would like to know the correct answers for the boxes with a red x by them.

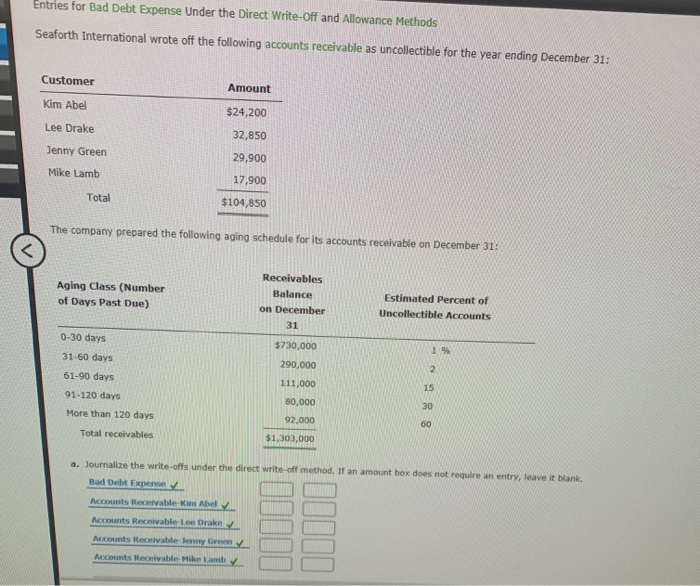

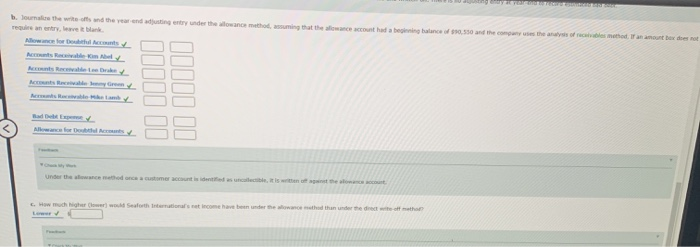

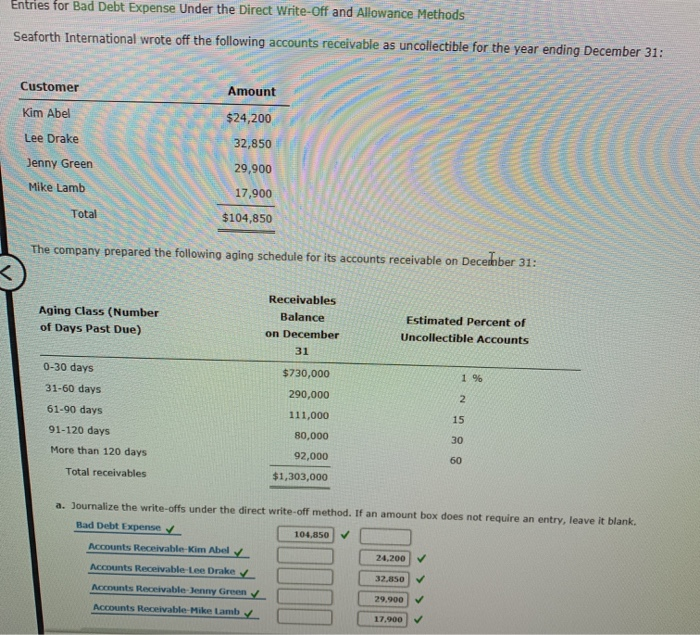

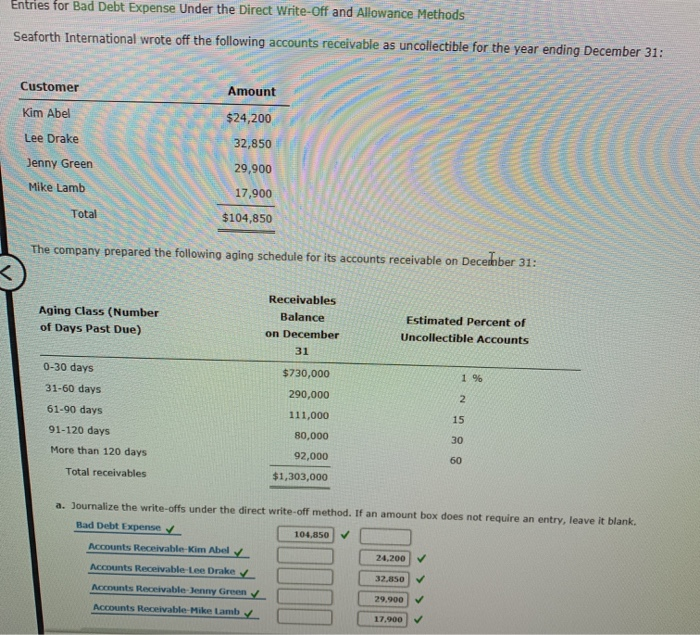

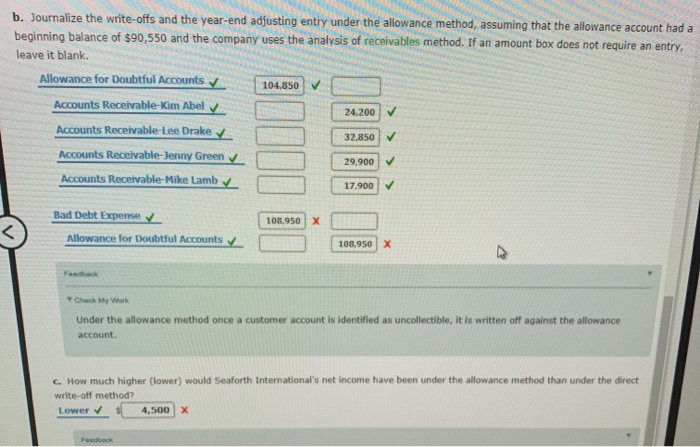

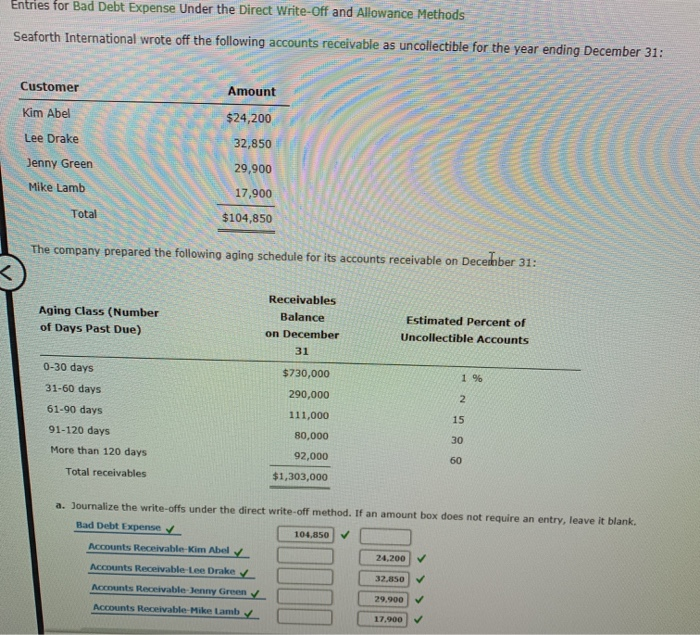

Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $24,200 Lee Drake 32,850 Jenny Green 29,900 Mike Lamb 17,900 Total $104,850 ompany prepared the following aging schedule for its accounts receivable on December 31: The Receivables Aging Class (Number Balance Estimated Percent of of Days Past Due) on December Uncollectible Accounts 31 0-30 days $730,000 1% 31-60 days 290,000 2 61-90 days 111,000 15 91-120 days 0,000 30 More than 120 days 92,000 60 Total receivables $1,303,000 a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank, Bad Debt Expense Accounts Receivable Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable Mike Lamb O0000 b. lournalire the write-offs and the year end adjusting entry under the allowance method, assuming that the aliowance accoset had a beainniee balance of es0 550 and the compeny uses the analysis of recelvables method. IT an amount beyx dees not require an entry, leave it blank Alowance for Doubthl Acconts Acconts Rcable-Km Abl Acconts Recable Le Drake Accosnts Rcwabde yGreen Acms Rcable Mke tand Bad Debt Exp Allowance for Dobtl Accnts y Under the alowance methed once a customer accaunt is identifed as uncalectible, it is wtten off againet the alonance account c. How much higher (ower) would Seaforth Internationals net income have been under the allowance ethod than under the dinect wite off methol Lower Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $24,200 Lee Drake 32,850 Jenny Green 29,900 Mike Lamb 17,900 Total $104,850 The company prepared the following aging schedule for its accounts receivable on December 31: Receivables Aging Class (Number of Days Past Due) Balance Estimated Percent of Uncollectible Accounts on December 31 0-30 days $730,000 1 % 31-60 days 290,000 2 61-90 days 111,000 15 91-120 days 80,000 30 More than 120 days 92,000 60 Total receivables $1,303,000 a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. Bad Debt Expense 104,850 Accounts Receivable-Kim Abel 24.200 V AcCounts Receivable Lee Drake 32.850 Accounts Receivable-Jenmy Green 29,900 Accounts Receivable-Mike Lamb 17,900 b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $90,550 and the company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank. Allowance for Doubtful Accounts 104.850 Accounts Receivable-Kim Abel 24,200 Accounts Receivable-Lee Drake 32.850 AcCounts Receivable-Jenny Green 29,900 Accounts Receivable-Mike Lamb 17,900 Bad Debt Expense 108,950 X Allowance for Doubtful Accounts 108,950 X Feedback Y Check My Work Under the allowance method once a customer account is identified as uncollectible, it is written off against the allowance account. c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? Lower 4,500