Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would appreciate if done using a calculator instead of excel so I can better follow along, thank you. 7. George has $5,000 in his saving

Would appreciate if done using a calculator instead of excel so I can better follow along, thank you.

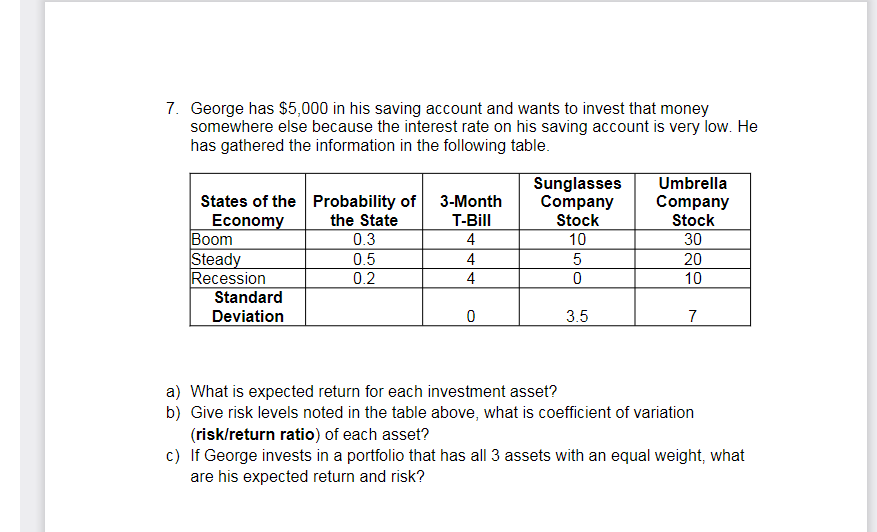

7. George has $5,000 in his saving account and wants to invest that money somewhere else because the interest rate on his saving account is very low. He has gathered the information in the following table. a) What is expected return for each investment asset? b) Give risk levels noted in the table above, what is coefficient of variation (risk/return ratio) of each asset? c) If George invests in a portfolio that has all 3 assets with an equal weight, what are his expected return and risk? 7. George has $5,000 in his saving account and wants to invest that money somewhere else because the interest rate on his saving account is very low. He has gathered the information in the following table. a) What is expected return for each investment asset? b) Give risk levels noted in the table above, what is coefficient of variation (risk/return ratio) of each asset? c) If George invests in a portfolio that has all 3 assets with an equal weight, what are his expected return and riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started