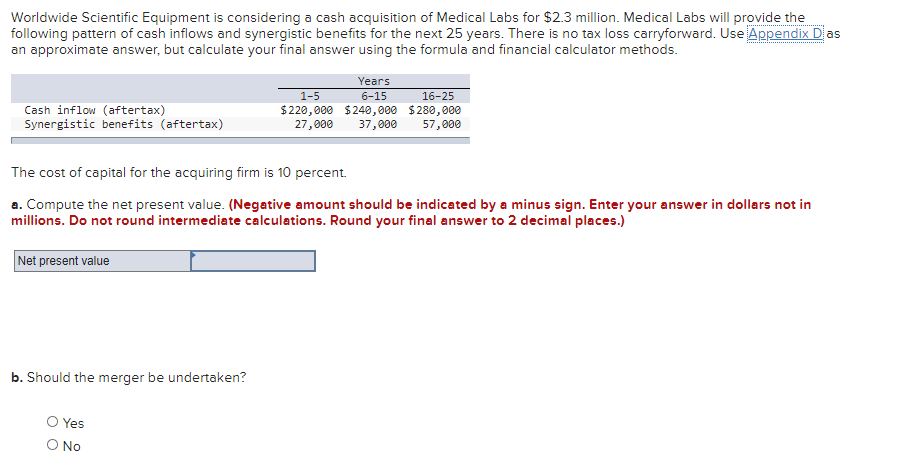

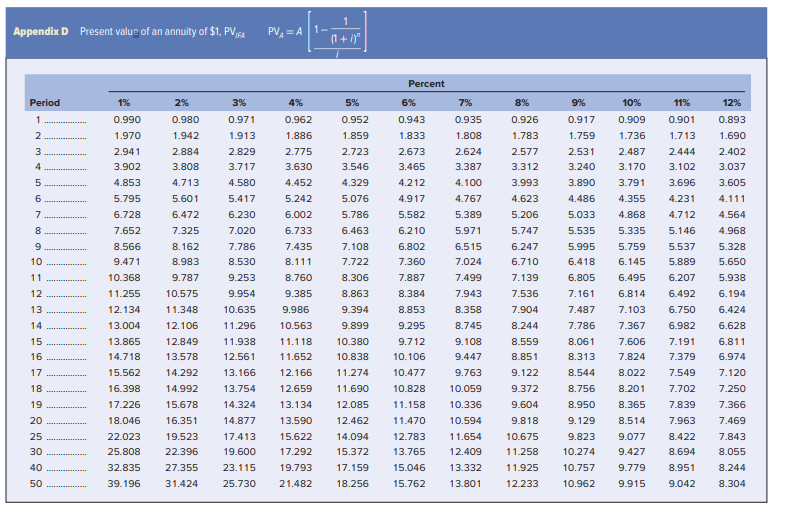

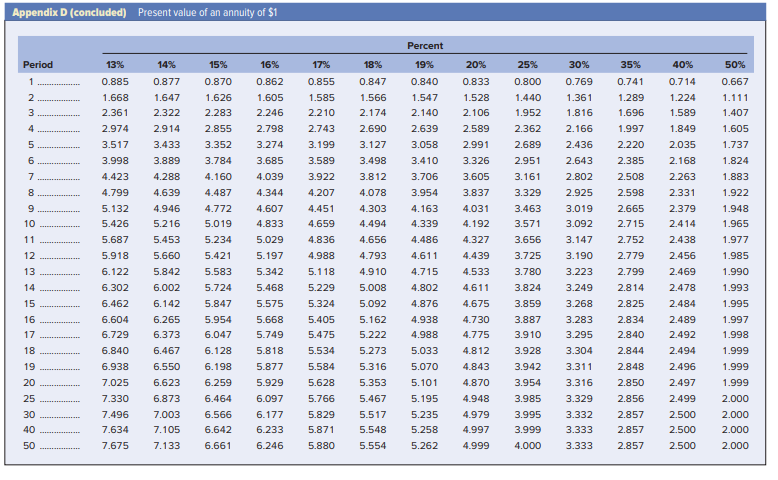

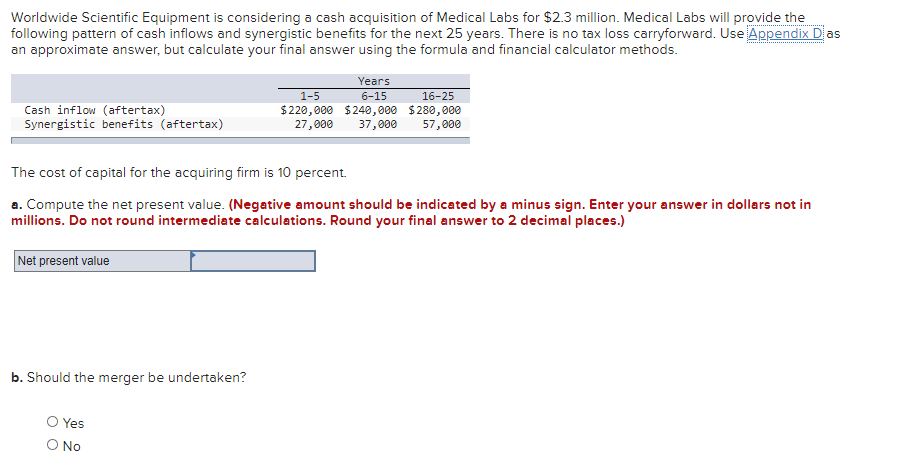

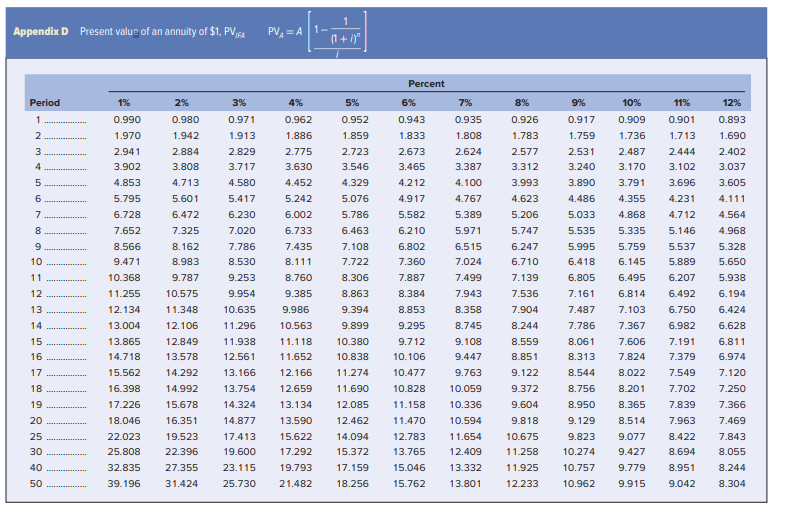

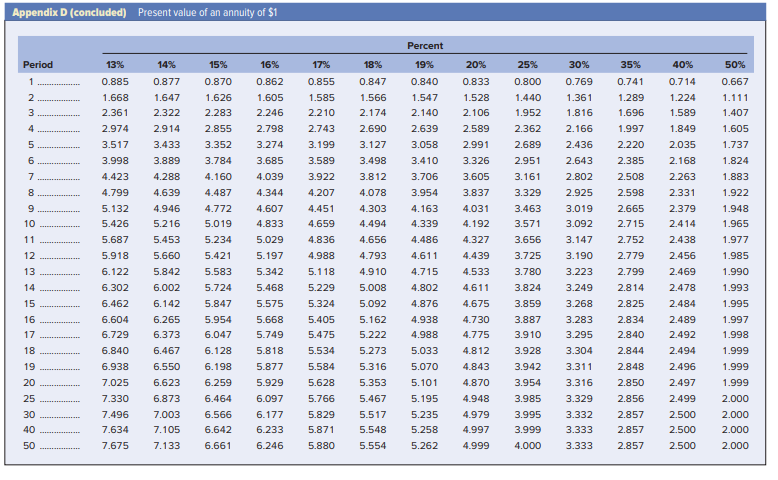

Worldwide Scientific Equipment is considering a cash acquisition of Medical Labs for $2.3 million. Medical Labs will provide the following pattern of cash inflows and synergistic benefits for the next 25 years. There is no tax loss carryforward. Use Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods. 1-5 Cash inflow (aftertax) Synergistic benefits (aftertax) Years 6-15 16-25 $220,000 $240,000 $280,000 27,000 37,000 57,000 The cost of capital for the acquiring firm is 10 percent. a. Compute the net present value. (Negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your final answer to 2 decimal places.) Net present value b. Should the merger be undertaken? Yes O No Appendix D Present value of an annuity of $1, PVCA PVA=A1- (1 + 11" Percent 6% Period 1% 2% 3% 4% 5% 7% 8% 12% 1 0.893 1.690 N 9% 0.917 1.759 2.531 3.240 0.990 1.970 2.941 3.902 3 4 2.402 3.037 3.605 5 4.853 6 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 4.111 5.795 6.728 7.652 8.566 9.471 10.368 11.255 7 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 8 4.564 4.968 5.328 5.650 9 10 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 11 5.938 6.194 12 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 10.575 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 9.077 9.427 9.779 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 7.943 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 18.256 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 12.783 13.765 15.046 15.762 13 11.348 8.358 6.750 14 12.134 13.004 13.865 8.244 6.982 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 15 16 17 18 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 6.424 6.628 6.811 6.974 7.120 7.250 7.366 8.745 9.108 9.447 9.763 10.059 10.336 10.594 11.654 12.409 13.332 13.801 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 19 7.191 7.379 7.549 7.702 7.839 7.963 8.422 8.694 20 7.469 25 30 7.843 8.055 40 11.925 8.951 8.244 8.304 50 12.233 9.915 9.042 Appendix D (concluded) Present value of an annuity of $1 Percent Period 14% 17% 18% 15% 0.870 16% 0.862 1 2 3 4 5 6 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4.339 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 7 25% 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 0.855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 30% 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 8 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 9 10 11 4.486 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 12 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 5.548 5.554 4.611 4.715 35% 0.741 1.289 1.696 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.856 2.857 2.857 2.857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 13 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 3.780 3.223 14 4.802 3.824 3.249 6.142 3.859 3.268 15 16 17 18 4.876 4.938 4.988 5.033 5.070 5.101 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 19 20 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 5.880 4.730 4.775 4.812 4.843 4.870 4.948 4.979 4.997 3.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.000 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.333 25 30 40 5.195 5.235 5.258 5.262 50 7.675 4.999 3.333