Answered step by step

Verified Expert Solution

Question

1 Approved Answer

would like to know how to work this question out to gain the answer Repton Limited proposes to acquire a new piece of machinery costing

would like to know how to work this question out to gain the answer

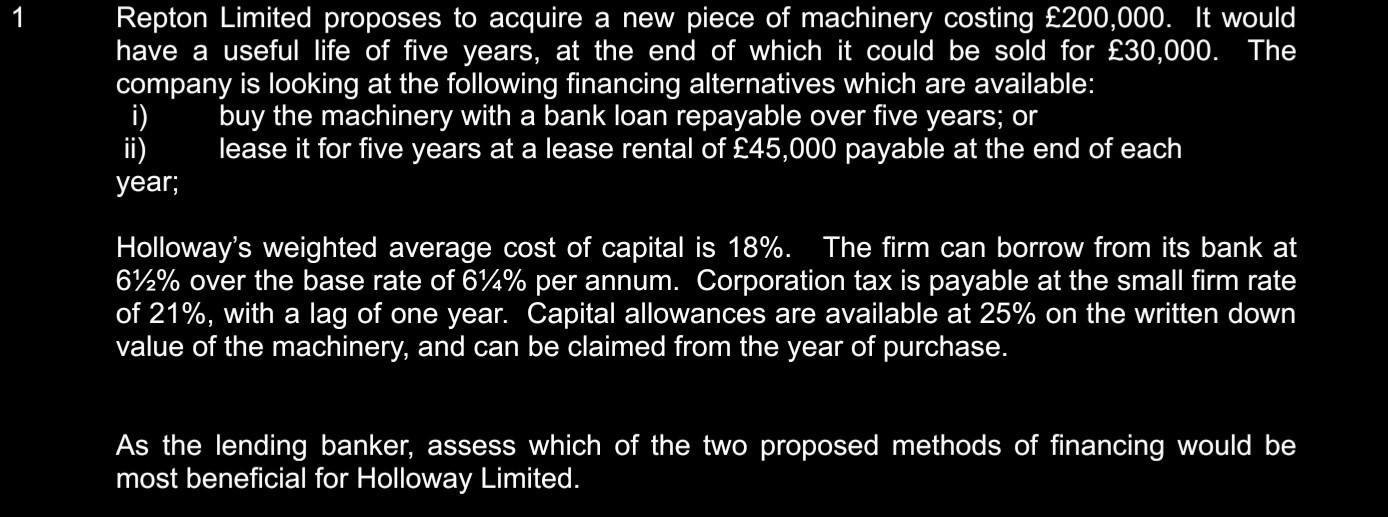

Repton Limited proposes to acquire a new piece of machinery costing 200,000. It would have a useful life of five years, at the end of which it could be sold for 30,000. The company is looking at the following financing alternatives which are available: i) buy the machinery with a bank loan repayable over five years; or ii) lease it for five years at a lease rental of 45,000 payable at the end of each year; Holloway's weighted average cost of capital is 18%. The firm can borrow from its bank at 61/2% over the base rate of 61/4% per annum. Corporation tax is payable at the small firm rate of 21%, with a lag of one year. Capital allowances are available at 25% on the written down value of the machinery, and can be claimed from the year of purchase. As the lending banker, assess which of the two proposed methods of financing would be most beneficial for Holloway LimitedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started