Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Would you please validate a-1 is correct? Would you please assist with a-2, I am lost on this one. The following is the pre-closing trial

Would you please validate a-1 is correct?

Would you please assist with a-2, I am lost on this one.

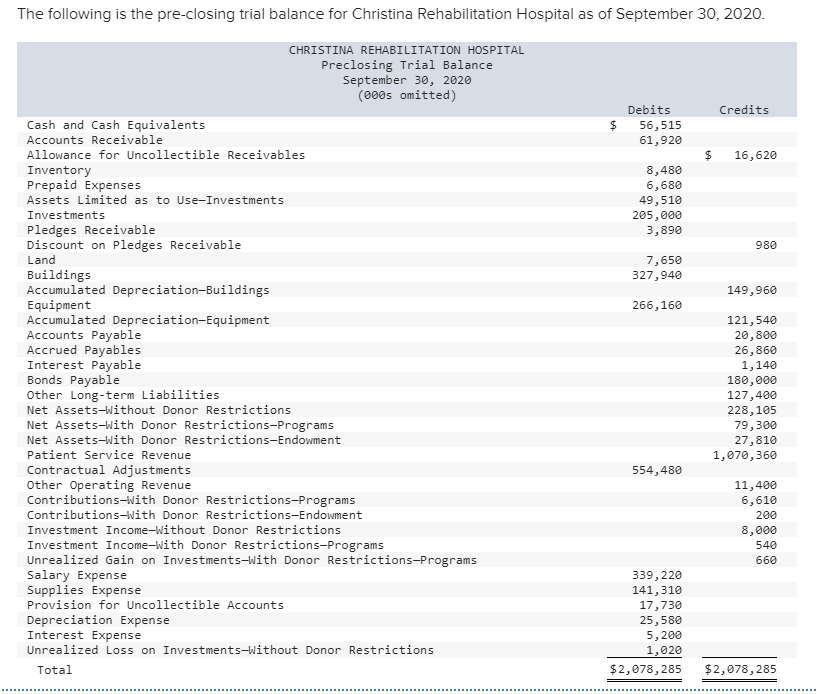

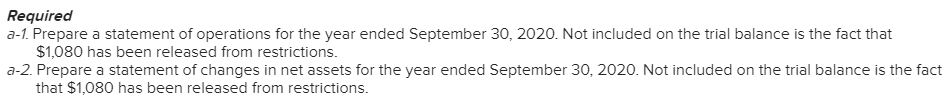

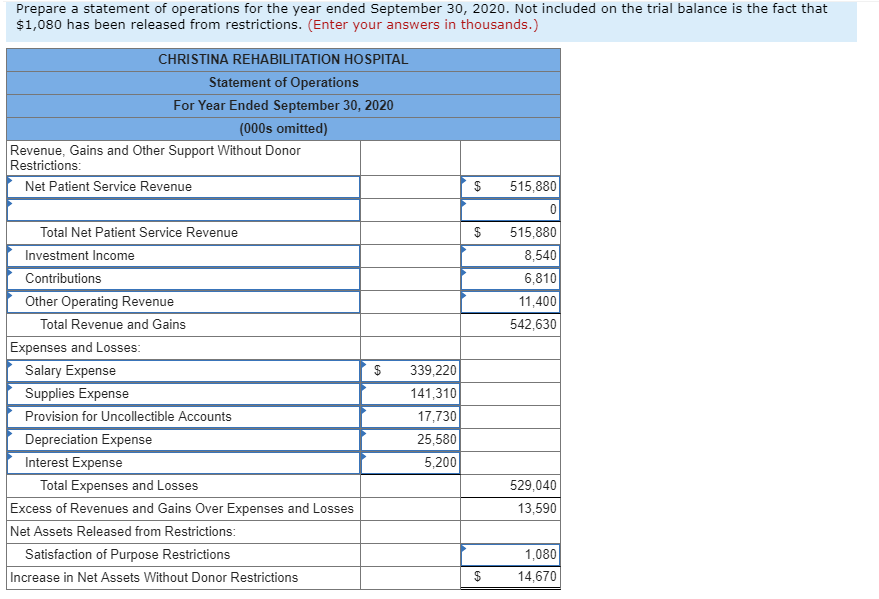

The following is the pre-closing trial balance for Christina Rehabilitation Hospital as of September 30, 2020. CHRISTINA REHABILITATION HOSPITAL Preclosing Trial Balance September 30, 2020 (000s omitted) Debits Credits Cash and Cash Equivalents Accounts Receivable 56,515 61,920 Allowance for Uncollectible Receivables 16,620 Inventory Prepaid Expenses Assets Limited as to Use-Investments 8,480 6,680 49,510 205,000 3,890 Investments Pledges Receivable Discount on Pledges Receivable 980 Land 7,650 327,940 Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Accrued Payables Interest Payable Bonds Payable Other Long-term Liabilities Net Assets-Without Donor Restrictions 149,960 266,160 121,540 20,800 26,860 1,140 180,000 127,400 228,105 Net Assets-With Donor Restrictions-Programs 79,300 27,810 1,070,360 Net Assets-With Donor Restrictions-Endowment Patient Service Revenue Contractual Adjustments Other Operating Revenue Contributions-with Donor Restrictions-Programs Contributions-With Donor Restrictions-Endowment 554,480 11,400 6,610 200 Investment Income-Without Donor Restrictions 8,000 Investment Income-With Donor Restrictions-Programs Unrealized Gain on Investments-With Donor Restrictions-Programs Salary Expense Supplies Expense Provision for Uncollectible Accounts 540 660 339,220 141,310 17,730 25,580 5,200 1,020 Depreciation Expense Interest Expense Unrealized Loss on Investments-Without Donor Restrictions Total $2,078, 285 $2,078,285 +A Required a-1. Prepare a statement of operations for the year ended September 30, 2020. Not included on the trial balance is the fact that $1,080 has been released from restrictions. a-2. Prepare a statement of changes in net assets for the year ended September 30, 2020. Not included on the trial balance is the fact that $1,080 has been released from restrictions. Prepare a statement of operations for the year ended September 30, 2020. Not included on the trial balance is the fact that $1,080 has been released from restrictions. (Enter your answers in thousands.) CHRISTINA REHABILITATION HOSPITAL Statement of Operations For Year Ended September 30, 2020 (000s omitted) Revenue, Gains and Other Support Without Donor Restrictions: 515,880 Net Patient Service Revenue 0 Total Net Patient Service Revenue 515,880 Investment Income 8,540 Contributions 6,810 Other Operating Revenue 11,400 Total Revenue and Gains 542,630 Expenses and Losses Salary Expense 339,220 141,310 Supplies Expense Provision for Uncollectible Accounts 17,730 Depreciation Expense 25,580 Interest Expense 5,200 529,040 Total Expenses and Losses |Excess of Revenues and Gains Over Expenses and Losses Net Assets Released from Restrictions: 13,590 Satisfaction of Purpose Restrictions 1,080 Increase in Net Assets Without Donor Restrictions 14,670 Prepare a statement of changes in net assets for the year ended September 30, 2020. Not included on the trial balance is the fact that $1,080 has been released from temporary purpose restrictions. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.) CHRISTINA REHABILITATION HOSPITAL Statement of Changes in Net Assets For Year Ended September 30, 2020 (000s omitted) Net Assets Without Donor Restrictions: 13,590 Excess of Revenues and Gains Over Expenses and Losses Investment Income 8,000 21,590 Increase in Net Assets Without Donor Restrictions: Net Assets With Donor Restrictions: Contributions for Endowment 200 Contributions for Programs 6,610 540 Investment Income 660 Unrealized Gain on Investments Unrealized Loss on Investments (1,020) 6,990 Increase in Net Assets With Donor Restrictions: Increase in Net Assets Net Assets at Beginning of the Year Net Assets at End of the Year 28,580 28,580

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started