How do we get the 1-year and 10-year values from these numbers? Is it not possible to derive these numbers from the figures given and

How do we get the 1-year and 10-year values from these numbers? Is it not possible to derive these numbers from the figures given and this is just an example to illustrate interest rate risk?

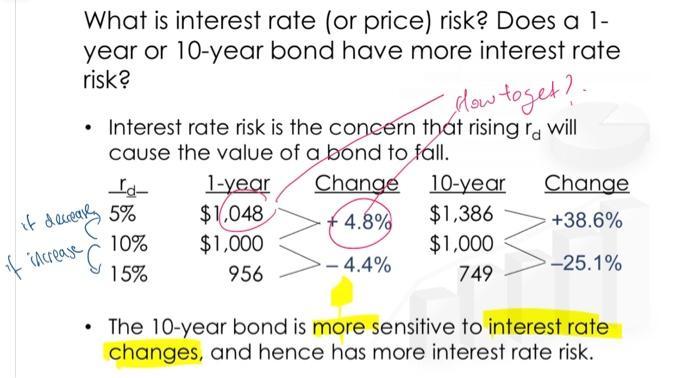

What is interest rate (or price) risk? Does a 1- year or 10-year bond have more interest rate risk? if decrease of increase . dow toget?. Interest rate risk is the concern that rising ra will cause the value of a bond to fall. Change 4.8% - 4.4% Id- 5% 10% 15% 1-year $1,048 $1,000 956 10-year $1,386 $1,000 749 Change +38.6% -25.1% The 10-year bond is more sensitive to interest rate changes, and hence has more interest rate risk.

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

It is assumed that the Face value or par value of the bond 100...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started