Answered step by step

Verified Expert Solution

Question

1 Approved Answer

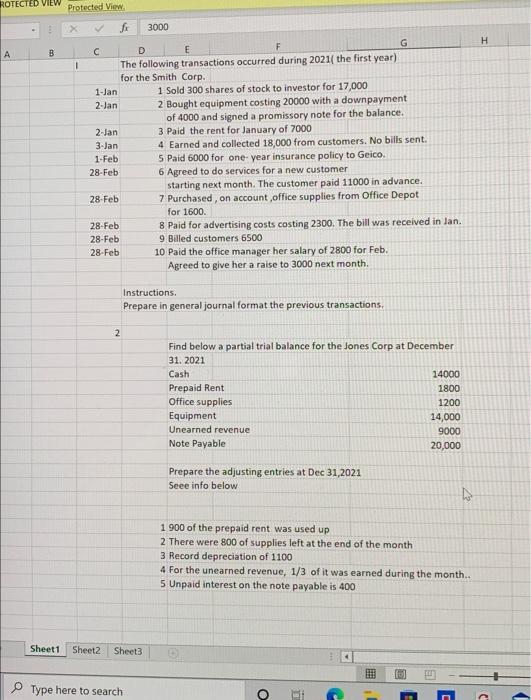

would greatly appreciate some help! ROTECTED VIEW Protected View 3000 B 1 G D E The following transactions occurred during 2021( the first year) for

would greatly appreciate some help!

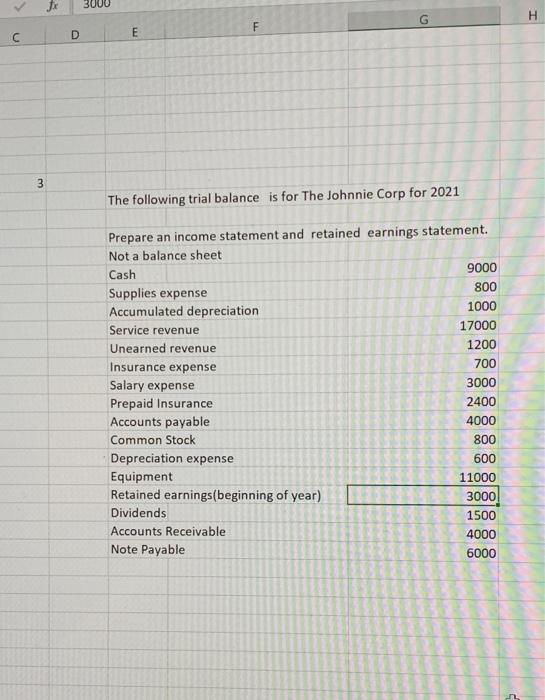

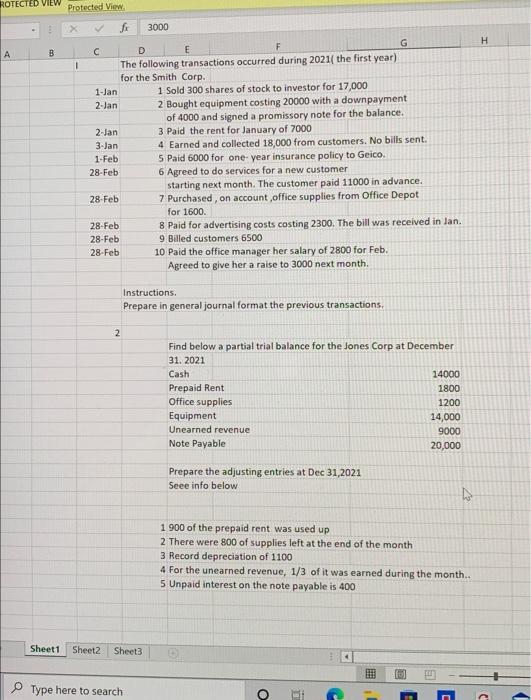

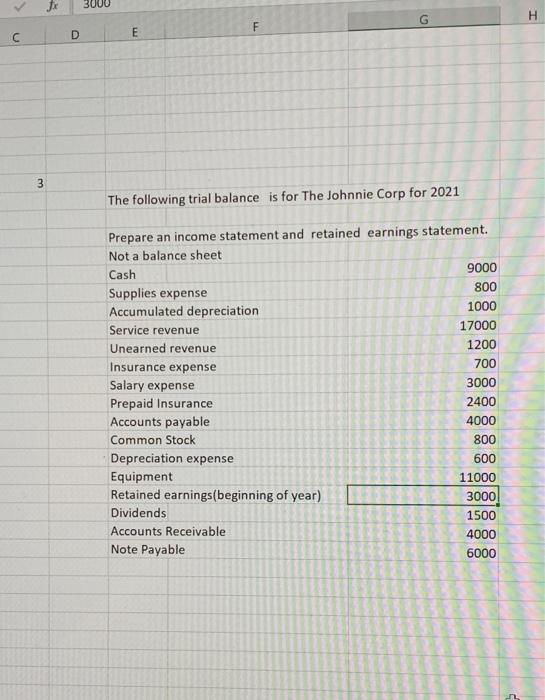

ROTECTED VIEW Protected View 3000 B 1 G D E The following transactions occurred during 2021( the first year) for the Smith Corp. 1-Jan 1 Sold 300 shares of stock to investor for 17,000 2-Jan 2 Bought equipment costing 20000 with a downpayment of 4000 and signed a promissory note for the balance. 2-Jan 3 Paid the rent for January of 7000 3.Jan 4 Earned and collected 18,000 from customers. No bills sent. 1-Feb 5 Paid 6000 for one year insurance policy to Geico. 28-Feb 6 Agreed to do services for a new customer starting next month. The customer paid 11000 in advance. 28-Feb 7 Purchased, on account office supplies from Office Depot for 1600 28-Feb 8 Paid for advertising costs costing 2300. The bill was received in lan. 28-Feb 9 Bled customers 6500 28-Feb 10 Paid the office manager her salary of 2800 for Feb. Agreed to give her a raise to 3000 next month. a Instructions. Prepare in general journal format the previous transactions, 2 Find below a partial trial balance for the Jones Corp at December 31. 2021 Cash 14000 Prepaid Rent 1800 Office supplies 1200 Equipment 14,000 Unearned revenue 9000 Note Payable 20,000 Prepare the adjusting entries at Dec 31,2021 Seee info below 1 900 of the prepaid rent was used up 2 There were 800 of supplies left at the end of the month 3 Record depreciation of 1100 4 For the unearned revenue, 1/3 of it was earned during the month.. 5 Unpaid interest on the note payable is 400 Sheet1 Sheet2 Sheets HE . Type here to search O C > 3000 G H D F E E 3 The following trial balance is for The Johnnie Corp for 2021 Prepare an income statement and retained earnings statement. Not a balance sheet Cash 9000 800 Supplies expense Accumulated depreciation 1000 Service revenue 17000 Unearned revenue 1200 Insurance expense 700 Salary expense 3000 Prepaid Insurance 2400 Accounts payable 4000 Common Stock 800 Depreciation expense 600 Equipment 11000 Retained earnings(beginning of year) 3000 Dividends 1500 Accounts Receivable 4000 Note Payable 6000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started