Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would it be all good of someone please do a financial analysis breaking it up from year 0 to year 30 on the following information?

Would it be all good of someone please do a financial analysis breaking it up from year 0 to year 30 on the following information?

Would it be all good of someone please do a financial analysis breaking it up from year 0 to year 30 on the following information?

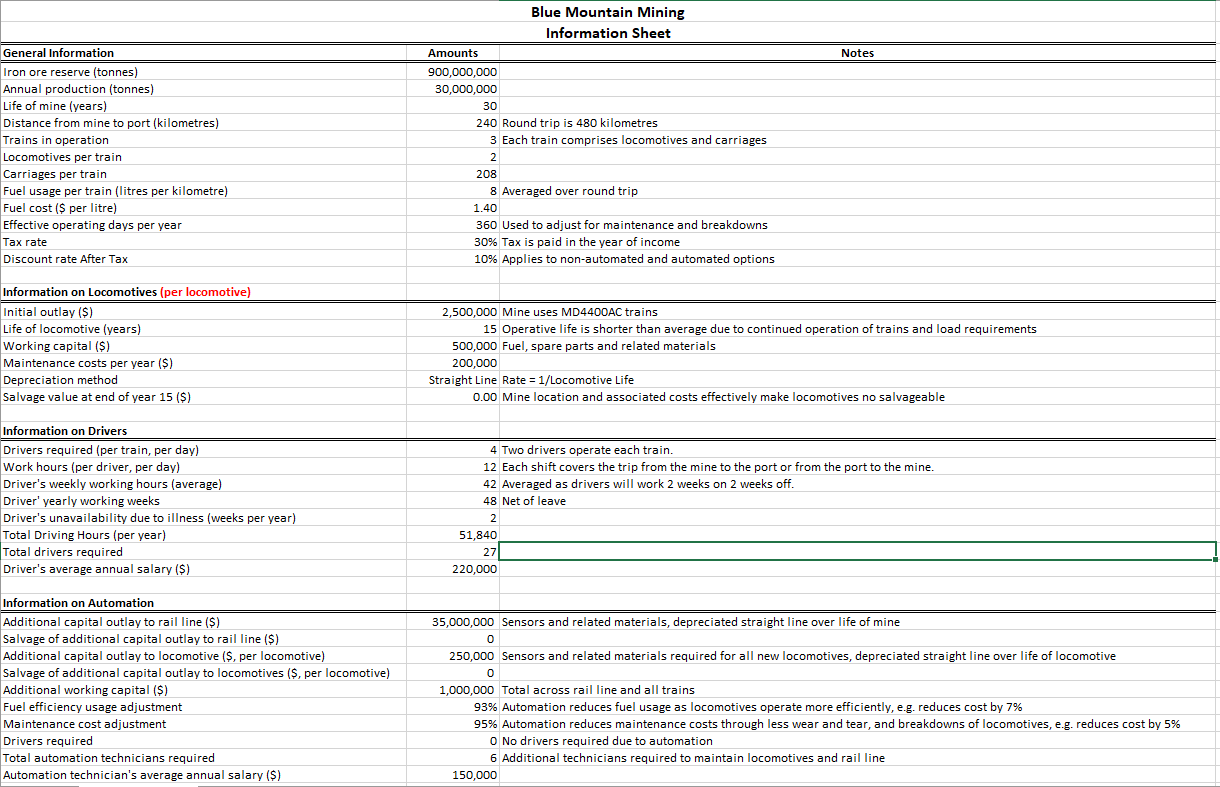

The objective is to decide whether or not a mining train station should use automated trains or trains with drivers (which one will cost less)

General Information Iron ore reserve (tonnes) Annual production (tonnes) Life of mine (years) Distance from mine to port (kilometres) Trains in operation Locomotives per train Carriages per train Fuel usage per train (litres per kilometre) Fuel cost ($ per litre) Effective operating days per year Tax rate Discount rate After Tax Information on Locomotives (per locomotive) Initial outlay ($) Life of locomotive (years) Working capital ($) Maintenance costs per year ($) Depreciation method Salvage value at end of year 15 ($) Information on Drivers Drivers required (per train, per day) Work hours (per driver, per day) Driver's weekly working hours (average) Driver' yearly working weeks Driver's unavailability due to illness (weeks per year) Total Driving Hours (per year) Total drivers required Driver's average annual salary ($) Information on Automation Additional capital outlay to rail line ($) Salvage of additional capital outlay to rail line ($) Additional capital outlay to locomotive ($, per locomotive) Salvage of additional capital outlay to locomotives ($, per locomotive) Additional working capital ($) Fuel efficiency usage adjustment Maintenance cost adjustment Drivers required Total automation technicians required Automation technician's average annual salary ($) Blue Mountain Mining Information Sheet Amounts 900,000,000 30,000,000 30 240 Round trip is 480 kilometres 3 Each train comprises locomotives and carriages 2 208 8 Averaged over round trip 1.40 360 Used to adjust for maintenance and breakdowns 30% Tax is paid in the year of income 10% Applies to non-automated and automated options 2,500,000 Mine uses MD4400AC trains 15 Operative life is shorter than average due to continued operation of trains and load requirements 500,000 Fuel, spare parts and related materials 200,000 Straight Line Rate = 1/Locomotive Life 0.00 Mine location and associated costs effectively make locomotives no salvageable 4 Two drivers operate each train. 12 Each shift covers the trip from the mine to the port or from the port to the mine. 42 Averaged as drivers will work 2 weeks on 2 weeks off. 48 Net of leave 2 51,840 27 220,000 35,000,000 Sensors and related materials, depreciated straight line over life of mine 0 250,000 Sensors and related materials required for all new locomotives, depreciated straight line over life of locomotive 0 1,000,000 Total across rail line and all trains 93% Automation reduces fuel usage as locomotives operate more efficiently, e.g. reduces cost by 7% 95% Automation reduces maintenance costs through less wear and tear, and breakdowns of locomotives, e.g. reduces cost by 5% O No drivers required due to automation 6 Additional technicians required to maintain locomotives and rail 150,000 Notes General Information Iron ore reserve (tonnes) Annual production (tonnes) Life of mine (years) Distance from mine to port (kilometres) Trains in operation Locomotives per train Carriages per train Fuel usage per train (litres per kilometre) Fuel cost ($ per litre) Effective operating days per year Tax rate Discount rate After Tax Information on Locomotives (per locomotive) Initial outlay ($) Life of locomotive (years) Working capital ($) Maintenance costs per year ($) Depreciation method Salvage value at end of year 15 ($) Information on Drivers Drivers required (per train, per day) Work hours (per driver, per day) Driver's weekly working hours (average) Driver' yearly working weeks Driver's unavailability due to illness (weeks per year) Total Driving Hours (per year) Total drivers required Driver's average annual salary ($) Information on Automation Additional capital outlay to rail line ($) Salvage of additional capital outlay to rail line ($) Additional capital outlay to locomotive ($, per locomotive) Salvage of additional capital outlay to locomotives ($, per locomotive) Additional working capital ($) Fuel efficiency usage adjustment Maintenance cost adjustment Drivers required Total automation technicians required Automation technician's average annual salary ($) Blue Mountain Mining Information Sheet Amounts 900,000,000 30,000,000 30 240 Round trip is 480 kilometres 3 Each train comprises locomotives and carriages 2 208 8 Averaged over round trip 1.40 360 Used to adjust for maintenance and breakdowns 30% Tax is paid in the year of income 10% Applies to non-automated and automated options 2,500,000 Mine uses MD4400AC trains 15 Operative life is shorter than average due to continued operation of trains and load requirements 500,000 Fuel, spare parts and related materials 200,000 Straight Line Rate = 1/Locomotive Life 0.00 Mine location and associated costs effectively make locomotives no salvageable 4 Two drivers operate each train. 12 Each shift covers the trip from the mine to the port or from the port to the mine. 42 Averaged as drivers will work 2 weeks on 2 weeks off. 48 Net of leave 2 51,840 27 220,000 35,000,000 Sensors and related materials, depreciated straight line over life of mine 0 250,000 Sensors and related materials required for all new locomotives, depreciated straight line over life of locomotive 0 1,000,000 Total across rail line and all trains 93% Automation reduces fuel usage as locomotives operate more efficiently, e.g. reduces cost by 7% 95% Automation reduces maintenance costs through less wear and tear, and breakdowns of locomotives, e.g. reduces cost by 5% O No drivers required due to automation 6 Additional technicians required to maintain locomotives and rail 150,000 NotesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started