Answered step by step

Verified Expert Solution

Question

1 Approved Answer

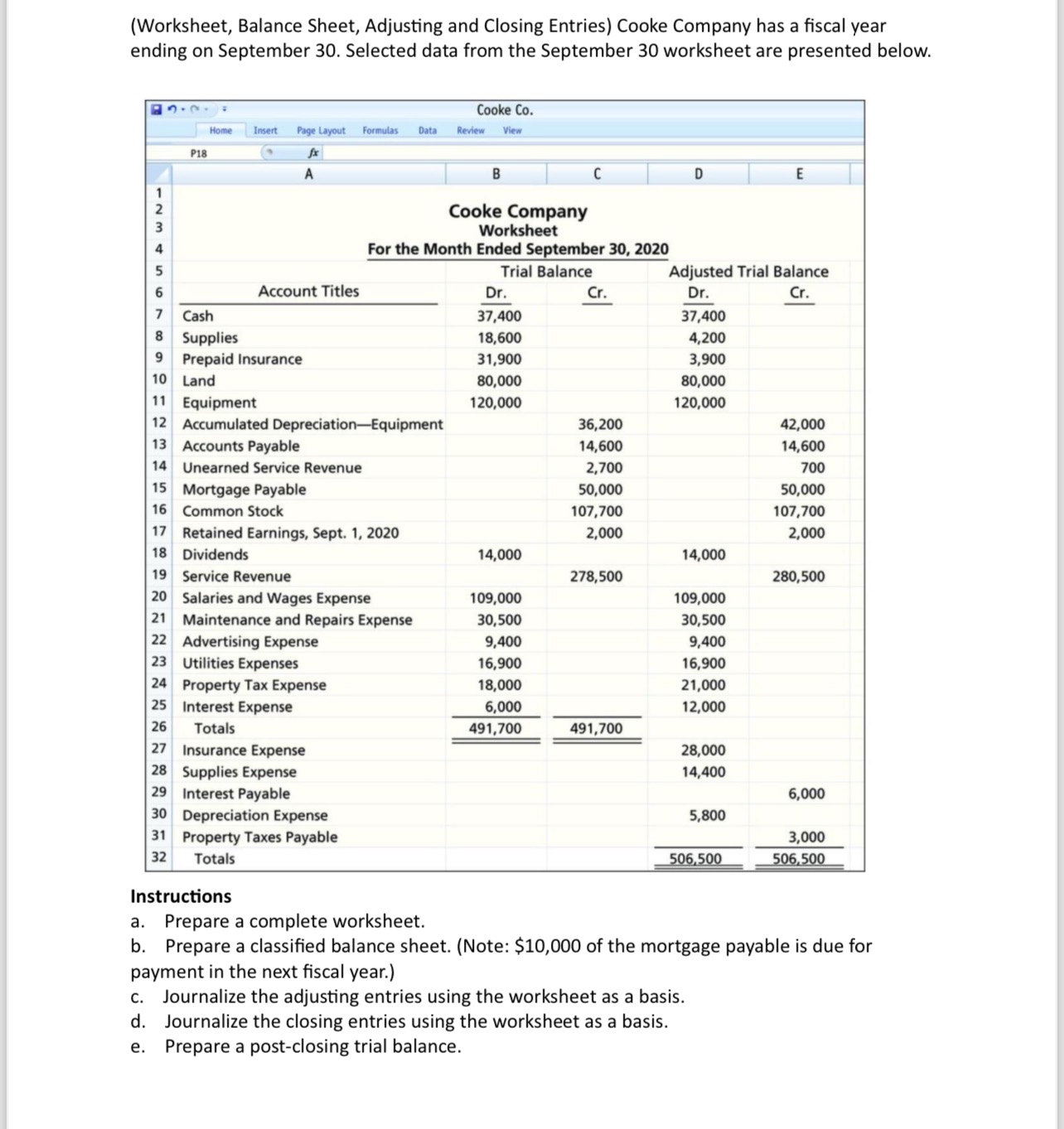

( Worksheet , Balance Sheet, Adjusting and Closing Entries ) Cooke Company has a fiscal year ending on September 3 0 . Selected data from

Worksheet Balance Sheet, Adjusting and Closing Entries Cooke Company has a fiscal year ending on September Selected data from the September worksheet are presented below.

tableancCooke CoHome Insert,Page Layout formulas,Review View,ViewPABCDE

tablefcacecbaaabbced

tableCooke CompanyWorksheetFor the Month Ended September Account Titles,Trial Balance,Adjusted Trial BalanceDrDrCash,,Supplies,,Prepaid Insurar,,Land,,Equipment,,Accumulated DpreciationEquipment,,Accounts Payal,,,Unearned Serv,ce Revenue,,Mortgage Paya,,,Common Stock,,,Retained Earni,gs Sept. Dividends,,Service Revenu,,,Salaries and Wges Expense,Maintenance aId Repairs Expense,Advertising Exense,Utilities Expens,,Property Tax Epense,Interest Expens,,Totals,,Insurance Expe,,,,Supplies Expen,,,,Interest PayabDepreciation Epense,,,Property Taxes,Payable,,,,Totals,,,,

Instructions

a Prepare a complete worksheet.

b Prepare a classified balance sheet. Note: $ of the mortgage payable is due for payment in the next fiscal year.

c Journalize the adjusting entries using the worksheet as a basis.

d Journalize the closing entries using the worksheet as a basis.

e Prepare a postclosing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started