Would love some help finishing this please

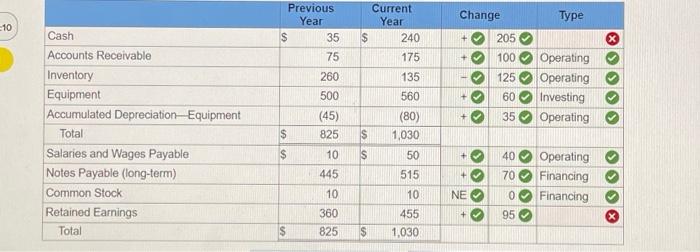

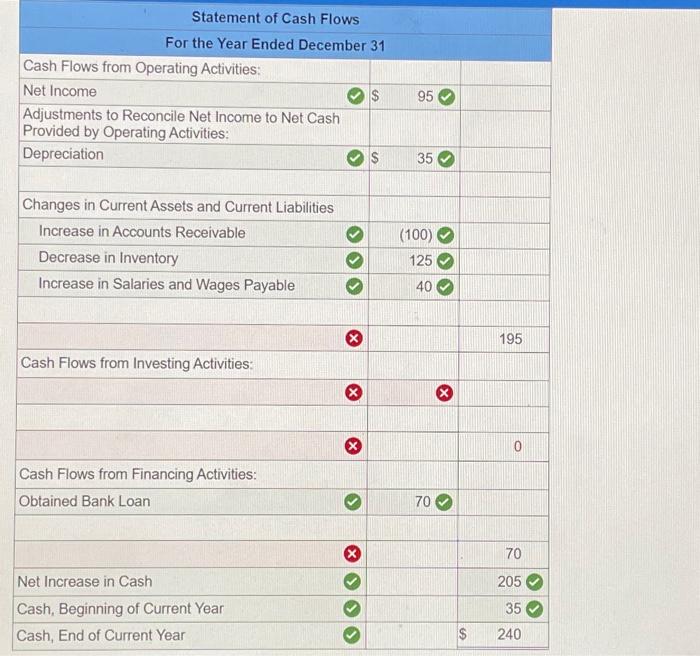

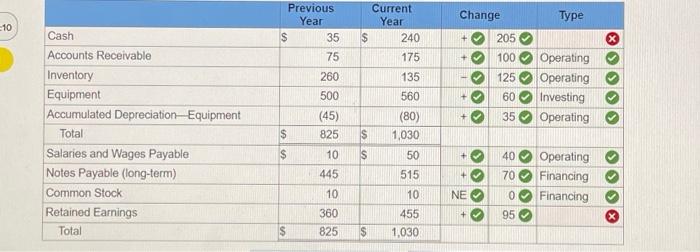

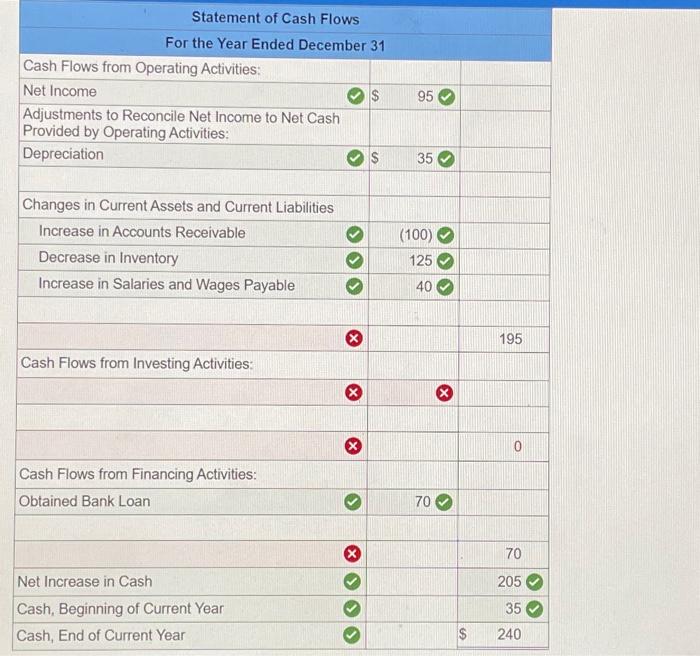

Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company's comparative balance sheet, at Decembe 31 , Is presented here. Required: 1. Calculate the change in each balance sheet account and indicate whether each account relates to operating, investing, and/or financing activities (+ for increase and - for decrease). 2. Prepare a statement of cash flows using the indirect method. 6. Are the cash flows typical of a start-up, healthy, or troubled company? Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Cash } & \multicolumn{2}{|c|}{\begin{tabular}{c} Previous \\ Year \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} Current \\ Year \end{tabular}} & \multicolumn{2}{|c|}{ Change } & \multicolumn{2}{|l|}{ Type } \\ \hline & $ & 35 & $ & 240 & +0 & 2050 & & \\ \hline Accounts Receivable & & 75 & & 175 & +0 & 100 & Operating & 0 \\ \hline Inventory & & 260 & & 135 & -0 & 1250 & Operating & 0 \\ \hline Equipment & & 500 & & 560 & +0 & 600 & Investing & ( \\ \hline Accumulated Depreciation-Equipment & & (45) & & (80) & +Q & 350 & Operating & 0 \\ \hline Total & $ & 825 & $ & 1,030 & & & & \\ \hline Salaries and Wages Payable & $ & 10 & \$ & 50 & +0 & 400 & Operating & Q \\ \hline Notes Payable (long-term) & & 445 & & 515 & +0 & 70 & Financing & 0 \\ \hline Common Stock & & 10 & & 10 & NE 0 & 00 & Financing & 0 \\ \hline Retained Earnings & & 360 & & 455 & +0 & 950 & & \\ \hline Total & $ & 825 & $ & 1,030 & & & & \\ \hline \end{tabular} \begin{tabular}{l} Statement of Cash Flows \\ For the Year Ended December 31 \\ \hline Cash Flows from Operating Activities: \\ \hline Net Income \\ \hline Adjustments to Reconcile Net Income to Net Cash \\ Provided by Operating Activities: \\ \hline Depreciation \\ \hline Changes in Current Assets and Current Liabilities \\ \hline Increase in Accounts Receivable \\ \hline Decrease in Inventory \\ \hline Increase in Salaries and Wages Payable \\ \hline Cash Flows from Investing Activities: \\ \hline Cash, Beginning of Current Year \\ \hline Obtained Bank Loan \\ \hline Net Increase in Cash \\ \hline Cash Flows from Financing Activities: \\ \hline \end{tabular}