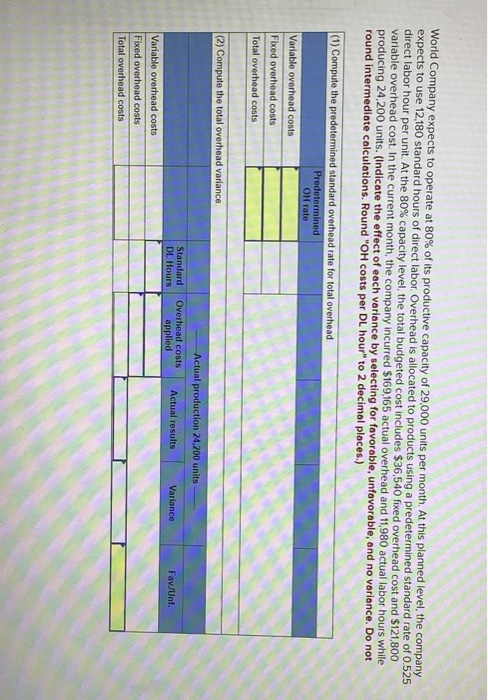

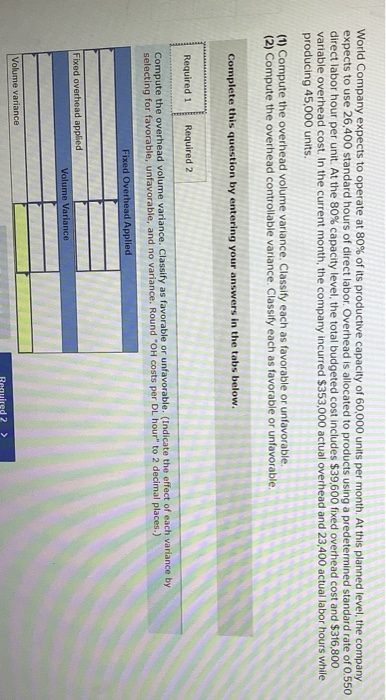

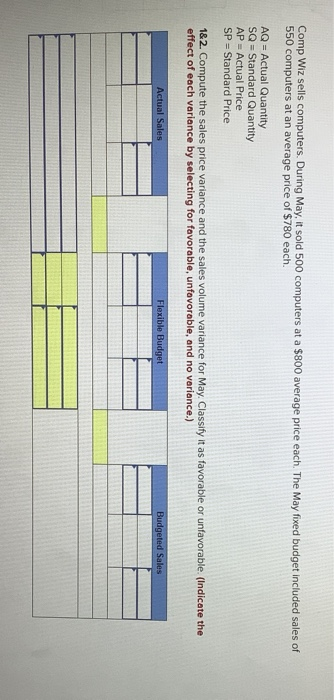

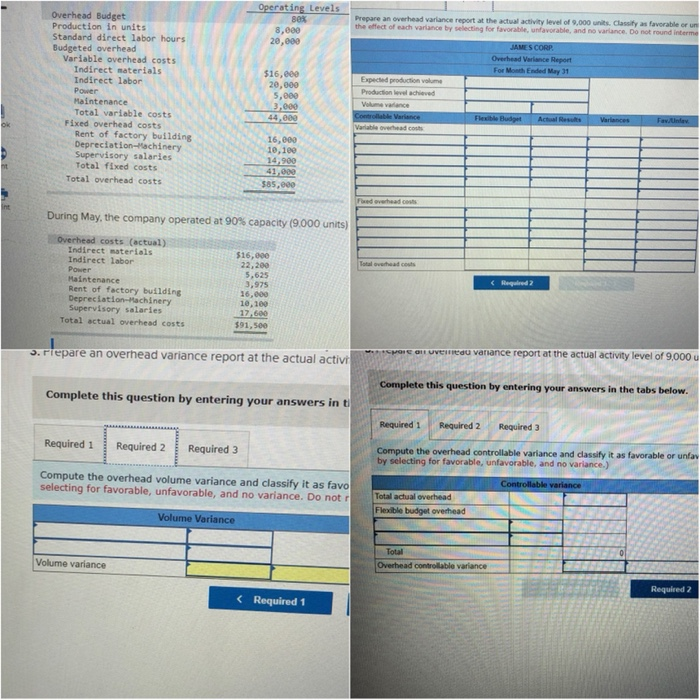

World Company expects to operate at 80% of its productive capacity of 29.000 units per month. At this planned level, the company expects to use 12,180 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate of 0.525 direct labor hour per unit. At the 80% capacity level, the total budgeted cost includes $36,540 fixed overhead cost and $121,800 variable overhead cost. In the current month, the company incurred $169,165 actual overhead and 11,980 actual labor hours while producing 24,200 units. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round intermediate calculations. Round "OH costs per DL hour" to 2 decimal places.) (1) Compute the predetermined standard overhead rate for total overhead. Predetermined OH rate Variable overhead costs Fixed overhead costs Total overhead costs (2) Compute the total overhead variance Standard DL Hours Actual production 24,200 units Overhead costs Actual results Variance applied Fav./Unf. Variable overhead costs Fixed overhead costs Total overhead costs World Company expects to operate at 80% of its productive capacity of 60,000 units per month. At this planned level, the company expects to use 26,400 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate of 0.550 direct labor hour per unit. At the 80% capacity level, the total budgeted cost includes $39,600 fixed overhead cost and $316,800 variable overhead cost. In the current month, the company incurred $353,000 actual overhead and 23,400 actual labor hours while producing 45,000 units. (1) Compute the overhead volume variance Classify each as favorable or unfavorable. (2) Compute the overhead controllable variance Classify each as favorable or unfavorable Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the overhead volume variance. Classify as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Round "OH costs per DL hour" to 2 decimal places.) Fixed Overhead Applied Fixed overhead applied Volume Variance Volume variance Comp Wiz sells computers. During May, it sold 500 computers at a $800 average price each. The May fixed budget included sales of 550 computers at an average price of $780 each. AQ - Actual Quantity SQ = Standard Quantity AP Actual Price SP = Standard Price 1&2. Compute the sales price variance and the sales volume variance for May. Classify it as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Actual Sales Flexible Budget Budgeted Sales Operating Levels sex 8,000 20,000 Prepare an overhead variance report at the actual activity level of 9,000 units. Classify as favorable or un the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round interme JAMES CORP Overhead Variance Report For Month Ended May 31 Overhead Budget Production in units Standard direct labor hours Budgeted overhead Variable overhead costs Indirect materials Indirect labor Power Maintenance Total variable costs Fixed overhead costs Rent of factory building Depreciation-achinery Supervisory salaries Total fixed costs Total overhead costs $16,000 20,000 5,000 3,000 44,000 Expected production volume Production level achieved Volume variance Control Variance Variable overhead costs Flexible Budget Actual Results Variances OK Fav. Unde 16,000 10,100 14,900 41.000 585,000 ht Fedoverhead costs int During May, the company operated at 90% capacity (9.000 units) Total head out Overhead costs (actual) Indirect materials Indirect labor Power Maintenance Rent of factory building Depreciation Machinery Supervisory salaries Total actual overhead costs