Answered step by step

Verified Expert Solution

Question

1 Approved Answer

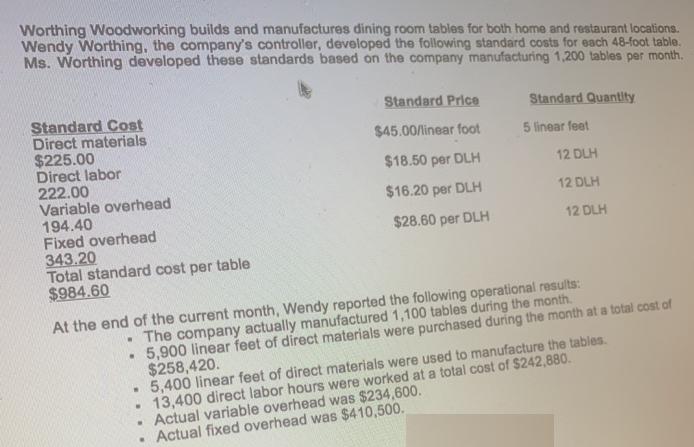

Worthing Woodworking builds and manufactures dining room tables for both home and restaurant locations. Wendy Worthing, the company's controller, developed the following standard costs

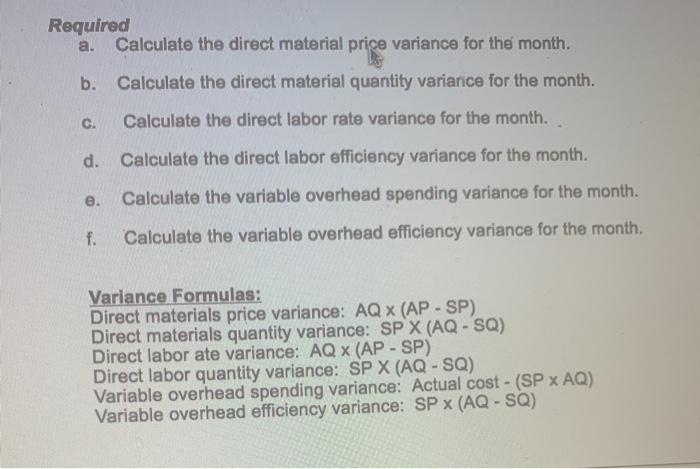

Worthing Woodworking builds and manufactures dining room tables for both home and restaurant locations. Wendy Worthing, the company's controller, developed the following standard costs for each 48-foot table. Ms. Worthing developed these standards based on the company manufacturing 1,200 tables per month. Standard Price Standard Quantity Standard Cost Direct materials $225.00 Direct labor 222.00 Variable overhead 194.40 Fixed overhead 343.20 Total standard cost per table $984.60 $45.00/linear foot 5 linear feet $18.50 per DLH 12 DLH $16.20 per DLH 12 DLH $28.60 per DLH 12 DLH The company actually manufactured 1,100 tables during the month. 5,900 linear feet of direct materials were purchased during the month at a total cost of $258,420. 5,400 linear feet of direct materials were used to manufacture the tables. 13,400 direct labor hours were worked at a total cost of $242,880. Actual variable overhead was $234,600. Actual fixed overhead was $410,500. At the end of the current month, Wendy reported the following operational results: Required a. Calculate the direct material price variance for the month. b. Calculate the direct material quantity variance for the month. C. Calculate the direct labor rate variance for the month. d. Calculate the direct labor efficiency variance for the month. e. Calculate the variable overhead spending variance for the month. f. Calculate the variable overhead efficiency variance for the month. Variance Formulas: Direct materials price variance: AQ x (AP - SP) Direct materials quantity variance: SP X (AQ-SQ) Direct labor ate variance: AQ x (AP - SP) Direct labor quantity variance: SP X (AQ- SQ) Variable overhead spending variance: Actual cost - (SP x AQ) Variable overhead efficiency variance: SP x (AQ - SQ)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dbf6d963d6_178529.pdf

180 KBs PDF File

635dbf6d963d6_178529.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started