Answered step by step

Verified Expert Solution

Question

1 Approved Answer

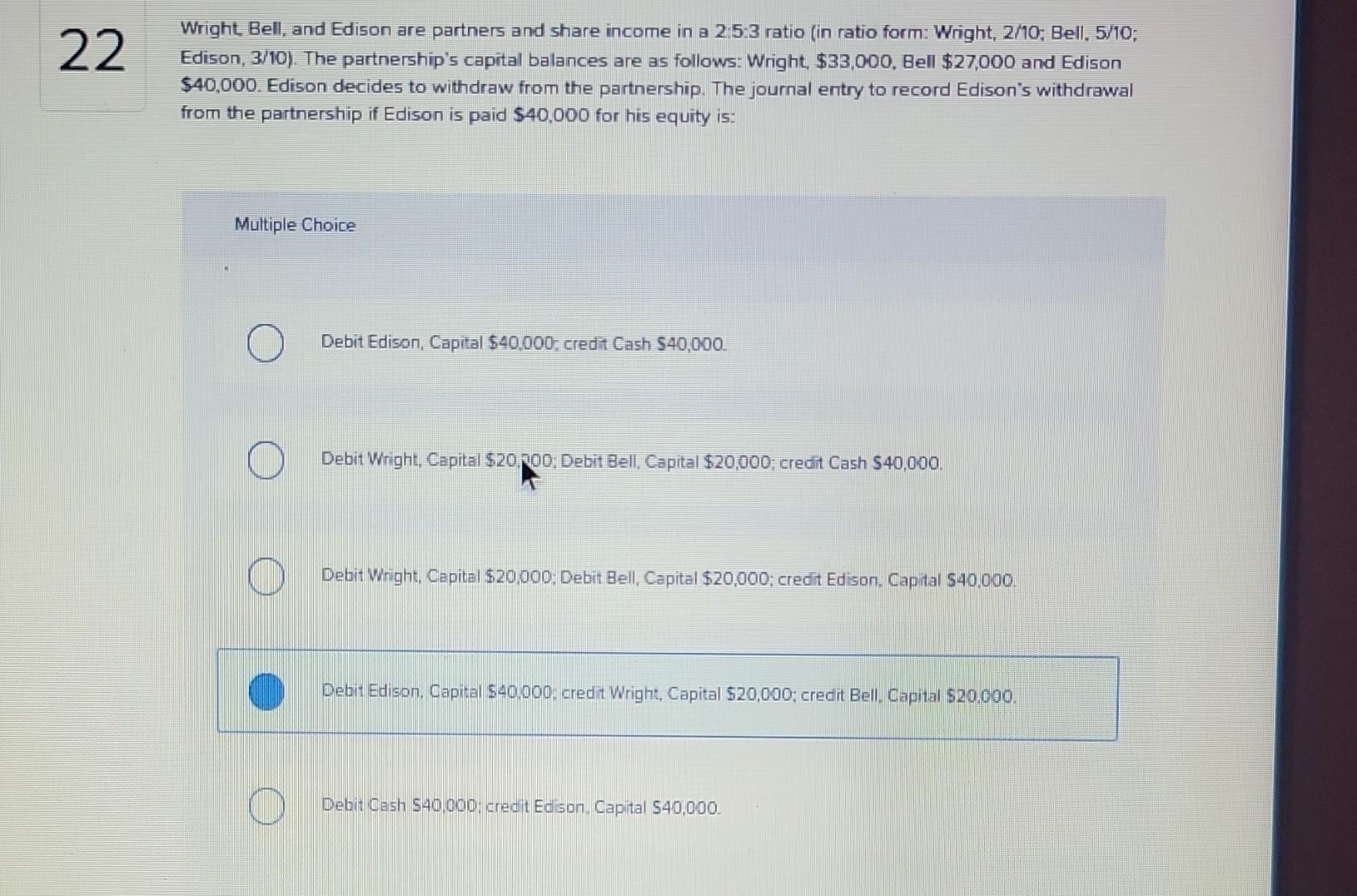

Wright, Bell, and Edison are partners and share income in a 2:5:3 ratio (in ratio form: Wright, 2/10; Bell, 5/10; Edison, 3/10). The partnership's capital

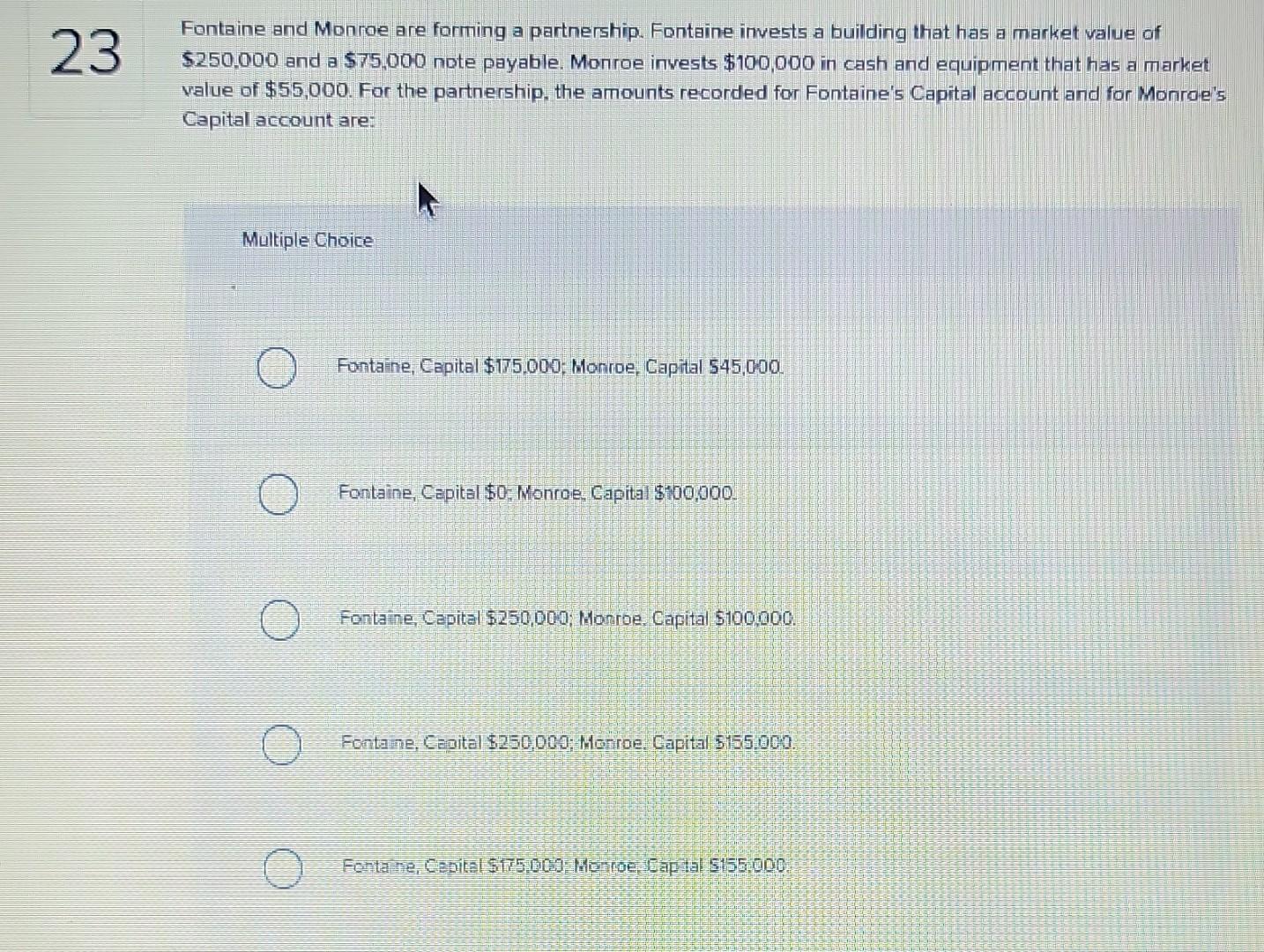

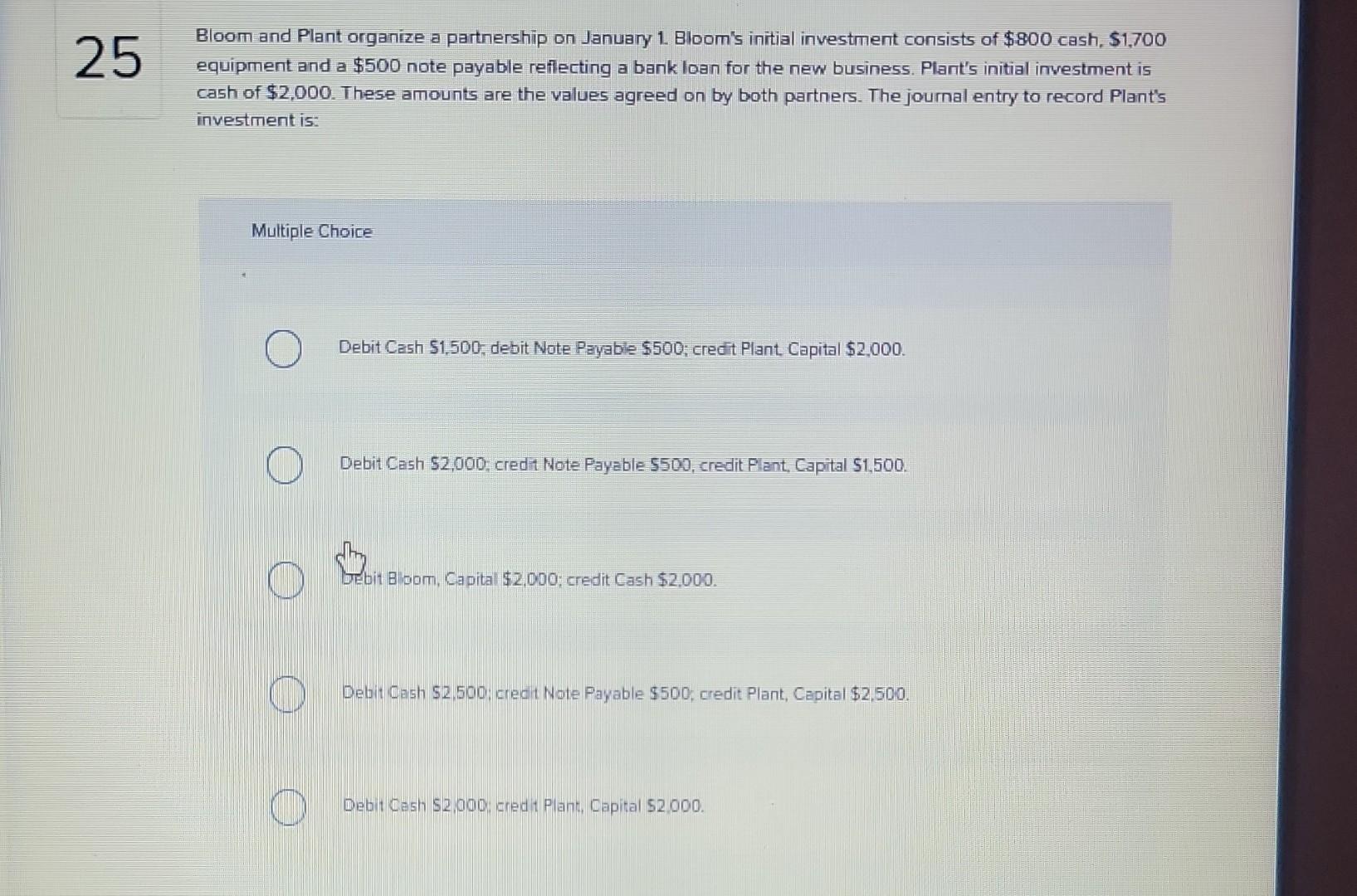

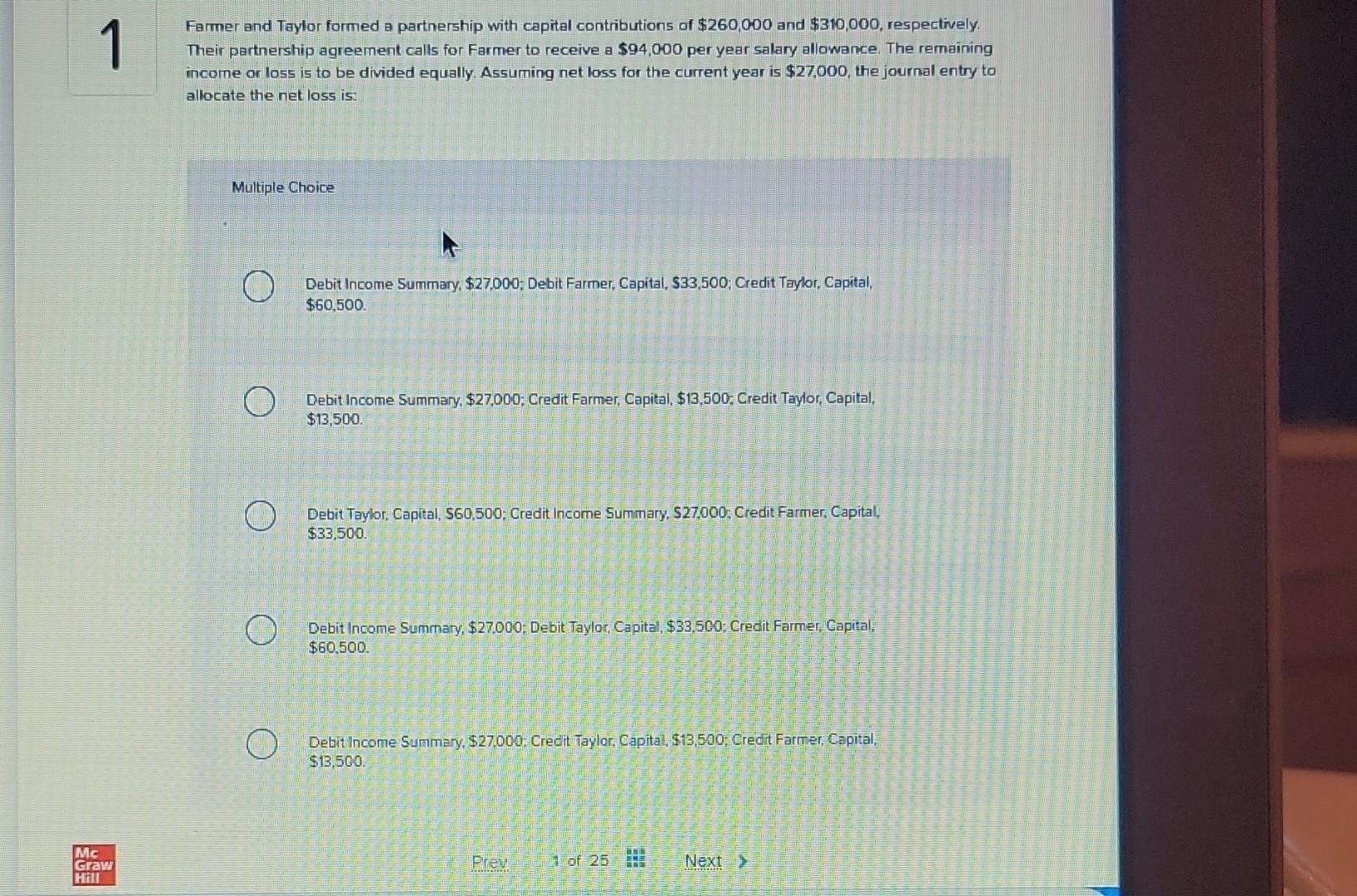

Wright, Bell, and Edison are partners and share income in a 2:5:3 ratio (in ratio form: Wright, 2/10; Bell, 5/10; Edison, 3/10). The partnership's capital balances are as follows: Wright, $33,000, Bell $27,000 and Edison $40,000. Edison decides to withdraw from the partnership. The journal entry to record Edison's withdrawal from the partnership if Edison is paid $40,000 for his equity is: Multiple Choice Debit Edison, Capital \$40,000, credit Cash \$40,000 Debit Wright, Capital \$20, p00; Debit Bell, Capital \$20,000; credit Cash \$40,000. Debit Wright, Capital \$20,000; Debit Bell, Capital \$20,000; credit Edison. Capital \$40,000. Debit Edison, Capital \$40,000; credit Wright, Capital \$20,000; credit Bell, Capital \$20,000. Debit Cash 540,000; credit Edison, Capital \$40,000. Bloom and Plant organize a partnership on January 1. Bloom's initial investment consists of $800 cash, $1,700 equipment and a $500 note payable reflecting a bank loan for the new business. Plant's initial investment is cash of $2,000. These amounts are the values agreed on by both partners. The journal entry to record Plant's investment is: Multiple Choice Debit Cash \$1,500, debit Note Payable \$500; credit Plant, Capital \$2,000. Debit Cash \$2,000; credit Note Payable \$500, credit Plant, Capital \$1,500. Debit Bloom, Capital \$2,000; credit Cash \$2,000. Debit Cash \$2,500; cred t Note Payable \$500, credit Plant, Capital \$2,500. Debit Cash \$2,000, cred 1 Plant, Capital \$2,000. Fontaine and Monroe are forming a partnership. Fontaine invests a building that has a market value of $250,000 and a \$75,000 note payable. Monroe invests $100,000 in cash and equipment that has a market value of \$55,000. For the partnership, the amounts recorded for Fontaine's Capital account and for Monroe's Capital account are: Multiple Choice Fontaine, Capital \$175,000: Monroe, Capital 545,000. Fontaine, Capital \$0: Monroe, Capital $100,000 Fontaine, Capital \$250,000; Monroe, Capital \$100,000. Fontane, Capital \$250,000; Monroe. Capital \$155,000. Fontane, Caplal ST5009 Homoe Gaptal 5155600 Farmer and Taylor formed a partnership with capital contributions of $260,000 and $310,000, respectively. Their partnership agreement calls for Farmer to receive a $94,000 per year salary allowance. The remaining income or loss is to be divided equally. Assuming net loss for the current year is $27,000, the journal entry to allocate the net loss is: Multiple Choice Debit Income Summary, \$27,000; Debit Farmer, Capital, \$33,500; Credit Taylor, Capital, $60,500. Debit Income Summary, \$27,000; Credit Farmer, Capital, \$13,500; Credit Taylor, Capital, $13,500. Debit Taylor, Capital, S60,500; Credit Income Summary, S27,000; Credit Farmer, Capital, $33,500. Debit Income Summary, $27,000; Debit Taylor, Capital, $33,500; Credit Farmer, Capital, $60,500. Debit Income Summary, \$27,000; Credit Taylor, Capital, \$13,500; Credit Farmer, Capital, $13,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started