Answered step by step

Verified Expert Solution

Question

1 Approved Answer

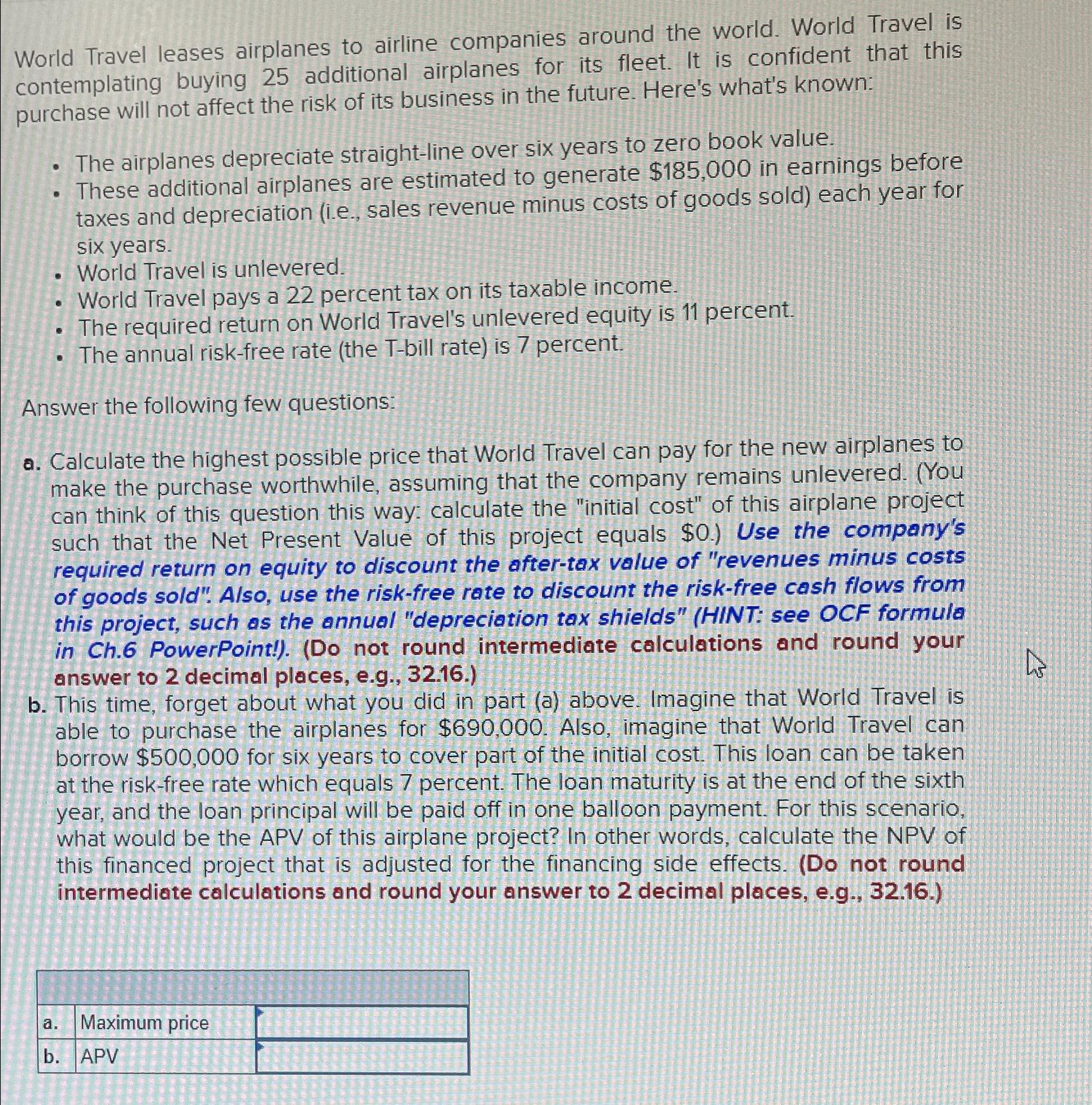

World Travel leases airplanes to airline companies around the world. World Travel is contemplating buying 2 5 additional airplanes for its fleet. It is confident

World Travel leases airplanes to airline companies around the world. World Travel is contemplating buying additional airplanes for its fleet. It is confident that this purchase will not affect the risk of its business in the future. Here's what's known:

The airplanes depreciate straightline over six years to zero book value.

These additional airplanes are estimated to generate $ in earnings before taxes and depreciation ie sales revenue minus costs of goods sold each year for six years.

World Travel is unlevered.

World Travel pays a percent tax on its taxable income.

The required return on World Travel's unlevered equity is percent.

The annual riskfree rate the Tbill rate is percent.

Answer the following few questions:

a Calculate the highest possible price that World Travel can pay for the new airplanes to make the purchase worthwhile, assuming that the company remains unlevered. You can think of this question this way: calculate the "initial cost" of this airplane project such that the Net Present Value of this project equals $ Use the company's required return on equity to discount the aftertax value of "revenues minus costs of goods sold". Also, use the riskfree rate to discount the riskfree cash flows from this project, such os the annual "depreciation tax shields" HINT: see OCF formula in Ch PowerPointlDo not round intermediate calculations and round your answer to decimal places, eg

b This time, forget about what you did in part a above. Imagine that World Travel is able to purchase the airplanes for $ Also, imagine that World Travel can borrow $ for six years to cover part of the initial cost. This loan can be taken at the riskfree rate which equals percent. The loan maturity is at the end of the sixth year, and the loan principal will be paid off in one balloon payment. For this scenario, what would be the APV of this airplane project? In other words, calculate the NPV of this financed project that is adjusted for the financing side effects. Do not round intermediate calculations and round your answer to decimal places, eg

a Maximum price

b APV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started