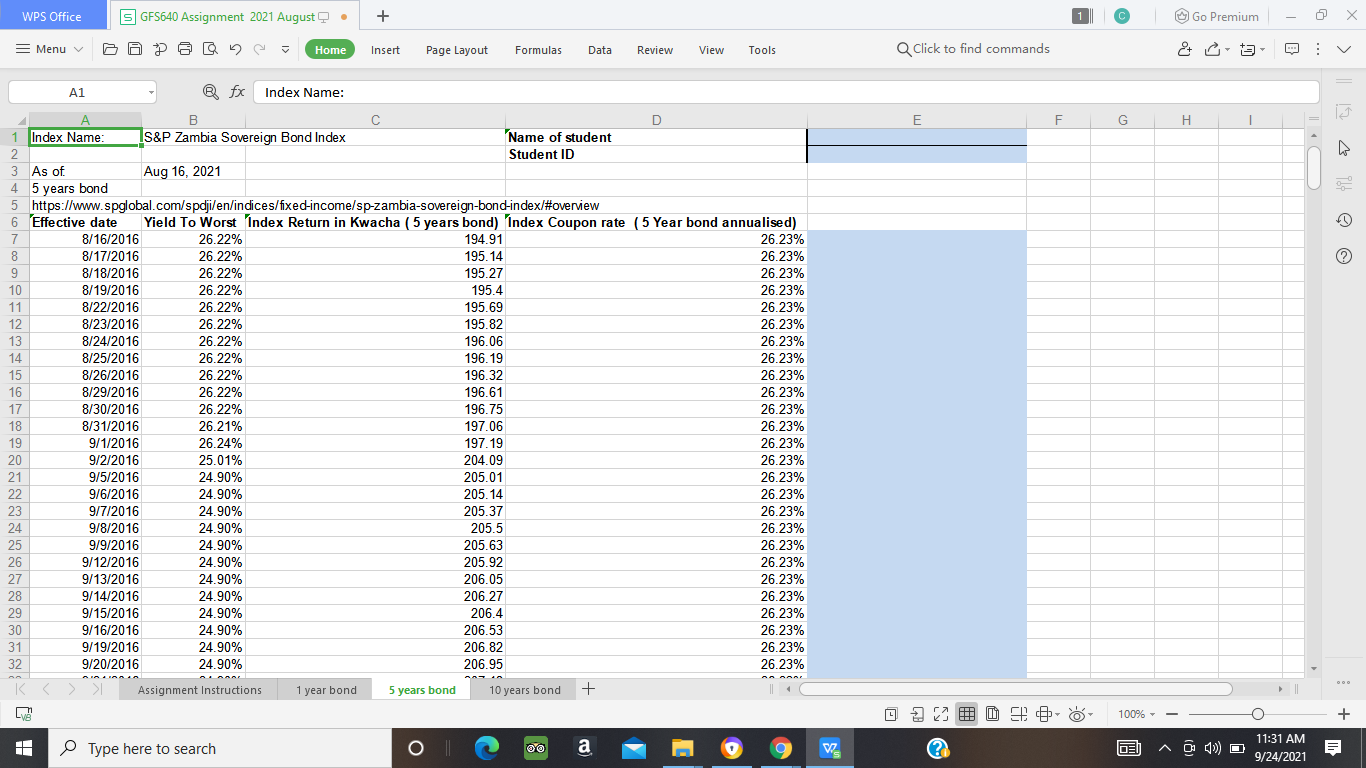

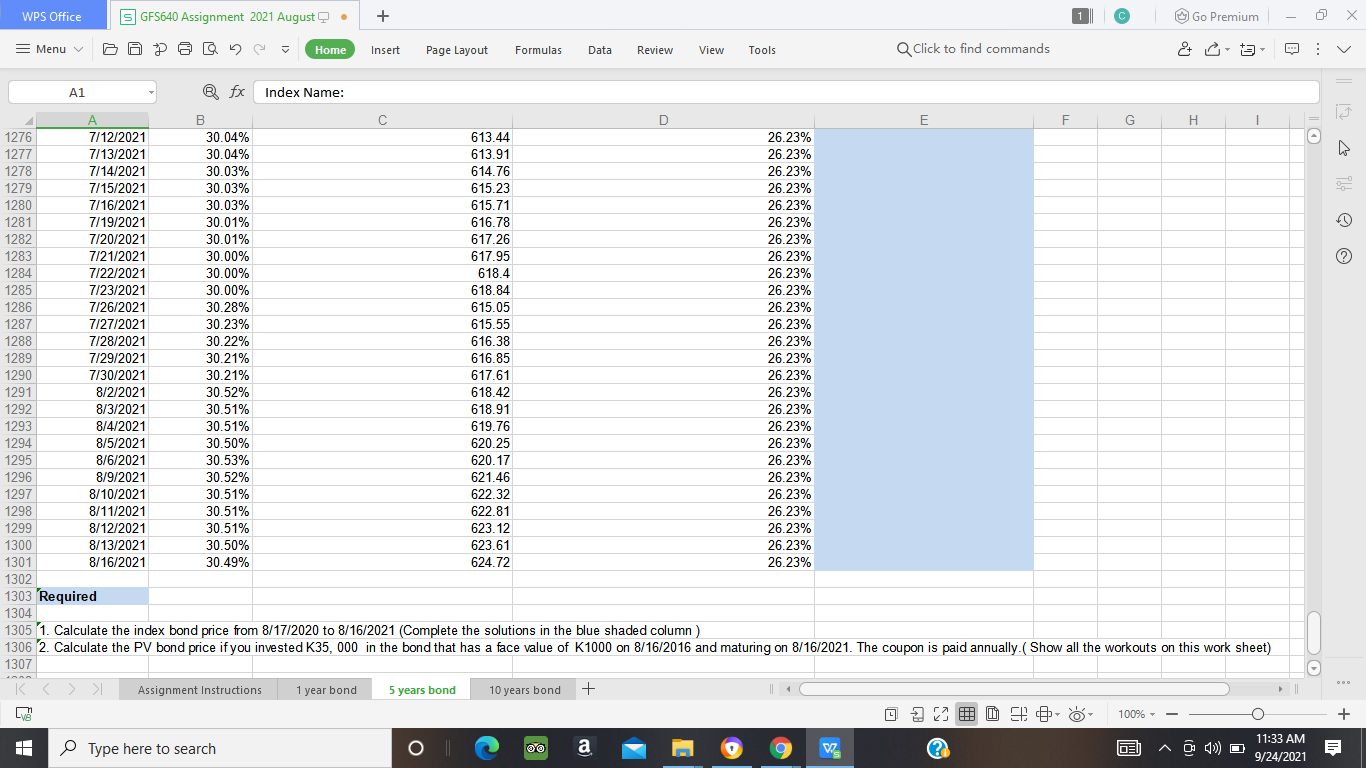

WPS Office SGFS640 Assignment 2021 August + C Go Premium Menu Home Insert Page Layout Formulas Data Review View Tools Q Click to find commands & ta C E F G H 1 7 60 A1 fx Index Name: A B C D 1 Index Name: S&P Zambia Sovereign Bond Index Name of student 2. Student ID 3 As of Aug 16, 2021 4 5 years bond 5 https://www.spglobal.com/spdji/en/indices/fixed-income/sp-zambia-sovereign-bond-index/#overview 6 Effective date Yield To Worst Index Return in Kwacha ( 5 years bond) Index Coupon rate (5 Year bond annualised) 7 8/16/2016 26.22% 194.91 26.23% 8 8/17/2016 26.22% 195.14 26.23% 9 8/18/2016 26.22% 195.27 26.23% 10 8/19/2016 26.22% 195.4 26.23% 11 8/22/2016 26.22% 195.69 26.23% 12 8/23/2016 26.22% 195.82 26.23% 13 8/24/2016 26.22% 196.06 26.23% 14 8/25/2016 26.22% 196.19 26.23% 15 8/26/2016 26.22% 196.32 26.23% 16 8/29/2016 26.22% 196.61 26.23% 17 8/30/2016 26.22% 196.75 26.23% 18 8/31/2016 26.21% 197.06 26.23% 19 9/1/2016 26.24% 197.19 26.23% 20 9/2/2016 25.01% 204.09 26.23% 21 9/5/2016 24.90% 205.01 26.23% 22 9/6/2016 24.90% 205.14 26.23% 23 9/7/2016 24.90% 205.37 26.23% 24 9/8/2016 24.90% 205.5 26.23% 25 9/9/2016 24.90% 205.63 26.23% 26 9/12/2016 24.90% 205.92 26.23% 27 9/13/2016 24.90% 206.05 26.23% 28 9/14/2016 24.90% 206.27 26.23% 29 9/15/2016 24.90% 206.4 26.23% 30 9/16/2016 24.90% 206.53 26.23% 31 9/19/2016 24.90% 206.82 26.23% 32 9/20/2016 24.90% 206.95 26.23% K > > Assignment Instructions 1 year bond 5 years bond 10 years bond + Lud ] o 100% + Type here to search 1 OD a V A IL 11:31 AM 9/24/2021 WPS Office SGFS640 Assignment 2021 August + C Go Premium = Menu Sot Home Insert Page Layout Formulas Data Review View Tools Q Click to find commands eta C 1285 A1 fx B Index Name: B D E F G . 1 1276 7/12/2021 30.04% 613.44 26.23% 1277 7/13/2021 30.04% 613.91 26.23% 1278 7/14/2021 30.03% 614.76 26.23% 1279 7/15/2021 30.03% 615.23 26.23% 1280 7/16/2021 30.03% 615.71 26.23% 1281 7/19/2021 30.01% 616.78 26.23% 1282 7/20/2021 30.01% 617.26 26.23% 1283 7/21/2021 30.00% 617.95 26.23% 1284 7/22/2021 30.00% 618.4 26.23% 7/23/2021 30.00% 618.84 26.23% 1286 7/26/2021 30.28% 615.05 26.23% 1287 7/27/2021 30.23% 615.55 26.23% 1288 7/28/2021 30.22% 616.38 26.23% 1289 7/29/2021 30.21% 616.85 26.23% 1290 7/30/2021 30.21% 617.61 26.23% 1291 8/2/2021 30.52% 618.42 26.23% 1292 8/3/2021 30.51% 618.91 26.23% 1293 8/4/2021 30.51% 619.76 26.23% 1294 8/5/2021 30.50% 620.25 26.23% 1295 8/6/2021 30.53% 620.17 26.23% 1296 8/9/2021 30.52% 621.46 26.23% 1297 8/10/2021 30.51% 622.32 26.23% 1298 8/11/2021 30.51% 622.81 26.23% 1299 8/12/2021 30.51% 623.12 26.23% 1300 8/13/2021 30.50% 623.61 26.23% 1301 8/16/2021 30.49% 624.72 26.23% 1302 1303 'Required 1304 1305 1. Calculate the index bond price from 8/17/2020 to 8/16/2021 (Complete the solutions in the blue shaded column) 1306 2. Calculate the PV bond price if you invested K35,000 in the bond that has a face value of K1000 on 8/16/2016 and maturing on 8/16/2021. The coupon is paid annually.( Show all the workouts on this work sheet) 1307 KC > > Assignment Instructions 1 year bond 5 years bond 10 years bond + LA O ED 0 100% Type here to search OD @ a 11:33 AM V7 DEI ^ () o 9/24/2021 + 1 WPS Office SGFS640 Assignment 2021 August + C Go Premium Menu Home Insert Page Layout Formulas Data Review View Tools Q Click to find commands & ta C E F G H 1 7 60 A1 fx Index Name: A B C D 1 Index Name: S&P Zambia Sovereign Bond Index Name of student 2. Student ID 3 As of Aug 16, 2021 4 5 years bond 5 https://www.spglobal.com/spdji/en/indices/fixed-income/sp-zambia-sovereign-bond-index/#overview 6 Effective date Yield To Worst Index Return in Kwacha ( 5 years bond) Index Coupon rate (5 Year bond annualised) 7 8/16/2016 26.22% 194.91 26.23% 8 8/17/2016 26.22% 195.14 26.23% 9 8/18/2016 26.22% 195.27 26.23% 10 8/19/2016 26.22% 195.4 26.23% 11 8/22/2016 26.22% 195.69 26.23% 12 8/23/2016 26.22% 195.82 26.23% 13 8/24/2016 26.22% 196.06 26.23% 14 8/25/2016 26.22% 196.19 26.23% 15 8/26/2016 26.22% 196.32 26.23% 16 8/29/2016 26.22% 196.61 26.23% 17 8/30/2016 26.22% 196.75 26.23% 18 8/31/2016 26.21% 197.06 26.23% 19 9/1/2016 26.24% 197.19 26.23% 20 9/2/2016 25.01% 204.09 26.23% 21 9/5/2016 24.90% 205.01 26.23% 22 9/6/2016 24.90% 205.14 26.23% 23 9/7/2016 24.90% 205.37 26.23% 24 9/8/2016 24.90% 205.5 26.23% 25 9/9/2016 24.90% 205.63 26.23% 26 9/12/2016 24.90% 205.92 26.23% 27 9/13/2016 24.90% 206.05 26.23% 28 9/14/2016 24.90% 206.27 26.23% 29 9/15/2016 24.90% 206.4 26.23% 30 9/16/2016 24.90% 206.53 26.23% 31 9/19/2016 24.90% 206.82 26.23% 32 9/20/2016 24.90% 206.95 26.23% K > > Assignment Instructions 1 year bond 5 years bond 10 years bond + Lud ] o 100% + Type here to search 1 OD a V A IL 11:31 AM 9/24/2021 WPS Office SGFS640 Assignment 2021 August + C Go Premium = Menu Sot Home Insert Page Layout Formulas Data Review View Tools Q Click to find commands eta C 1285 A1 fx B Index Name: B D E F G . 1 1276 7/12/2021 30.04% 613.44 26.23% 1277 7/13/2021 30.04% 613.91 26.23% 1278 7/14/2021 30.03% 614.76 26.23% 1279 7/15/2021 30.03% 615.23 26.23% 1280 7/16/2021 30.03% 615.71 26.23% 1281 7/19/2021 30.01% 616.78 26.23% 1282 7/20/2021 30.01% 617.26 26.23% 1283 7/21/2021 30.00% 617.95 26.23% 1284 7/22/2021 30.00% 618.4 26.23% 7/23/2021 30.00% 618.84 26.23% 1286 7/26/2021 30.28% 615.05 26.23% 1287 7/27/2021 30.23% 615.55 26.23% 1288 7/28/2021 30.22% 616.38 26.23% 1289 7/29/2021 30.21% 616.85 26.23% 1290 7/30/2021 30.21% 617.61 26.23% 1291 8/2/2021 30.52% 618.42 26.23% 1292 8/3/2021 30.51% 618.91 26.23% 1293 8/4/2021 30.51% 619.76 26.23% 1294 8/5/2021 30.50% 620.25 26.23% 1295 8/6/2021 30.53% 620.17 26.23% 1296 8/9/2021 30.52% 621.46 26.23% 1297 8/10/2021 30.51% 622.32 26.23% 1298 8/11/2021 30.51% 622.81 26.23% 1299 8/12/2021 30.51% 623.12 26.23% 1300 8/13/2021 30.50% 623.61 26.23% 1301 8/16/2021 30.49% 624.72 26.23% 1302 1303 'Required 1304 1305 1. Calculate the index bond price from 8/17/2020 to 8/16/2021 (Complete the solutions in the blue shaded column) 1306 2. Calculate the PV bond price if you invested K35,000 in the bond that has a face value of K1000 on 8/16/2016 and maturing on 8/16/2021. The coupon is paid annually.( Show all the workouts on this work sheet) 1307 KC > > Assignment Instructions 1 year bond 5 years bond 10 years bond + LA O ED 0 100% Type here to search OD @ a 11:33 AM V7 DEI ^ () o 9/24/2021 + 1