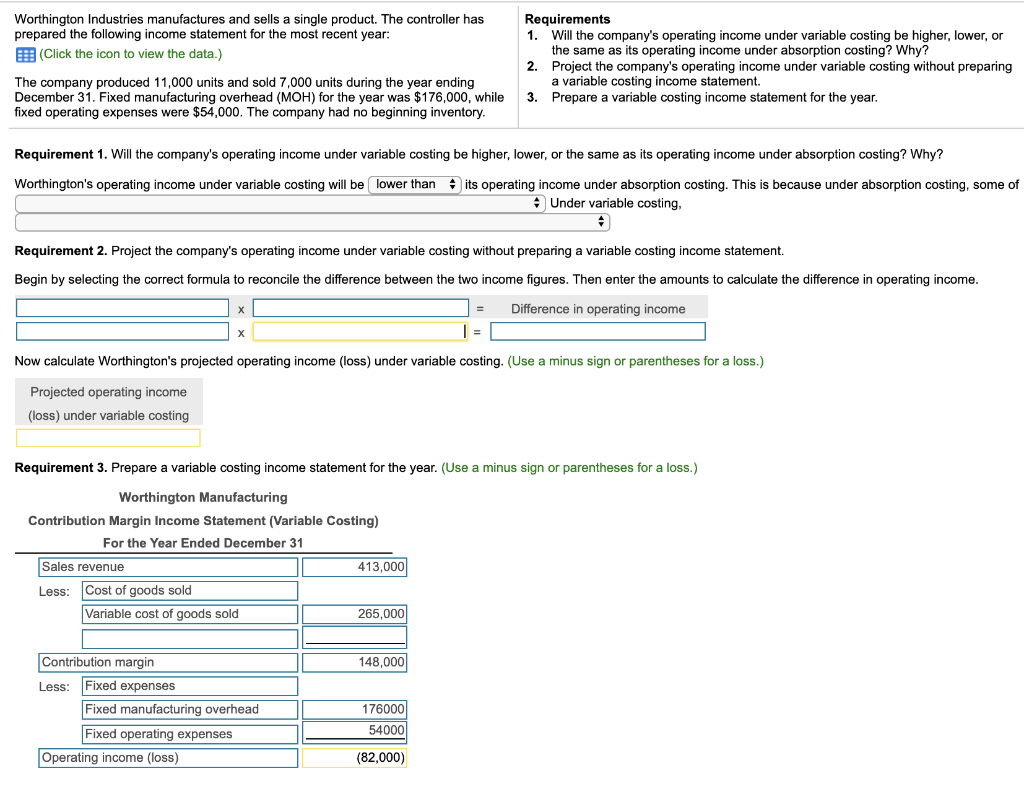

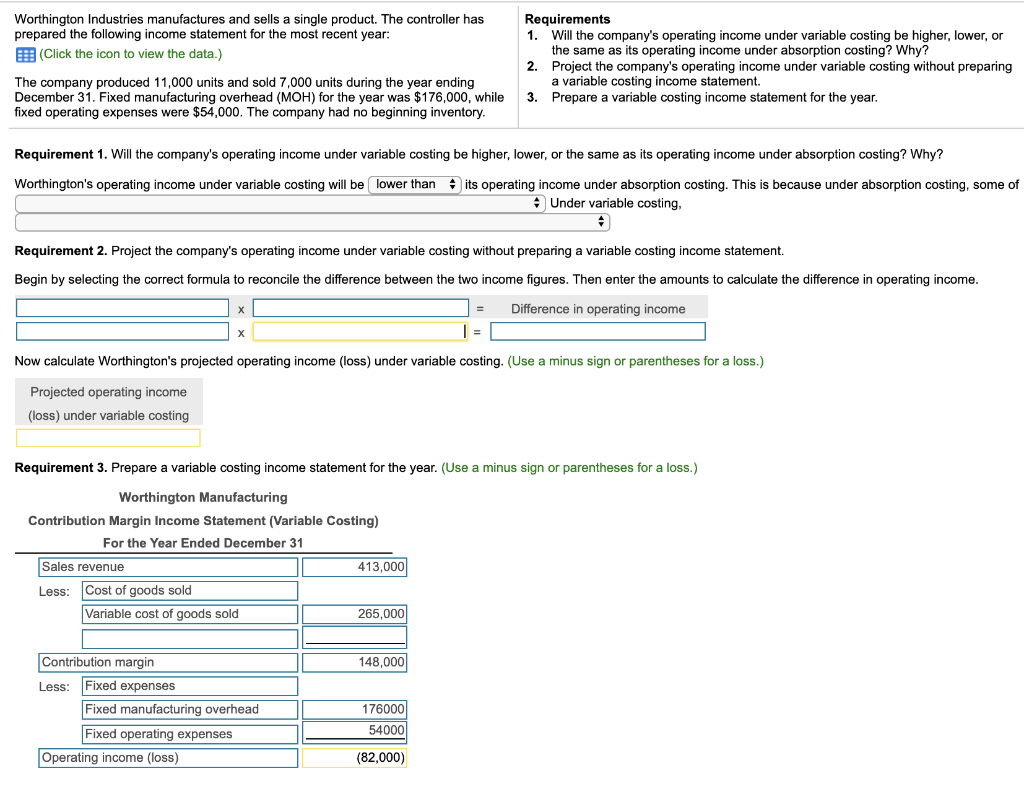

Worthington Industries manufactures and sells a single product. The controller has prepared the following income statement for the most recent year: (Click the icon to view the data.) The company produced 11,000 units and sold 7,000 units during the year ending December 31. Fixed manufacturing overhead (MOH) for the year was $176,000, while fixed operating expenses were $54,000. The company had no beginning inventory. Requirements 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? 2. Project the company's operating income under variable costing without preparing a variable costing income statement. 3. Prepare a variable costing income statement for the year. Requirement 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? Worthington's operating income under variable costing will be lower than its operating income under absorption costing. This is because under absorption costing, some of Under variable costing, Requirement 2. Project the company's operating income under variable costing without preparing a variable costing income statement. Begin by selecting the correct formula to reconcile the difference between the two income figures. Then enter the amounts to calculate the difference in operating income. X Difference in operating income X Now calculate Worthington's projected operating income (loss) under variable costing. (Use a minus sign or parentheses for a loss.) Projected operating income (loss) under variable costing Requirement 3. Prepare a variable costing income statement for the year. (Use a minus sign or parentheses for a loss.) Worthington Manufacturing Contribution Margin Income Statement (Variable Costing) For the Year Ended December 31 Sales revenue 413,000 Less: Cost of goods sold Variable cost of goods sold 265,000 148,000 Contribution margin Less: Fixed expenses Fixed manufacturing overhead Fixed operating expenses Operating income (loss) 176000 54000 (82,000) Worthington Industries manufactures and sells a single product. The controller has prepared the following income statement for the most recent year: (Click the icon to view the data.) The company produced 11,000 units and sold 7,000 units during the year ending December 31. Fixed manufacturing overhead (MOH) for the year was $176,000, while fixed operating expenses were $54,000. The company had no beginning inventory. Requirements 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? 2. Project the company's operating income under variable costing without preparing a variable costing income statement. 3. Prepare a variable costing income statement for the year. Requirement 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? Worthington's operating income under variable costing will be lower than its operating income under absorption costing. This is because under absorption costing, some of Under variable costing, Requirement 2. Project the company's operating income under variable costing without preparing a variable costing income statement. Begin by selecting the correct formula to reconcile the difference between the two income figures. Then enter the amounts to calculate the difference in operating income. X Difference in operating income X Now calculate Worthington's projected operating income (loss) under variable costing. (Use a minus sign or parentheses for a loss.) Projected operating income (loss) under variable costing Requirement 3. Prepare a variable costing income statement for the year. (Use a minus sign or parentheses for a loss.) Worthington Manufacturing Contribution Margin Income Statement (Variable Costing) For the Year Ended December 31 Sales revenue 413,000 Less: Cost of goods sold Variable cost of goods sold 265,000 148,000 Contribution margin Less: Fixed expenses Fixed manufacturing overhead Fixed operating expenses Operating income (loss) 176000 54000 (82,000)