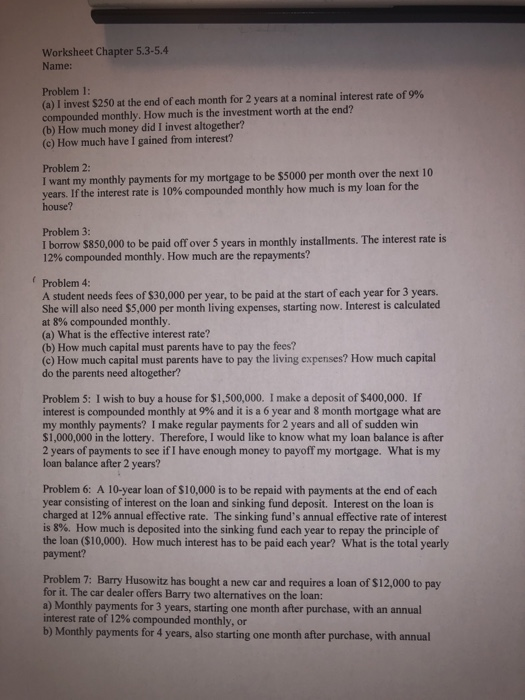

Worksheet Chapter 53-5.4 Name: Problem 1: (a) I invest $250 at the end of each month for 2 years at a nominal interest rate of 9% compounded monthly. How much is the investment worth at the end? (b) How much money did I invest altogether? (c) How much have I gained from interest? Problem 2: I want my monthly payments for my mortgage to be $5000 per month over the next 10 years, if the interest rate is 10% compounded monthly how much is my loan for the house? Problem 3: I borrow $850,000 to be paid off over 5 years in monthly installments. The interest rate is compounded monthly. How much are the repayments? Problem 4: A student needs fees of $30,000 per year, to be paid at the start of each year for 3 years. She will also need $5,000 per month living expenses, starting now. Interest is calculated at 8% compounded monthly (a) What is the effective interest rate? (b) How much capital must parents have to pay the fees? (c) How much capital must parents have to pay the living expenses? How much capital do the parents need altogether? Problem 5: I wish to buy a house for $1,500,000. I make a deposit of $400,000. If interest is compounded monthly at 9% and it is a 6 year and 8 month mortgage what are my monthly payments? I make regular payments for 2 years and all of sudden win $1,000,000 in the lottery. Therefore, I would like to know what my loan balance is after 2 years of payments to see if I have enough money to payoff my mortgage. What is my loan balance after 2 years? Problem 6: A 10-year loan of $10,000 is to be repaid with payments at the end of each year consisting of interest on the loan and sinking fund deposit. Interest on the loan is charged at 12% annual effective rate. The sinking fund's annual effective rate of interest is 8%. How much is deposited into the sinking fund each year to repay the principle of the loan ($10,000). How much interest has to be paid each year? What is the total yearly Problem 7: Barry Husowitz has bought a new car and requires a loan of $12,000 to pay for it. The car dealer offers Barry two alternatives on the loan: a) Monthly payments for 3 years, starting one month after purchase, with an annual interest rate of 12% compounded monthly, or b) Monthly payments for 4 years, also starting one month after purchase, with annual