would like to know how to get the numbers for 1999

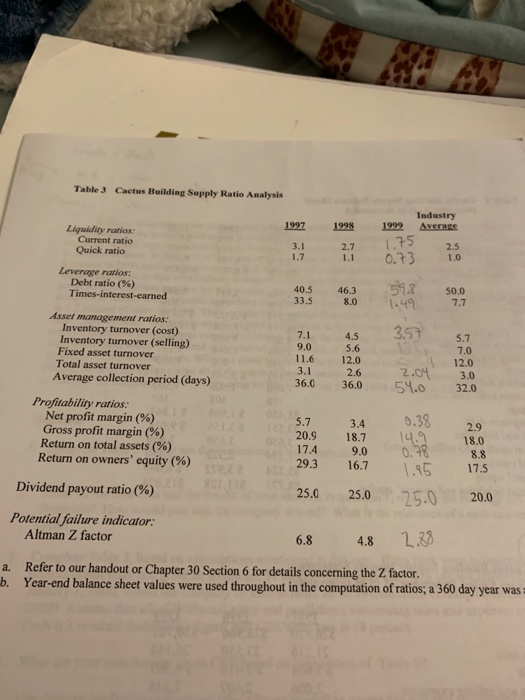

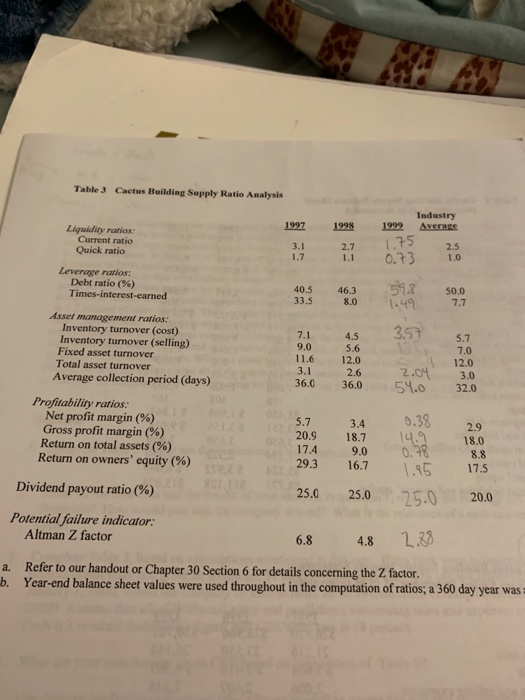

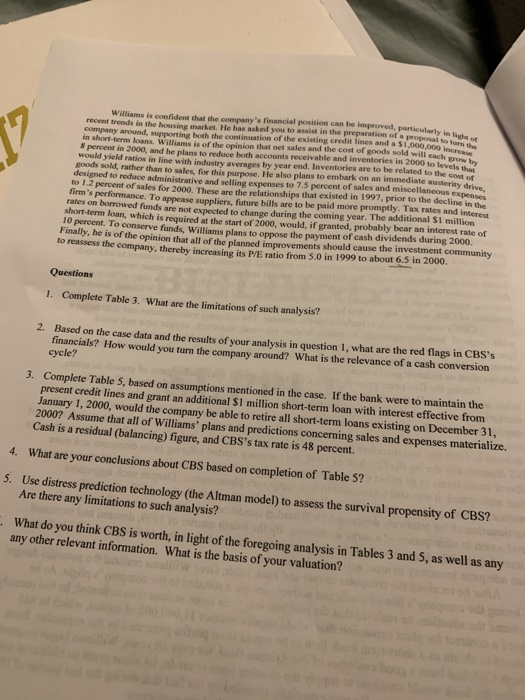

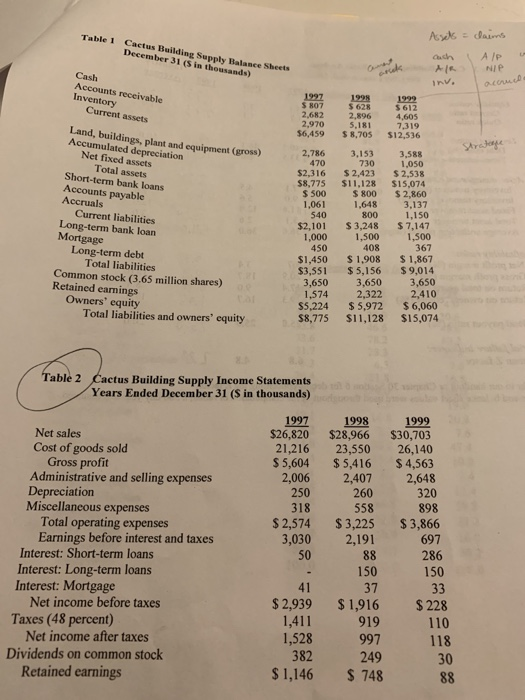

Table 3 Cactus Building Supply Ratio Analysis Industry Average 1998 1999 1997 Liguidity ratios: Current ratio Quick ratio 1.75 0.73 3.1 1.7 2.7 1.1 2.5 1.0 Leverage ratios: Debt ratio (%) Times-interest-earned 51.8 1.49 40.5 46.3 50.0 33.5 8.0 7.7 Asset management ratios: Inventory turnover (cost) Inventory turmover (selling) Fixed asset turnover Total asset turnover 357 1951 7.1 9.0 11.6 3.1 4.5 5.6 12.0 2.6 36.0 5.7 7.0 12.0 3.0 2.04 54.0 Average collection period (days) 36.0 32.0 Profitability ratios: Net profit margin (%) Gross profit margin (%) Return on total assets (%) Return on owners' equity (%) 0.38 14.9 0. 78 1.85 5.7 3.4 2.9 20.9 02 18.7 18.0 17.4 9.0 8.8 29.3 16.7 17.5 Dividend payout ratio (%) 25.0 25.0 25.0 20.0 Potential failure indicator: Altman Z factor 2.38 6.8 4.8 Refer to our handout or Chapter 30 Section 6 for details concerning the Z factor. b. Year-end balance sheet values were used throughout in the computation of ratios; a 360 day year was = a. Williams is confident that the company's financial position can be improved, particularty in recent trends in the housing market. He has asked you to assist in the preparation of a proposal to t company around, supporting both the continuation of the existing credit lines and a $1,000,000 incr in short-term loans. Williams is of the opinion that net sales and the cost of goods sold will each er 8 percent in 200o0, and he plans to reduce both accounts receivable and inventories in 2000 to levels the would yield ratios in line with industry averages by year end. Inventories are to be related to the cost e goods sold, rather than to sales, for this purpose. He also plans to embark on an immediate austerity drive designed to reduce administrative and selling expenses to 7.5 percent of sales and miscellaneous expenses to 1.2 percent of sales for 2000. These are the relationships that existed in 1997, prior to the decline in the firm's performance. To appease suppliers, future bills are to be paid more promptly. Tax rates and interest rates on borrowed funds are not expected to change during the coming year. The additional Si million short-term loan, which is required at the start of 2000, would, if granted, probably bear an interest rate of 10 percent. To conserve funds, Williams plans to oppose the payment of cash dividends during 2000. Finally, he is of the opinion that all of the planned improvements should cause the investment community to reassess the company, thereby increasing its P/E ratio from 5.0 in 1999 to about 6.5 in 2000. Questions 1. Complete Table 3. What are the limitations of such analysis? 2. Based on the case data and the results of vour analysis in question 1, what are the red flags in CBS's financials? How would you turn the company around? What is the relevance of a cash conversion cycle? 3. Complete Table 5, based on assumptions mentioned in the case. If the bank were to maintain the present credit lines and grant an additional $I million short-term loan with interest effective from January 1, 2000, would the company be able to retire all short-term loans existing on December 31, 2000? Assume that all of Williams' plans and predictions concerning sales and expenses materialize. Cash is a residual (balancing) figure, and CBS's tax rate is 48 percent. 4. What are your conclusions about CBS based on completion of Table 5? 5. Use distress prediction technology (the Altman model) to assess the survival propensity of CBS? Are there any limitations to such analysis? What do you think CBS is worth, in light of the foregoing analysis in Tables 3 and 5, as well as any any other relevant information. What is the basis of your valuation? Assels = dais Table 1 Cactus Building Supply Balance Sheets December 31 (S in thousands) A /P NIP Cash Accounts receivable Inventory Current assets acomed Inv. 1997 S B07 2,682 2,970 $6,459 1998 $ 628 2,896 5,181 $8,705 1999 $612 4,605 7,319 S12,536 Land, buildings, plant and equipment (gross) Accumulated depreciation Net fixed assets Stratiage 3,153 730 $2,423 $11,128 2,786 3,588 1,050 $2,538 $15,074 $2,860 3,137 1,150 $7,147 1,500 367 $1,867 $9,014 3,650 2,410 $6,060 $15,074 470 Total assets $2,316 Short-term bank loans Accounts payable Accruals Current liabilities Long-term bank loan Mortgage Long-term debt Total liabilities Common stock (3,65 million shares) Retained earmings Owners' equity Total liabilities and owners' equity $8,775 $ 500 1,061 540 $ 800 1,648 800 $2,101 1,000 450 $1,450 $3,551 3,650 1,574 $5,224 $8,775 $3,248 1,500 408 $ 1,908 $ 5,156 3,650 2,322 $ 5,972 $11,128 Car Table 2 Cactus Building Supply Income Statements Years Ended December 31 (S in thousands) 1997 $26,820 21,216 $ 5,604 2,006 1998 $28,966 23,550 $ 5,416 2,407 260 558 1999 $30,703 26,140 $ 4,563 2,648 320 898 Net sales Cost of goods sold Gross profit Administrative and selling expenses Depreciation Miscellaneous expenses Total operating expenses Earnings before interest and taxes Interest: Short-term loans Interest: Long-term loans Interest: Mortgage Net income before taxes Taxes (48 percent) Net income after taxes Dividends on common stock Retained earnings 250 318 $ 2,574 3,030 $3,225 2,191 88 $3,866 697 286 50 150 150 41 $ 2,939 1,411 1,528 382 37 33 $ 1,916 $ 228 919 110 997 118 30 249 $1,146 $ 748 88