Question

Would someone be able to develop a schedule showing the financial impact of two business owners of an S corporation? It's from a homework question:

Would someone be able to develop a schedule showing the financial impact of two business owners of an S corporation? It's from a homework question:

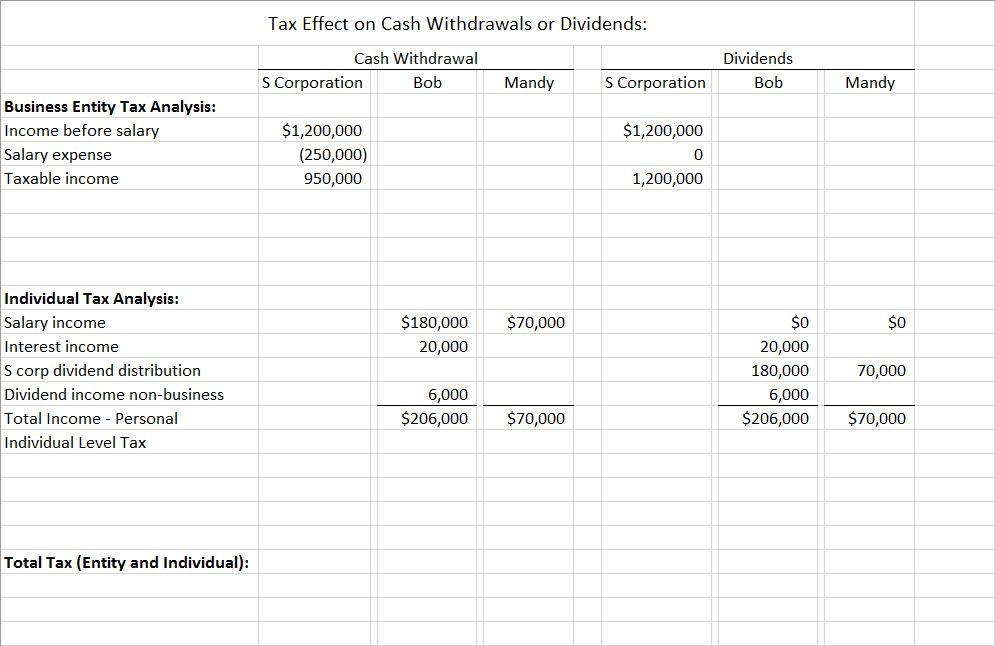

Explain the tax effect based on providing $180,000 per year for the clients salary and $70,000 per year for his daughters salary if they withdraw cash from the business or pay dividends.

The two owners are Bob and his daughter Mandy. So Bob would get the $180,000 salary and Mandy would get the $70,000 salary. So they could either withdraw cash from the business in the form of a salary or distribute in the form of dividends. The taxable income for the S corporation is $1,200,000. Bob has interest income of $20,000 and dividend income of $6,000. I know the corporation doesn't get taxed: only the individual owners do. Bob would have 60% ownership in the business and Mandy would have 40% ownership interest.

I started to figure out how it would look in an Excel spreadsheet:

I'm having trouble figuring this out in excel and performing the necessary calculations. If someone could please help me I would appreciate it! Thank you!

Tax Effect on Cash Withdrawals or Dividends: Cash Withdrawal S Corporation Bob Dividends Bob Mandy S Corporation Mandy Business Entity Tax Analysis: Income before salary Salary expense Taxable income $1,200,000 (250,000) 950,000 $1,200,000 0 1,200,000 $70,000 $0 $180,000 20,000 Individual Tax Analysis: Salary income Interest income Scorp dividend distribution Dividend income non-business Total Income - Personal Individual Level Tax $0 20,000 180,000 6,000 $206,000 70,000 6,000 $206,000 $70,000 $70,000 Total Tax (Entity and Individual)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started