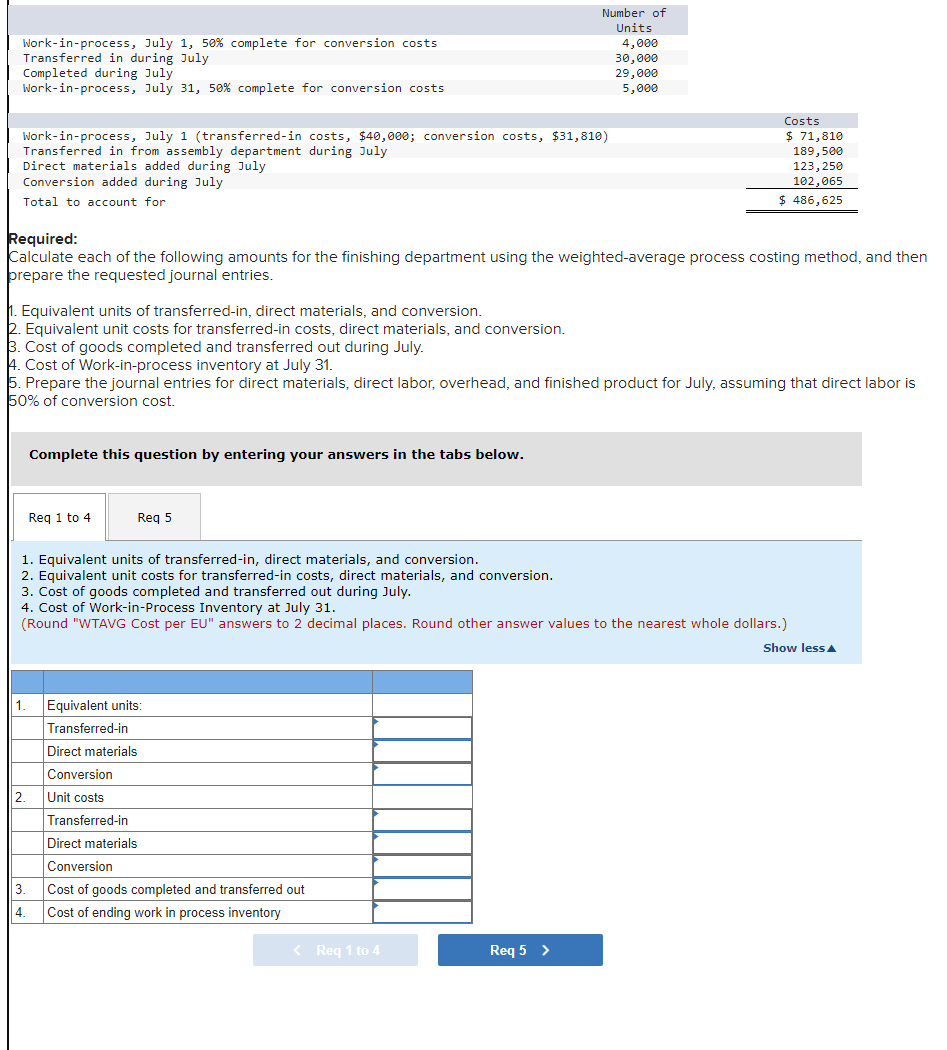

Work-in-process, July 1, 50% complete for conversion costs Number of Units Transferred in during July Completed during July Work-in-process, July 31, 50% complete for

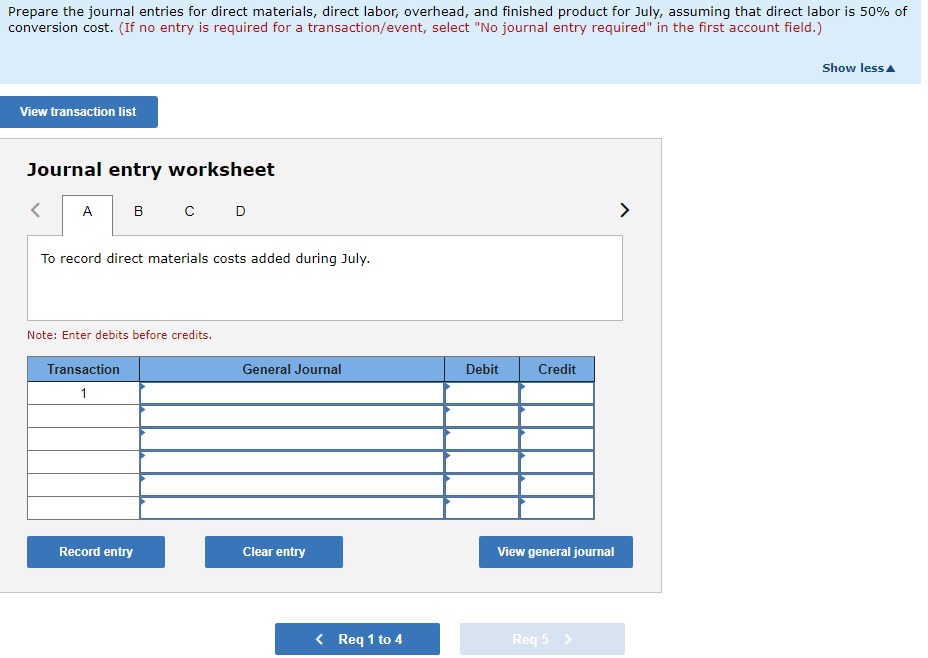

Work-in-process, July 1, 50% complete for conversion costs Number of Units Transferred in during July Completed during July Work-in-process, July 31, 50% complete for conversion costs 4,000 30,000 29,000 5,000 Work-in-process, July 1 (transferred-in costs, $40,000; conversion costs, $31,810) Transferred in from assembly department during July Direct materials added during July Conversion added during July Total to account for Required: Costs $ 71,810 189,500 123,250 102,065 $ 486,625 Calculate each of the following amounts for the finishing department using the weighted-average process costing method, and then prepare the requested journal entries. 1. Equivalent units of transferred-in, direct materials, and conversion. 2. Equivalent unit costs for transferred-in costs, direct materials, and conversion. 3. Cost of goods completed and transferred out during July. 4. Cost of Work-in-process inventory at July 31. 5. Prepare the journal entries for direct materials, direct labor, overhead, and finished product for July, assuming that direct labor is 50% of conversion cost. Complete this question by entering your answers in the tabs below. Req 1 to 4 Req 5 1. Equivalent units of transferred-in, direct materials, and conversion. 2. Equivalent unit costs for transferred-in costs, direct materials, and conversion. 3. Cost of goods completed and transferred out during July. 4. Cost of Work-in-Process Inventory at July 31. (Round "WTAVG Cost per EU" answers to 2 decimal places. Round other answer values to the nearest whole dollars.) 1. Equivalent units: Transferred-in Direct materials Conversion 2. Unit costs Transferred-in Direct materials Conversion 3. Cost of goods completed and transferred out 4. Cost of ending work in process inventory < Req 1 to 4 Req 5 > Show less Prepare the journal entries for direct materials, direct labor, overhead, and finished product for July, assuming that direct labor is 50% of conversion cost. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet A B C D To record direct materials costs added during July. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal < Req 1 to 4 Req 5 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started