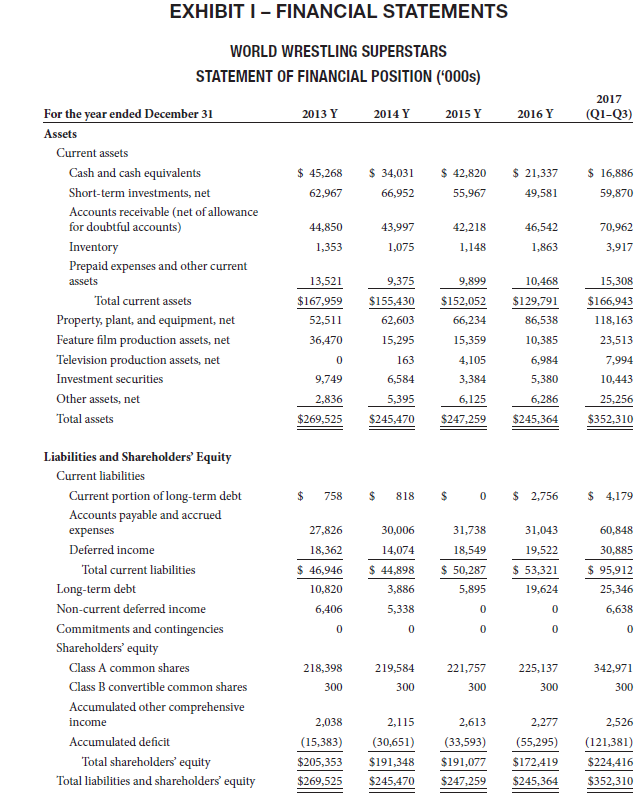

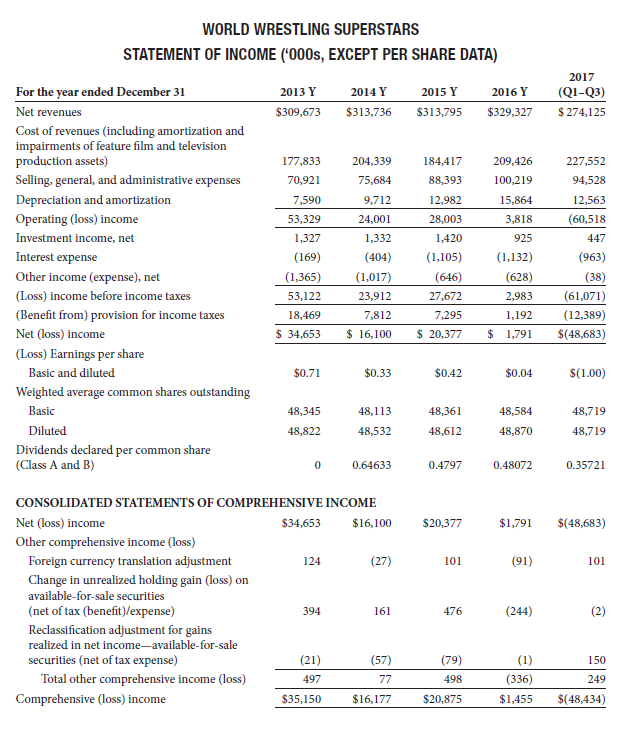

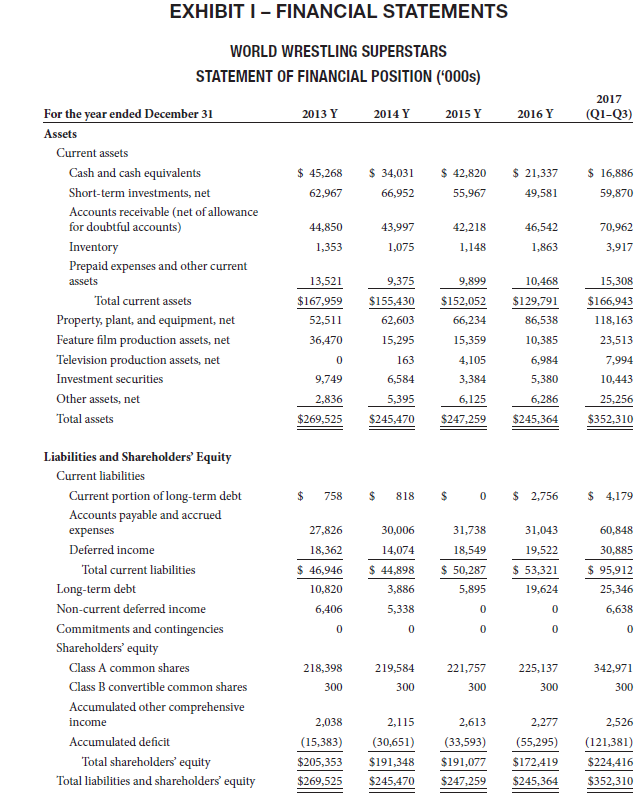

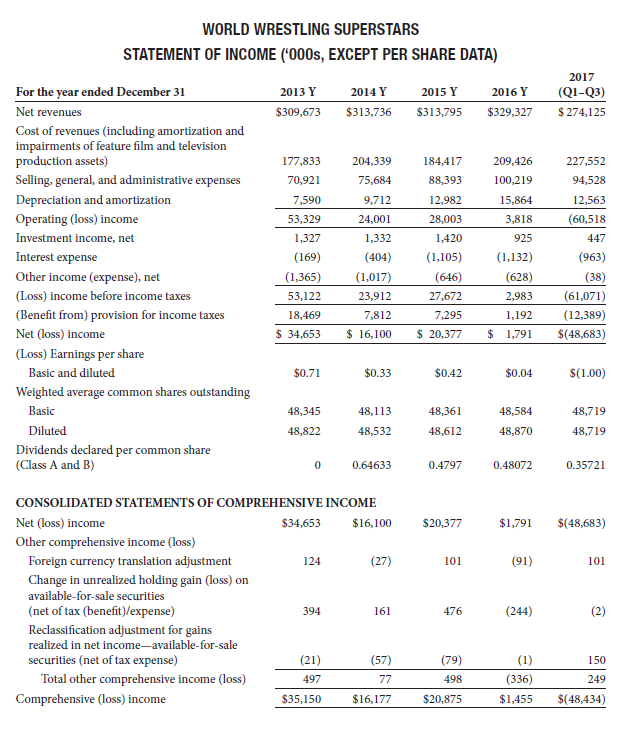

World Wrestling Superstars World Wrestling Superstars (WWS) is a large, multinational entertainment company that delivers wrestling content year-round to a global audience. WWS delivers its content through various media, such as cable television, pay-per-view (PPV), the Internet, and books. WWS's mission statement is: To be an international leader in the creation and delivery of wresting-related entertainment content across various platforms. WWS started out in 1965 as a small, regional wrestling company in Calgary, Alberta. WWS hosted live wrestling events in various cities in Alberta. Generally, the company would rely upon Canadian wrestling talent, occasionally attracting a large headlining superstar from the United States or Japan. In 1975, WWS expanded to offer live shows across Canada. The company's big break came in 1981 when it landed a televi- sion deal to broadcast its wrestling program once a week, live from various locations across Canada. The television deal led to a more international audience and a rapid expansion into the United States. WWS experienced significant growth during the 1980s and early 1990s. However, the company felt some growing pains during the mid-1990s when the general public began to suspect that wrestling was staged. At this point, the company decided to rebrand itself as an entertainment company, as opposed to a competitive wrestling company. WWS was open about the fact that the wrestling matches were staged, and instead focused on detailed storylines, extreme wrestling stunts, and comedic characters. In addition, wws immediately embraced the Internet as a means of delivering content and connecting with its audiences. In 2004, WWS went public and is now traded on the Toronto and New York stock exchanges. The company has experienced steady growth since the Internet era, and its share price has reflected the strong performance. After years of strong performance, fiscal 2017 appears to be ushering in a new period of challenges. Transition from pay-per-view events to Internet subscription speciality programming, the continual chal- lenge posed by Internet piracy, and drug scandals have begun to take their toll on the company. In addition, new companies are beginning to challenge WWS's status as an industry leader. The most challenging issue has been the company's development and launch of the WWS Network (WWSN). WWSN is a monthly subscription-based speciality channel that provides subscribers with 24/7 access to WWS material. WWSN is available through most cable providers, WWS's website, or a mobile app. Subscribers pay $9.99 per month for WWSN, and can cancel any time after a minimum of six months. WWSN offers subscriber access to the monthly PPV events, and therefore, WWSN subscribers reduce the number of PPV purchases. After spending significant amounts to develop the WWSN technology and acquire additional content to build up historical libraries, the network launched during the most recent fiscal quarter. Analysts were con- cerned with the low number of subscribers and the backlash from cable providers about losing PPV revenue. Some cable providers have threatened to drop WWS content due to the competition provided by WWSN. The market has punished WWS's share price for the preliminary poor results from the launch of WWSN. The shares are down 16% from their all-time high of $42 per share since the third-quarter financial state- ments were released. Further declines, of up to 50% of the market capitalization, are expected if analysts consensus earnings estimates for the fiscal year are not achieved. The poor performance of the WWSN has resulted in a corporate shake-up, and many of the executive- level management team has resigned. The CEO, Barry Heart, has recently hired you as the new CFO. Barry is the company's founder and visionary. He is expecting that analysts' expectations will be met once fourth quarter earnings are released. Barry hands you the WWS's previous four years of annual financial statements, along with the financial results for the first three quarters of this fiscal year, 2017 (Exhibit I). Barry has received a report from the accounting group that shows fourth-quarter profit (after taxes) of $40.5 million. However, the figures do not include the impacts of various accounting issues. Barry provides you with a file of outstanding accounting issues as prepared by the previous CFO before his resignation (Exhibit II) that have yet to be reflected in fourth-quarter earnings. Barry would you like you to prepare a report that provides a recommendation for the appropriate treat- ment of each accounting issue. In addition, Barry would like you to provide an estimate for annual earnings per share. Analysts are expecting the annual EPS to be $0.05 per share. Required Prepare the report for Barry. Note that the company's marginal tax rate is 26.4% and the discount rate for discounting cash flows is 4%. ACC1304 - Group Assignment 1 1. Identify the User (s), Use(s) of your report 2. Identify any applicabe constraint(s) 3. Identify 4 issues that should be included in your report 4. For each issue identified, explain why it is relevant and what might be the impact(s) 5. For each issue identified, provide two options for WWS. Justify your answers. 6. For each issue identified and of the two options identified in question 5, please recommend one option. Justify your answers EXHIBITI - FINANCIAL STATEMENTS WORLD WRESTLING SUPERSTARS STATEMENT OF FINANCIAL POSITION ('000s) 2017 For the year ended December 31 2013 Y 2014 Y 2015 Y 2016 Y (Q1-Q3) Assets Current assets Cash and cash equivalents $ 45,268 $ 34,031 $ 42,820 $ 21,337 $ 16,886 Short-term investments, net 62,967 66,952 55,967 49,581 59,870 Accounts receivable (net of allowance for doubtful accounts) 44,850 43,997 42,218 46,542 70,962 1,353 1,075 1,148 1,863 3,917 Inventory Prepaid expenses and other current assets 13,521 9,375 9,899 10,468 15,308 Total current assets $167,959 $155,430 $152,052 $129,791 $166,943 52,511 62,603 66,234 86,538 118,163 Property, plant, and equipment, net Feature film production assets, net Television production assets, net 36,470 15,295 15,359 10,385 23,513 0 163 4,105 6,984 7,994 Investment securities 9,749 6,584 3,384 5,380 10,443 Other assets, net 2,836 5,395 6,125 6,286 25,256 Total assets $269,525 $245,470 $247,259 $245,364 $352,310 Liabilities and Shareholders' Equity Current liabilities $ 758 $ 818 $ 0 $ 2,756 $ 4,179 Current portion of long-term debt Accounts payable and accrued expenses 27,826 30,006 31,738 31,043 60,848 Deferred income 18,362 14,074 18,549 19,522 30,885 Total current liabilities $ 46,946 $ 44,898 $ 50,287 $ 53,321 $ 95,912 Long-term debt 10,820 3,886 5,895 19,624 25,346 Non-current deferred income 6,406 5,338 0 0 6,638 0 0 0 0 0 Commitments and contingencies Shareholders' equity Class A common shares 218,398 219,584 221,757 225,137 342,971 Class B convertible common shares 300 300 300 300 300 Accumulated other comprehensive income 2,038 2,115 2,613 2,277 2,526 Accumulated deficit (15,383) (30,651) (33,593) (55,295) (121,381) $205,353 $191,348 $191,077 $172,419 $224,416 Total shareholders' equity Total liabilities and shareholders' equity $269,525 $245,470 $247,259 $245,364 $352,310 WORLD WRESTLING SUPERSTARS STATEMENT OF INCOME ('000s, EXCEPT PER SHARE DATA) 2017 For the year ended December 31 2013 Y 2014 Y 2015 Y 2016 Y (Q1-Q3) Net revenues $309,673 $313,736 $313,795 $329,327 $ 274,125 177,833 204,339 184,417 209,426 227,552 Cost of revenues (including amortization and impairments of feature film and television production assets) Selling, general, and administrative expenses Depreciation and amortization Operating (loss) income Investment income, net 70,921 75,684 88,393 100,219 94,528 7,590 9,712 12,982 15,864 12,563 53,329 24,001 28,003 3,818 (60,518 1,327 1,332 1,420 925 447 Interest expense (169) (404) (1,105) (1,132) (963) Other income (expense), net (1,365) (1,017) (646) (628) (38 (Loss) income before income taxes 53,122 23,912 27,672 2,983 (61,071) 18,469 7,812 7,295 1,192 (12,389) (Benefit from) provision for income taxes Net (loss) income $ 34,653 $ 16,100 $ 20,377 $ 1,791 $(48,683) (Loss) Earnings per share Basic and diluted $0.71 $0.33 $0.42 $0.04 $(1.00) Weighted average common shares outstanding Basic 48,345 48,113 48,361 48,584 48,719 Diluted 48,822 48,532 48,612 48,870 48,719 Dividends declared per common share (Class A and B) 0 0.64633 0.4797 0.48072 0.35721 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Net (loss) income $34,653 $16,100 $20,377 $1,791 $(48,683) 124 (27) 101 (91) 101 394 161 476 (244) ( (2) Other comprehensive income (loss) Foreign currency translation adjustment Change in unrealized holding gain (loss) on available-for-sale securities (net of tax (benefit)/expense) Reclassification adjustment for gains realized in net income-available-for-sale securities (net of tax expense) Total other comprehensive income (loss) Comprehensive (loss) income (21) (57) (79) (1) 150 497 77 498 (336) 249 $35,150 $16,177 $20,875 $1,455 $(48,434) LANDIT "-ADVITIUIVAL INT UNIVITIVI WWS Network Subscriptions In the third quarter of 2017, WWS launched the WWSN and 496,668 paid subscribers signed up to receive the service. The breakdown of new subscribers over the three months in the third quarter is as follows: Month 1 Month 2 Month 3 Total 372,501 99,334 24,833 496,668 Subscribers pay $9.99 at the beginning of each month, and must purchase a minimum of six months of service. Subscribers who cancel before the minimum six-month period are charged a cancellation fee equal to the number of remaining months to reach the minimum time period times the monthly fee. In addition to the monthly fee, subscribers can purchase additional content on a PPV basis. Each month features a unique program that can be purchased for $2.99. For example, the first three months of content featured a documentary on the history of WWS, a backstage look at WWS, and a documentary on WWS's largest superstars. A total of 72,251 PPV items were purchased during the third quarter. Television Contract During the third quarter, WWS reached a new agreement with the Japan Sports Channel (JSC) whereby JSC will be the exclusive provider of WWS's flagship weekly episodic wrestling program in Japan for the next three years. The agreement was signed with JSC at the beginning of month two and was effective immedi- ately. JSC has already begun broadcasting WWS content on its network. The terms of the agreement require WWS to provide JSC with weekly wrestling content in exchange for a $3-million upfront fee, and an annual royalty of $0.75 per viewer. The third quarter has seen approximately 1.3 million viewers; however, the actual number of viewers will be determined by Japan's television rating agency. It could take up to six months to determine the exact number of viewers. Feature Film and Television Productions The following is the breakdown of the feature film and television production intangible assets ('000): Feature film productions $ 9,640 Television productions $3,357 In release 3,292 1,918 Completed but not released In production In development 8,650 2,719 1,881 0 $23,463 $7,994 The feature film productions are movies and documentaries developed by WWS for distribution through WWSN, DVD sales, PPV, or online downloads. The in release" and "completed but not released" categories are expected to generate annual revenues of a total of $3.5 million annually over the next five years (for both the feature film and television categories combined, respectively). The in production" category for feature film productions includes WWS's portion of the development costs of a new Hollywood movie featuring a former WWS heavyweight champion and a big movie star. The movie is expected to debut in the fourth quarter of 2017, and WWS is entitled to receive 3.5% of gross revenues from the movies but must incur $1.5 million in advertising fees in each of the next two years. The movie is expected to earn gross revenues of $360 million over a two-year period, with 75% earned in the 2018 fiscal year. The "in development" category includes two documentaries that are currently being developed for re- lease in the 2018 fiscal year. One documentary showcases the rise to stardom of Chris Francios, a former EXHIBIT II (CONTINUED) - ADDITIONAL INFORMATION WWS heavyweight champion. The second documentary features Barry Heart's journey in taking WWS from a small, regional wrestling company to a large, multinational entertainment company. Each documen- tary represents half of the total development costs. The television productions consist of episodic series. The amounts capitalized include development costs, production costs, overhead costs, and employee salaries. The in production costs are related to a new program being created to run every Thursday night that features young and up-and-coming wrestlers. The program is called "Are You Strong Enough?" Barry is hopeful that this new program will be a hit. The "in release and completed but not released categories of television products are expected to generate annual revenues of $1,750,000 in each of the next four years. Legal Proceeding WWS has been sued by Crazy-Man Steve Ostroski, a former wrestler with WWS. Crazy-Man is a four-time heavyweight champion, and a fan favourite. Crazy-Man left WWS after a heated contract dispute. Now, he is suing WWS for royalties related to his characters and name's use in digital and movie content. Crazy-Man had a unique contract with WWS that allowed him to retain ownership and creative control over his name and character. WWS lawyers are trying to settle the case for $500,000. If WWS loses, it may be required to pay a 5% royalty on all content sold that includes Crazy-Man's name or character. The following is a listing of the content that includes Crazy-Man's name: Title Selling Price Expected Units Sold Number of Years Units Will Be Sold Over $14.99 125,000 $34.99 175,000 Documentary: Wrestling with Scars Video game: WWS 2017 Coffee table book: WWS Legends Feature film: The Warrior Three years One year Four years Two years $29.99 280,000 $19.99 135,000 There is a 50% chance that Crazy-Man will settle for $500,000. Steroid Use Allegations Recently, the wrestling industry has received some negative attention. Many wrestlers have passed away at very young ages and in tragic manners. The past quarter has been especially challenging as former WWS superstar Chris Francios went on a crime spree. Chris's legal defence is arguing that his time with WWS led to excessive head injuries and the use of steroids and other narcotics that have significantly impacted his mental state. WWS has not been named in any lawsuit thus far, but national media has picked up the story, resulting in much negative publicity. There is also a rumour that there could be some level of government investigation regarding the use of narcotics in the industry and excessive numbers of wrestler deaths. Barry Heart is clearly concerned about this issue. Investment Securities At the end of the third quarter, WWS made an investment in a regional wrestling company (Total Wrestling Action, TWA). WWS paid $5 million for a 9% stake in TWA. The two wrestling companies are planning to work together to share wrestling talent, co-promote events, and share other resources. WWS sees TWA as a developmental company that can provide much-needed new talent to WWS's main roster of superstars. WWS has the ability to elect 3 of the 10 board members. Currently, Barry and two other WWS execu- tives are sitting on TWA's board. As of its third quarter of 2017, TWA's fair value was estimated to be $5.2 million. TWA earned income of $8.5 million during the third quarter, and paid dividends of $1 million. The investment is currently reported at its cost basis as part of the investment securities. Long-Term Debt On March 1, WWS issued long-term debt in the form of a bond with a face value of $7 million. The bonds were issued at par and have a coupon rate and market rate of 5%. The bonds pay interest semi-annually and mature after 10 years. The company's management believes that interest rates will increase in the next few years as the econo- my begins to accelerate and inflation becomes more of a concern. Accordingly, WWS management is plan- ning to redeem the bonds within a two-to three-year period and therefore it elected to measure the bonds at fair value. The first interest payment has been made. The market yield for similar bonds at year end was 4.11%. World Wrestling Superstars World Wrestling Superstars (WWS) is a large, multinational entertainment company that delivers wrestling content year-round to a global audience. WWS delivers its content through various media, such as cable television, pay-per-view (PPV), the Internet, and books. WWS's mission statement is: To be an international leader in the creation and delivery of wresting-related entertainment content across various platforms. WWS started out in 1965 as a small, regional wrestling company in Calgary, Alberta. WWS hosted live wrestling events in various cities in Alberta. Generally, the company would rely upon Canadian wrestling talent, occasionally attracting a large headlining superstar from the United States or Japan. In 1975, WWS expanded to offer live shows across Canada. The company's big break came in 1981 when it landed a televi- sion deal to broadcast its wrestling program once a week, live from various locations across Canada. The television deal led to a more international audience and a rapid expansion into the United States. WWS experienced significant growth during the 1980s and early 1990s. However, the company felt some growing pains during the mid-1990s when the general public began to suspect that wrestling was staged. At this point, the company decided to rebrand itself as an entertainment company, as opposed to a competitive wrestling company. WWS was open about the fact that the wrestling matches were staged, and instead focused on detailed storylines, extreme wrestling stunts, and comedic characters. In addition, wws immediately embraced the Internet as a means of delivering content and connecting with its audiences. In 2004, WWS went public and is now traded on the Toronto and New York stock exchanges. The company has experienced steady growth since the Internet era, and its share price has reflected the strong performance. After years of strong performance, fiscal 2017 appears to be ushering in a new period of challenges. Transition from pay-per-view events to Internet subscription speciality programming, the continual chal- lenge posed by Internet piracy, and drug scandals have begun to take their toll on the company. In addition, new companies are beginning to challenge WWS's status as an industry leader. The most challenging issue has been the company's development and launch of the WWS Network (WWSN). WWSN is a monthly subscription-based speciality channel that provides subscribers with 24/7 access to WWS material. WWSN is available through most cable providers, WWS's website, or a mobile app. Subscribers pay $9.99 per month for WWSN, and can cancel any time after a minimum of six months. WWSN offers subscriber access to the monthly PPV events, and therefore, WWSN subscribers reduce the number of PPV purchases. After spending significant amounts to develop the WWSN technology and acquire additional content to build up historical libraries, the network launched during the most recent fiscal quarter. Analysts were con- cerned with the low number of subscribers and the backlash from cable providers about losing PPV revenue. Some cable providers have threatened to drop WWS content due to the competition provided by WWSN. The market has punished WWS's share price for the preliminary poor results from the launch of WWSN. The shares are down 16% from their all-time high of $42 per share since the third-quarter financial state- ments were released. Further declines, of up to 50% of the market capitalization, are expected if analysts consensus earnings estimates for the fiscal year are not achieved. The poor performance of the WWSN has resulted in a corporate shake-up, and many of the executive- level management team has resigned. The CEO, Barry Heart, has recently hired you as the new CFO. Barry is the company's founder and visionary. He is expecting that analysts' expectations will be met once fourth quarter earnings are released. Barry hands you the WWS's previous four years of annual financial statements, along with the financial results for the first three quarters of this fiscal year, 2017 (Exhibit I). Barry has received a report from the accounting group that shows fourth-quarter profit (after taxes) of $40.5 million. However, the figures do not include the impacts of various accounting issues. Barry provides you with a file of outstanding accounting issues as prepared by the previous CFO before his resignation (Exhibit II) that have yet to be reflected in fourth-quarter earnings. Barry would you like you to prepare a report that provides a recommendation for the appropriate treat- ment of each accounting issue. In addition, Barry would like you to provide an estimate for annual earnings per share. Analysts are expecting the annual EPS to be $0.05 per share. Required Prepare the report for Barry. Note that the company's marginal tax rate is 26.4% and the discount rate for discounting cash flows is 4%. ACC1304 - Group Assignment 1 1. Identify the User (s), Use(s) of your report 2. Identify any applicabe constraint(s) 3. Identify 4 issues that should be included in your report 4. For each issue identified, explain why it is relevant and what might be the impact(s) 5. For each issue identified, provide two options for WWS. Justify your answers. 6. For each issue identified and of the two options identified in question 5, please recommend one option. Justify your answers EXHIBITI - FINANCIAL STATEMENTS WORLD WRESTLING SUPERSTARS STATEMENT OF FINANCIAL POSITION ('000s) 2017 For the year ended December 31 2013 Y 2014 Y 2015 Y 2016 Y (Q1-Q3) Assets Current assets Cash and cash equivalents $ 45,268 $ 34,031 $ 42,820 $ 21,337 $ 16,886 Short-term investments, net 62,967 66,952 55,967 49,581 59,870 Accounts receivable (net of allowance for doubtful accounts) 44,850 43,997 42,218 46,542 70,962 1,353 1,075 1,148 1,863 3,917 Inventory Prepaid expenses and other current assets 13,521 9,375 9,899 10,468 15,308 Total current assets $167,959 $155,430 $152,052 $129,791 $166,943 52,511 62,603 66,234 86,538 118,163 Property, plant, and equipment, net Feature film production assets, net Television production assets, net 36,470 15,295 15,359 10,385 23,513 0 163 4,105 6,984 7,994 Investment securities 9,749 6,584 3,384 5,380 10,443 Other assets, net 2,836 5,395 6,125 6,286 25,256 Total assets $269,525 $245,470 $247,259 $245,364 $352,310 Liabilities and Shareholders' Equity Current liabilities $ 758 $ 818 $ 0 $ 2,756 $ 4,179 Current portion of long-term debt Accounts payable and accrued expenses 27,826 30,006 31,738 31,043 60,848 Deferred income 18,362 14,074 18,549 19,522 30,885 Total current liabilities $ 46,946 $ 44,898 $ 50,287 $ 53,321 $ 95,912 Long-term debt 10,820 3,886 5,895 19,624 25,346 Non-current deferred income 6,406 5,338 0 0 6,638 0 0 0 0 0 Commitments and contingencies Shareholders' equity Class A common shares 218,398 219,584 221,757 225,137 342,971 Class B convertible common shares 300 300 300 300 300 Accumulated other comprehensive income 2,038 2,115 2,613 2,277 2,526 Accumulated deficit (15,383) (30,651) (33,593) (55,295) (121,381) $205,353 $191,348 $191,077 $172,419 $224,416 Total shareholders' equity Total liabilities and shareholders' equity $269,525 $245,470 $247,259 $245,364 $352,310 WORLD WRESTLING SUPERSTARS STATEMENT OF INCOME ('000s, EXCEPT PER SHARE DATA) 2017 For the year ended December 31 2013 Y 2014 Y 2015 Y 2016 Y (Q1-Q3) Net revenues $309,673 $313,736 $313,795 $329,327 $ 274,125 177,833 204,339 184,417 209,426 227,552 Cost of revenues (including amortization and impairments of feature film and television production assets) Selling, general, and administrative expenses Depreciation and amortization Operating (loss) income Investment income, net 70,921 75,684 88,393 100,219 94,528 7,590 9,712 12,982 15,864 12,563 53,329 24,001 28,003 3,818 (60,518 1,327 1,332 1,420 925 447 Interest expense (169) (404) (1,105) (1,132) (963) Other income (expense), net (1,365) (1,017) (646) (628) (38 (Loss) income before income taxes 53,122 23,912 27,672 2,983 (61,071) 18,469 7,812 7,295 1,192 (12,389) (Benefit from) provision for income taxes Net (loss) income $ 34,653 $ 16,100 $ 20,377 $ 1,791 $(48,683) (Loss) Earnings per share Basic and diluted $0.71 $0.33 $0.42 $0.04 $(1.00) Weighted average common shares outstanding Basic 48,345 48,113 48,361 48,584 48,719 Diluted 48,822 48,532 48,612 48,870 48,719 Dividends declared per common share (Class A and B) 0 0.64633 0.4797 0.48072 0.35721 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Net (loss) income $34,653 $16,100 $20,377 $1,791 $(48,683) 124 (27) 101 (91) 101 394 161 476 (244) ( (2) Other comprehensive income (loss) Foreign currency translation adjustment Change in unrealized holding gain (loss) on available-for-sale securities (net of tax (benefit)/expense) Reclassification adjustment for gains realized in net income-available-for-sale securities (net of tax expense) Total other comprehensive income (loss) Comprehensive (loss) income (21) (57) (79) (1) 150 497 77 498 (336) 249 $35,150 $16,177 $20,875 $1,455 $(48,434) LANDIT "-ADVITIUIVAL INT UNIVITIVI WWS Network Subscriptions In the third quarter of 2017, WWS launched the WWSN and 496,668 paid subscribers signed up to receive the service. The breakdown of new subscribers over the three months in the third quarter is as follows: Month 1 Month 2 Month 3 Total 372,501 99,334 24,833 496,668 Subscribers pay $9.99 at the beginning of each month, and must purchase a minimum of six months of service. Subscribers who cancel before the minimum six-month period are charged a cancellation fee equal to the number of remaining months to reach the minimum time period times the monthly fee. In addition to the monthly fee, subscribers can purchase additional content on a PPV basis. Each month features a unique program that can be purchased for $2.99. For example, the first three months of content featured a documentary on the history of WWS, a backstage look at WWS, and a documentary on WWS's largest superstars. A total of 72,251 PPV items were purchased during the third quarter. Television Contract During the third quarter, WWS reached a new agreement with the Japan Sports Channel (JSC) whereby JSC will be the exclusive provider of WWS's flagship weekly episodic wrestling program in Japan for the next three years. The agreement was signed with JSC at the beginning of month two and was effective immedi- ately. JSC has already begun broadcasting WWS content on its network. The terms of the agreement require WWS to provide JSC with weekly wrestling content in exchange for a $3-million upfront fee, and an annual royalty of $0.75 per viewer. The third quarter has seen approximately 1.3 million viewers; however, the actual number of viewers will be determined by Japan's television rating agency. It could take up to six months to determine the exact number of viewers. Feature Film and Television Productions The following is the breakdown of the feature film and television production intangible assets ('000): Feature film productions $ 9,640 Television productions $3,357 In release 3,292 1,918 Completed but not released In production In development 8,650 2,719 1,881 0 $23,463 $7,994 The feature film productions are movies and documentaries developed by WWS for distribution through WWSN, DVD sales, PPV, or online downloads. The in release" and "completed but not released" categories are expected to generate annual revenues of a total of $3.5 million annually over the next five years (for both the feature film and television categories combined, respectively). The in production" category for feature film productions includes WWS's portion of the development costs of a new Hollywood movie featuring a former WWS heavyweight champion and a big movie star. The movie is expected to debut in the fourth quarter of 2017, and WWS is entitled to receive 3.5% of gross revenues from the movies but must incur $1.5 million in advertising fees in each of the next two years. The movie is expected to earn gross revenues of $360 million over a two-year period, with 75% earned in the 2018 fiscal year. The "in development" category includes two documentaries that are currently being developed for re- lease in the 2018 fiscal year. One documentary showcases the rise to stardom of Chris Francios, a former EXHIBIT II (CONTINUED) - ADDITIONAL INFORMATION WWS heavyweight champion. The second documentary features Barry Heart's journey in taking WWS from a small, regional wrestling company to a large, multinational entertainment company. Each documen- tary represents half of the total development costs. The television productions consist of episodic series. The amounts capitalized include development costs, production costs, overhead costs, and employee salaries. The in production costs are related to a new program being created to run every Thursday night that features young and up-and-coming wrestlers. The program is called "Are You Strong Enough?" Barry is hopeful that this new program will be a hit. The "in release and completed but not released categories of television products are expected to generate annual revenues of $1,750,000 in each of the next four years. Legal Proceeding WWS has been sued by Crazy-Man Steve Ostroski, a former wrestler with WWS. Crazy-Man is a four-time heavyweight champion, and a fan favourite. Crazy-Man left WWS after a heated contract dispute. Now, he is suing WWS for royalties related to his characters and name's use in digital and movie content. Crazy-Man had a unique contract with WWS that allowed him to retain ownership and creative control over his name and character. WWS lawyers are trying to settle the case for $500,000. If WWS loses, it may be required to pay a 5% royalty on all content sold that includes Crazy-Man's name or character. The following is a listing of the content that includes Crazy-Man's name: Title Selling Price Expected Units Sold Number of Years Units Will Be Sold Over $14.99 125,000 $34.99 175,000 Documentary: Wrestling with Scars Video game: WWS 2017 Coffee table book: WWS Legends Feature film: The Warrior Three years One year Four years Two years $29.99 280,000 $19.99 135,000 There is a 50% chance that Crazy-Man will settle for $500,000. Steroid Use Allegations Recently, the wrestling industry has received some negative attention. Many wrestlers have passed away at very young ages and in tragic manners. The past quarter has been especially challenging as former WWS superstar Chris Francios went on a crime spree. Chris's legal defence is arguing that his time with WWS led to excessive head injuries and the use of steroids and other narcotics that have significantly impacted his mental state. WWS has not been named in any lawsuit thus far, but national media has picked up the story, resulting in much negative publicity. There is also a rumour that there could be some level of government investigation regarding the use of narcotics in the industry and excessive numbers of wrestler deaths. Barry Heart is clearly concerned about this issue. Investment Securities At the end of the third quarter, WWS made an investment in a regional wrestling company (Total Wrestling Action, TWA). WWS paid $5 million for a 9% stake in TWA. The two wrestling companies are planning to work together to share wrestling talent, co-promote events, and share other resources. WWS sees TWA as a developmental company that can provide much-needed new talent to WWS's main roster of superstars. WWS has the ability to elect 3 of the 10 board members. Currently, Barry and two other WWS execu- tives are sitting on TWA's board. As of its third quarter of 2017, TWA's fair value was estimated to be $5.2 million. TWA earned income of $8.5 million during the third quarter, and paid dividends of $1 million. The investment is currently reported at its cost basis as part of the investment securities. Long-Term Debt On March 1, WWS issued long-term debt in the form of a bond with a face value of $7 million. The bonds were issued at par and have a coupon rate and market rate of 5%. The bonds pay interest semi-annually and mature after 10 years. The company's management believes that interest rates will increase in the next few years as the econo- my begins to accelerate and inflation becomes more of a concern. Accordingly, WWS management is plan- ning to redeem the bonds within a two-to three-year period and therefore it elected to measure the bonds at fair value. The first interest payment has been made. The market yield for similar bonds at year end was 4.11%