WOULD BE EXTREMELY GRATEFUL FOR HELP WITH THIS. WILL UPVOTE. PLEASE!

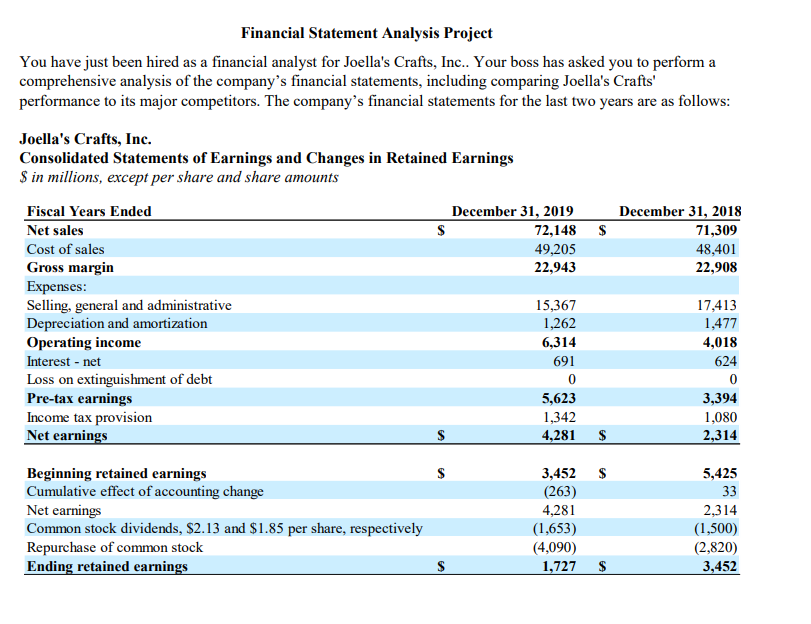

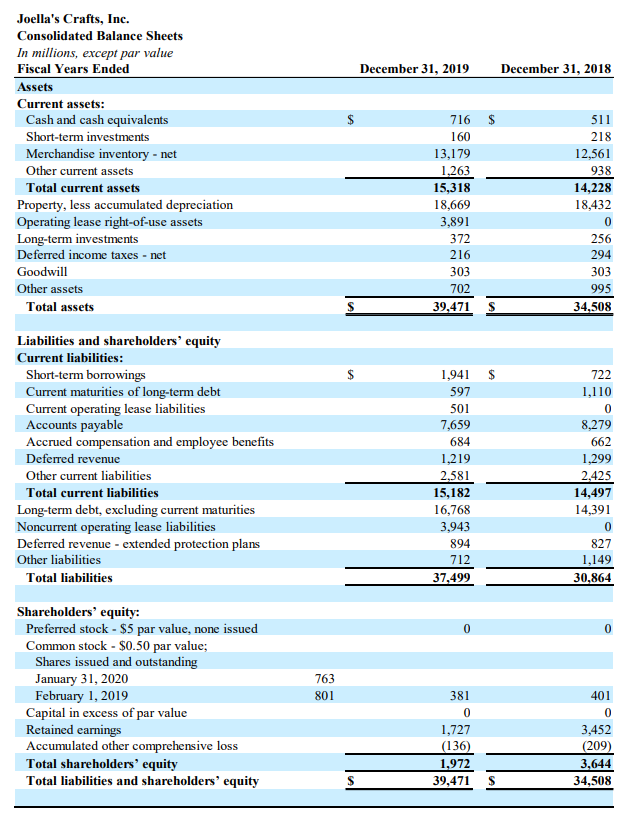

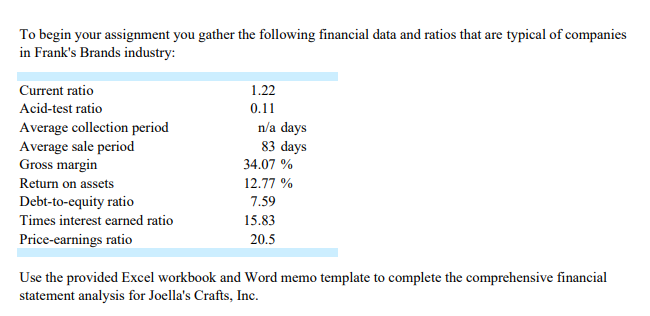

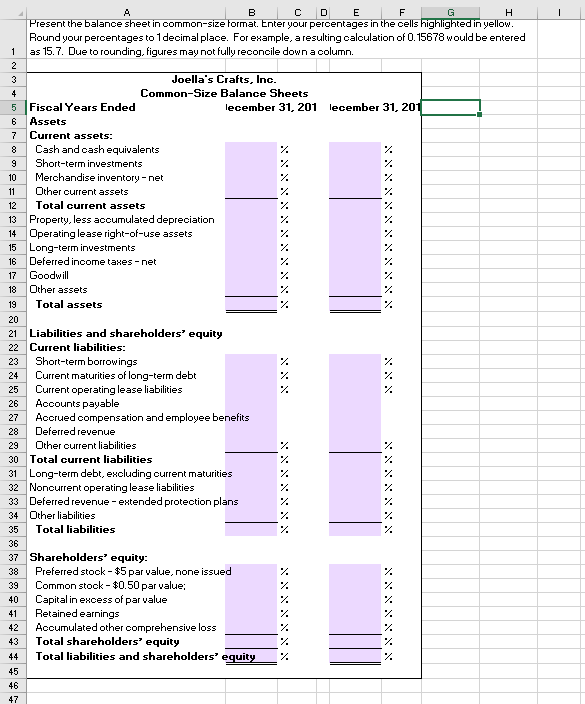

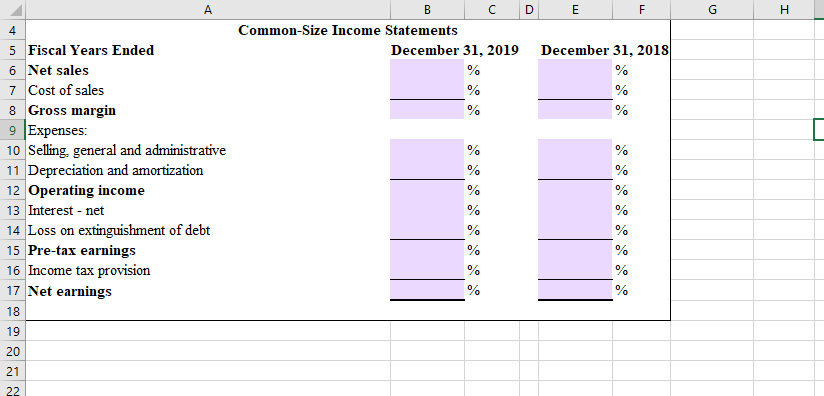

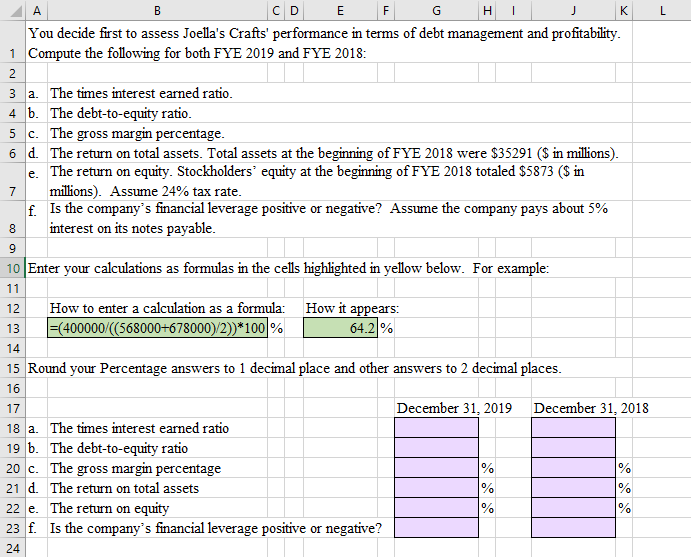

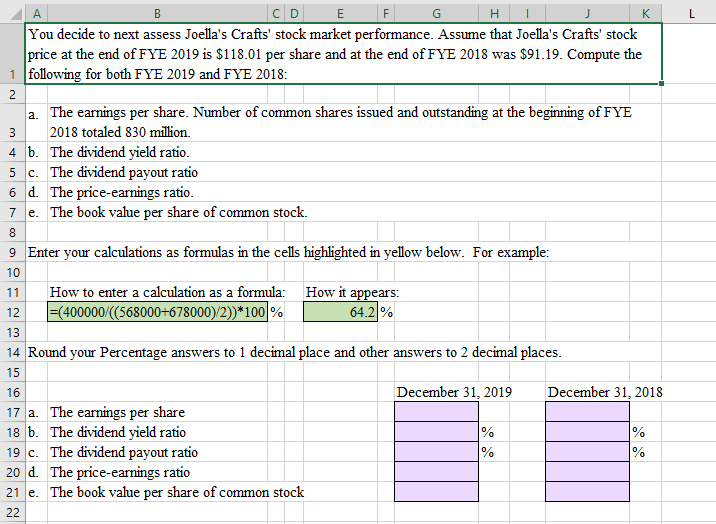

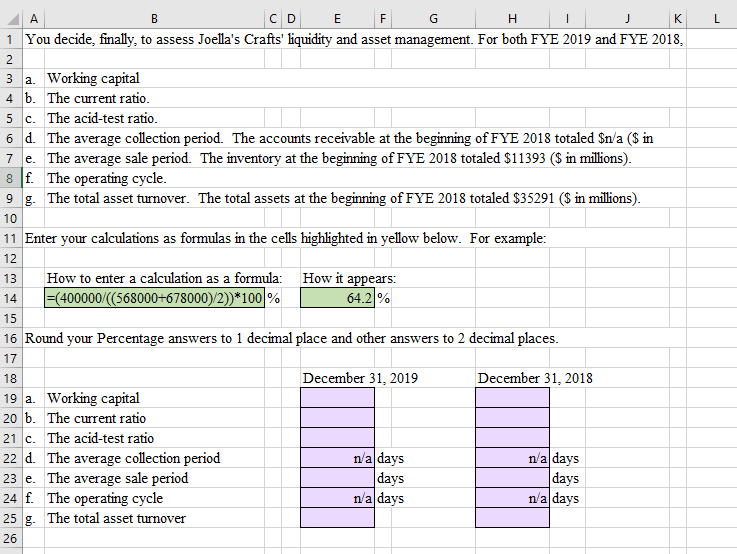

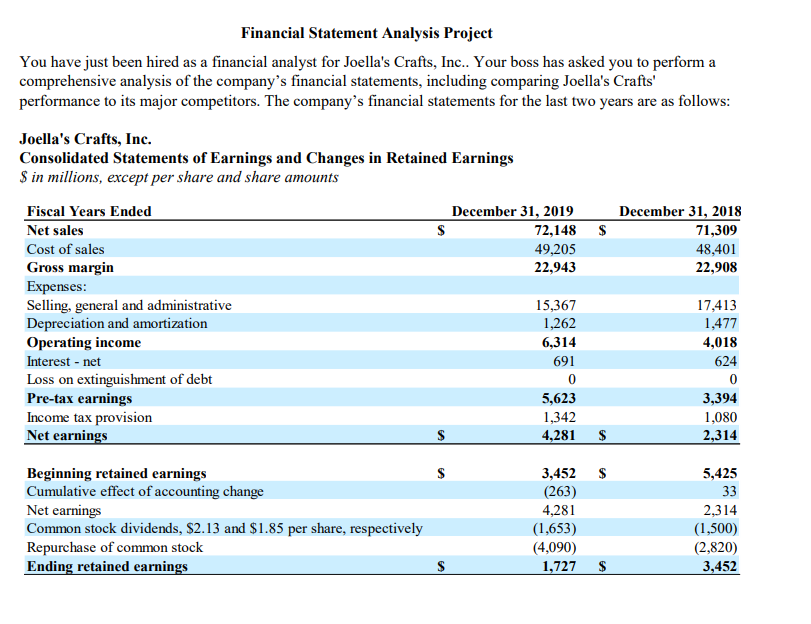

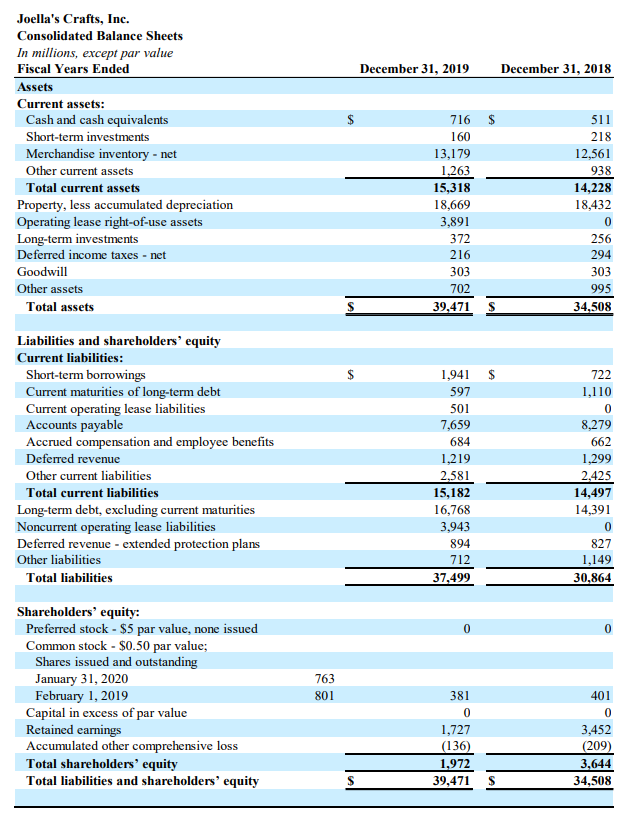

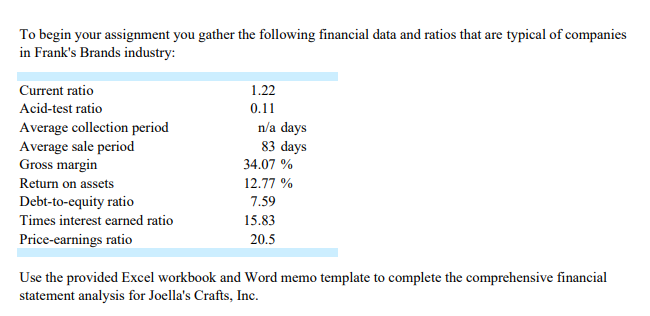

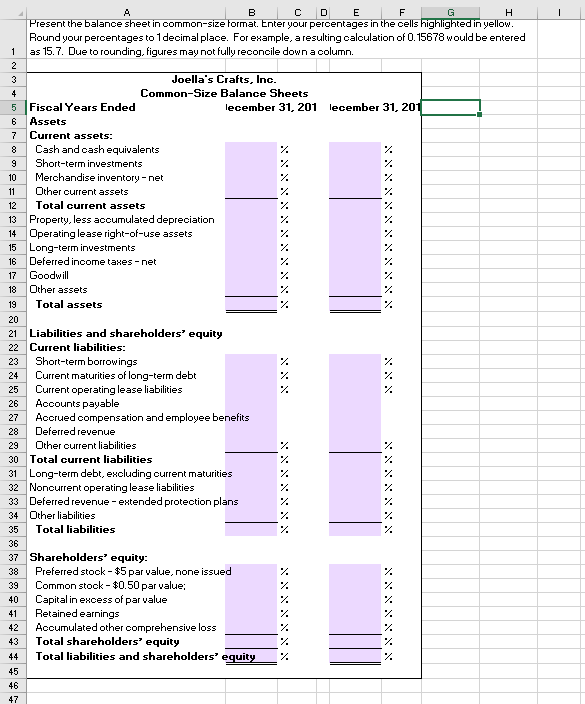

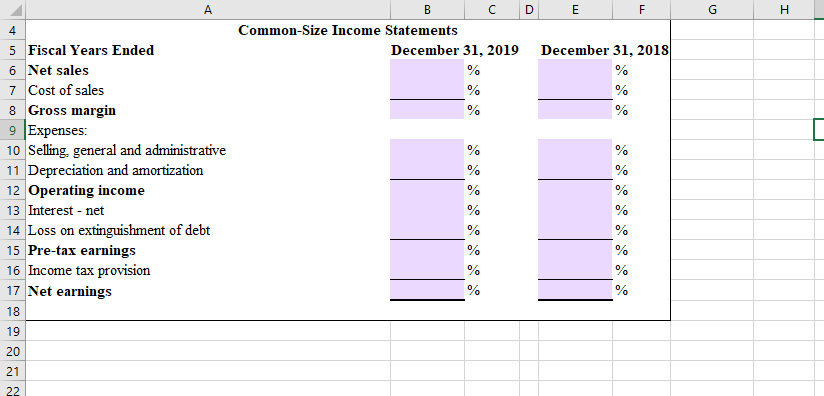

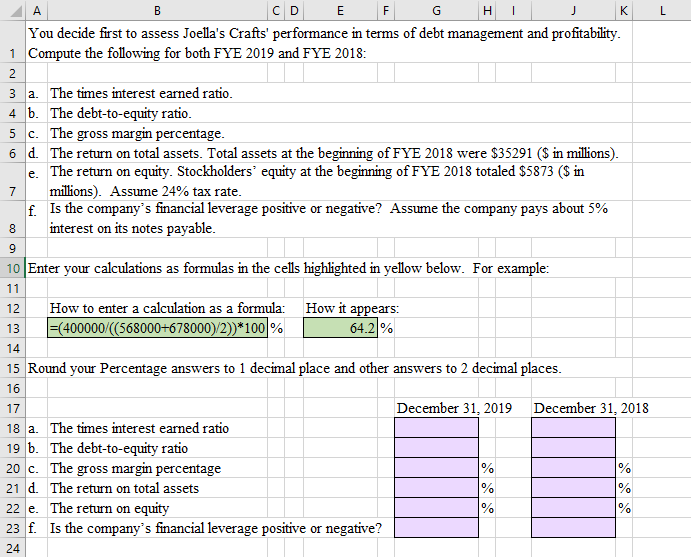

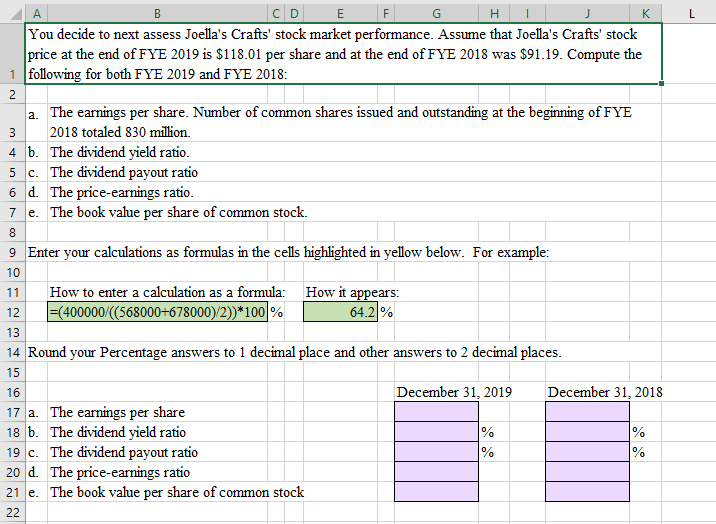

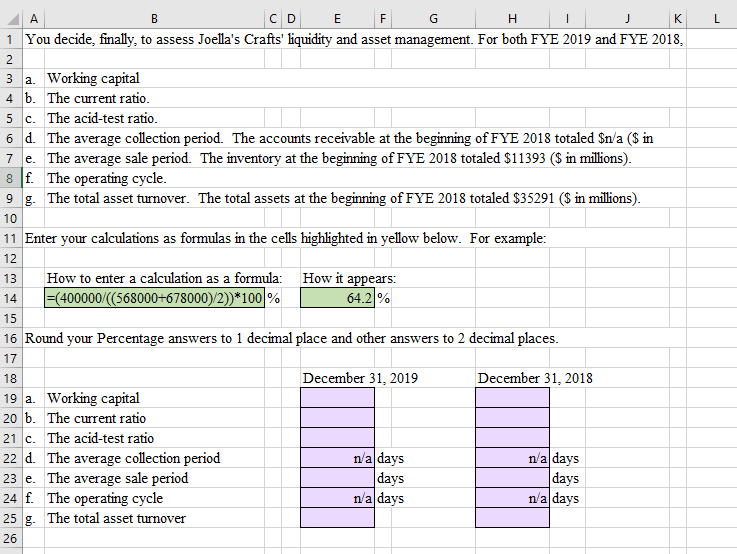

Financial Statement Analysis Project You have just been hired as a financial analyst for Joella's Crafts, Inc.. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Joella's Crafts performance to its major competitors. The company's financial statements for the last two years are as follows: Joella's Crafts, Inc. Consolidated Statements of Earnings and Changes in Retained Earnings $ in millions, except per share and share amounts Fiscal Years Ended December 31, 2019 December 31, 2018 Net sales $ 72,148 $ 71,309 Cost of sales 49,205 48,401 Gross margin 22,943 22,908 Expenses: Selling, general and administrative 15,367 17,413 Depreciation and amortization 1,262 1,477 Operating income 6,314 4,018 Interest - net 691 624 Loss on extinguishment of debt 0 0 Pre-tax earnings 5,623 3,394 Income tax provision 1,342 1,080 Net earnings 4,281 $ 2,314 $ Beginning retained earnings Cumulative effect of accounting change Net earnings Common stock dividends, $2.13 and $1.85 per share, respectively Repurchase of common stock Ending retained earnings 3,452 (263) 4,281 (1,653) (4,090) 1,727 5,425 33 2,314 (1,500) (2,820) 3,452 $ December 31, 2019 December 31, 2018 $ Joella's Crafts, Inc. Consolidated Balance Sheets In millions, except par value Fiscal Years Ended Assets Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Goodwill Other assets Total assets 716 $ 160 13,179 1.263 15,318 18,669 3,891 372 216 303 702 39,471 511 218 12,561 938 14,228 18,432 0 256 294 303 995 34,508 Liabilities and shareholders' equity Current liabilities: Short-term borrowings Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - extended protection plans Other liabilities Total liabilities 1,941 597 501 7,659 684 1,219 2,581 15,182 16,768 3,943 894 712 37,499 722 1,110 0 8,279 662 1,299 2,425 14,497 14,391 0 827 1,149 30.864 0 Shareholders' equity: Preferred stock - $5 par value, none issued Common stock - $0.50 par value; Shares issued and outstanding January 31, 2020 February 1, 2019 Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity 763 801 381 0 1,727 (136) 1,972 39,471 401 0 3,452 (209) 3,644 34,508 S S To begin your assignment you gather the following financial data and ratios that are typical of companies in Frank's Brands industry: Current ratio Acid-test ratio Average collection period Average sale period Gross margin Return on assets Debt-to-equity ratio Times interest earned ratio Price-earnings ratio 1.22 0.11 n/a days 83 days 34.07 % 12.77 % 7.59 15.83 20.5 Use the provided Excel workbook and Word memo template to complete the comprehensive financial statement analysis for Joella's Crafts, Inc. 1 A B C D E F G H Present the balance sheet in common-size format. Enter your percentages in the cells highlighted in yellow. Round your percentages to 1 decimal place. For example, a resulting calculation of O.15678 would be entered 1 as 15.7. Due to rounding, figures may not fully reconcile down a column. 2 3 Joella's Crafts, Inc. 4 Common-Size Balance Sheets 5 Fiscal Years Ended lecember 31, 201 lecember 31, 201 6 Assets 7 Current assets: 8 Cash and cash equivalents 9 Short-term investments 10 Merchandise inventory - net 11 Other current assets 12 Total current assets 13 Property, less accumulated depreciation 14 Operating lease right-of-use assets 15 Long-term investments 16 Deferred income taxes - net 17 Goodwill 18 Other assets 19 Total assets 20 21 Liabilities and shareholders' equity 22 Current liabilities: 23 Short-term borrowings 24 Current maturities of long-term debt % 25 Current operating lease liabilities 2. 26 Accounts payable 27 Accrued compensation and employee benefits 28 Deferred revenue 29 Other current liabilities 30 Total current liabilities 31 Long-term debt, excluding current maturities 32 Noncurrent operating lease liabilities 33 Deferred revenue - extended protection plans 34 Other liabilities 35 Total liabilities 36 37 Shareholders' equity: 38 Preferred stock - $5 par value, none issued 39 Common stock - $0.50 par value: 40 Capital in excess of par value 41 Retained earnings 42 Accumulated other comprehensive loss 43 Total shareholders' equity 44 Total liabilities and shareholders' equity 45 46 47 XXXXXXX G I 4 B D E F Common-Size Income Statements December 31, 2019 December 31, 2018 % % % % % 5 Fiscal Years Ended 6 Net sales 7 Cost of sales 8 Gross margin 9 Expenses 10 Selling, general and administrative 11 Depreciation and amortization 12 Operating income 13 Interest - net 14 Loss on extinguishment of debt 15 Pre-tax earnings 16 Income tax provision 17 Net earnings 18 % % % % % % % % % % % % % % % % 19 20 21 22 A F G K L B C D E HI You decide first to assess Joella's Crafts' performance in terms of debt management and profitability. 1 Compute the following for both FYE 2019 and FYE 2018: 2 3. a. The times interest earned ratio. 4 b. The debt-to-equity ratio. 5 c. The gross margin percentage. 6 d. The return on total assets. Total assets at the beginning of FYE 2018 were $35291 ($ in millions). e. The return on equity. Stockholders' equity at the beginning of FYE 2018 totaled $5873 ($ in millions). Assume 24% tax rate. f. Is the company's financial leverage positive or negative? Assume the company pays about 5% 8 interest on its notes payable. 9 10 Enter your calculations as formulas in the cells highlighted in yellow below. For example: 7 B 11 12 How to enter a calculation as a formula: How it appears: = (400000/((568000+678000)/2))*100% 64.21% 13 14 15 Round your Percentage answers to 1 decimal place and other answers to 2 decimal places. 16 December 31, 2019 December 31, 2018 17 18 a. The times interest earned ratio 19 b. The debt-to-equity ratio 20 c. The gross margin percentage 21 d. The return on total assets 22 e. The return on equity 23 f. Is the company's financial leverage positive or negative? 24 % % % % % % O 0 A B H K L 2 C D E F G You decide to next assess Joella's Crafts' stock market performance. Assume that Joella's Crafts' stock price at the end of FYE 2019 is $118.01 per share and at the end of FYE 2018 was $91.19. Compute the 1 following for both FYE 2019 and FYE 2018: 2 a. The earnings per share. Number of common shares issued and outstanding at the beginning of FYE 3 2018 totaled 830 million 4 b. The dividend yield ratio. 5 c. The dividend payout ratio 6 d. The price-earnings ratio. 7 e. The book value per share of common stock. 8 9 Enter your calculations as formulas in the cells highlighted in yellow below. For example: 10 11 How to enter a calculation as a formula: How it appears: = (400000/((568000+678000)/2))*100% 64.21% 12 13 14 Round your Percentage answers to 1 decimal place and other answers to 2 decimal places. 15 16 December 31, 2019 December 31, 2018 17 a. The earnings per share 18 b. The dividend yield ratio 19 c. The dividend payout ratio 20 d. The price-earnings ratio 21 e. The book value per share of common stock % % % 22 A B E F K L 2 CD G H 1 You decide, finally, to assess Joella's Crafts' liquidity and asset management. For both FYE 2019 and FYE 2018. 2 3 a. Working capital 4 b. The current ratio. 5 c. The acid-test ratio. 6 d. The average collection period. The accounts receivable at the beginning of FYE 2018 totaled $n/a ($ in 7 e. The average sale period. The inventory at the beginning of FYE 2018 totaled $11393 ($ in millions). 8 f. The operating cycle. 9 g. The total asset turnover. The total assets at the beginning of FYE 2018 totaled $35291 (S in millions). 10 11 Enter your calculations as formulas in the cells highlighted in yellow below. For example: 12 13 How to enter a calculation as a formula: How it appears: =(400000/((568000+678000)/2))*100% 64.2 % 15 16 Round your Percentage answers to 1 decimal place and other answers to 2 decimal places. 17 18 December 31, 2019 December 31, 2018 19 a. Working capital 20 b. The current ratio 21 c. The acid-test ratio 22 d. The average collection period n/a days n/a days 23 e. The average sale period days days 24 f. The operating cycle n'a days n/a days 25 g. The total asset turnover 14 26