Answered step by step

Verified Expert Solution

Question

1 Approved Answer

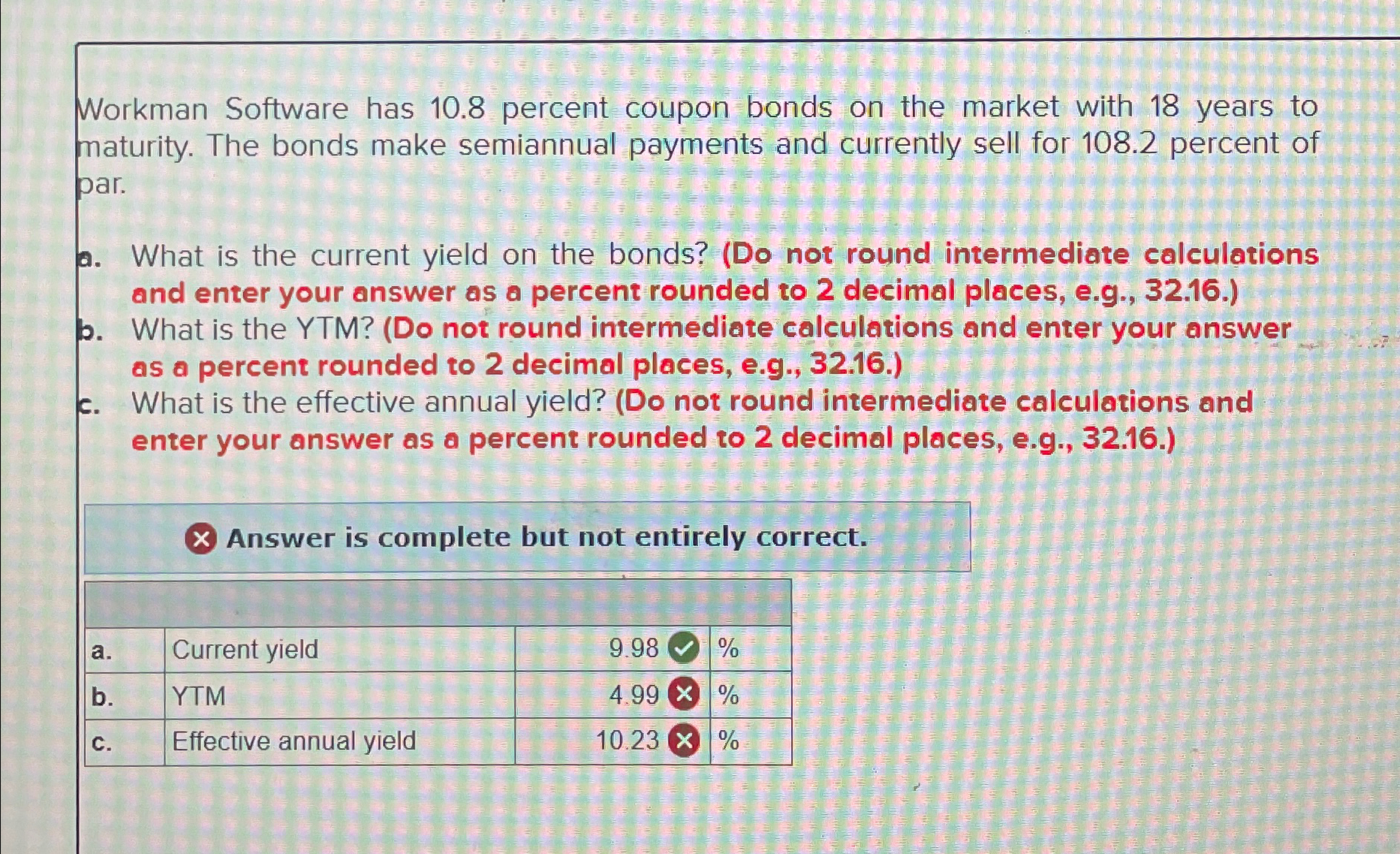

Workman Software has 1 0 . 8 percent coupon bonds on the market with 1 8 years to maturity. The bonds make semiannual payments and

Workman Software has percent coupon bonds on the market with years to maturity. The bonds make semiannual payments and currently sell for percent of par.

a What is the current yield on the bonds? Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

b What is the YTMDo not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

c What is the effective annual yield? Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

Answer is complete but not entirely correct.

tableaCurrent yield,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started