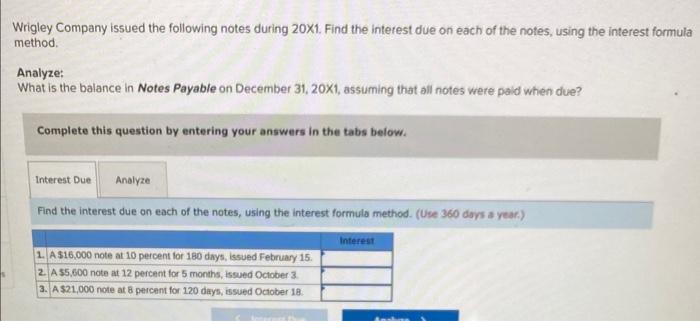

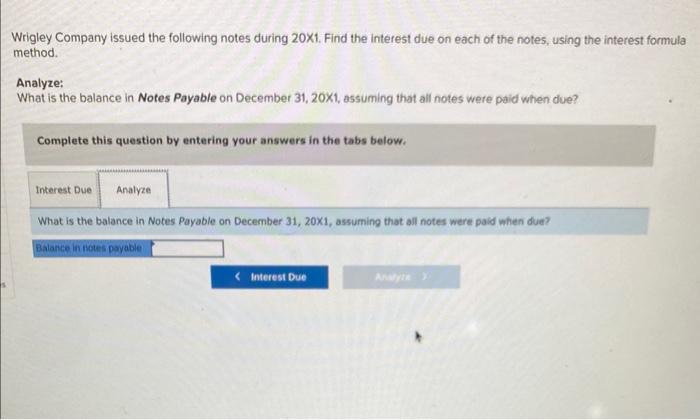

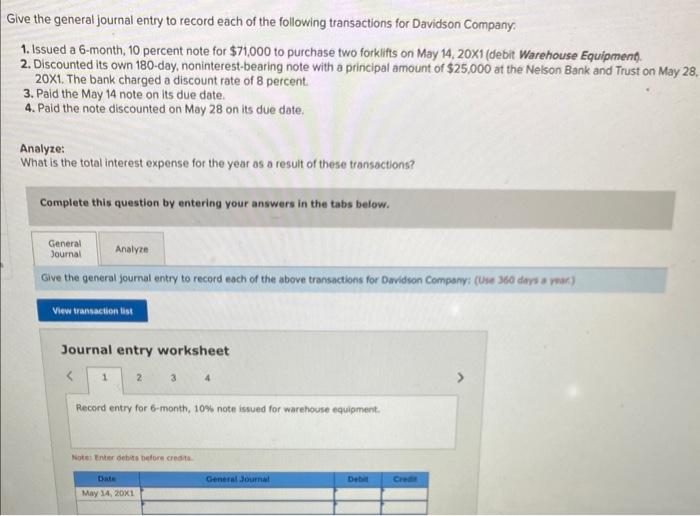

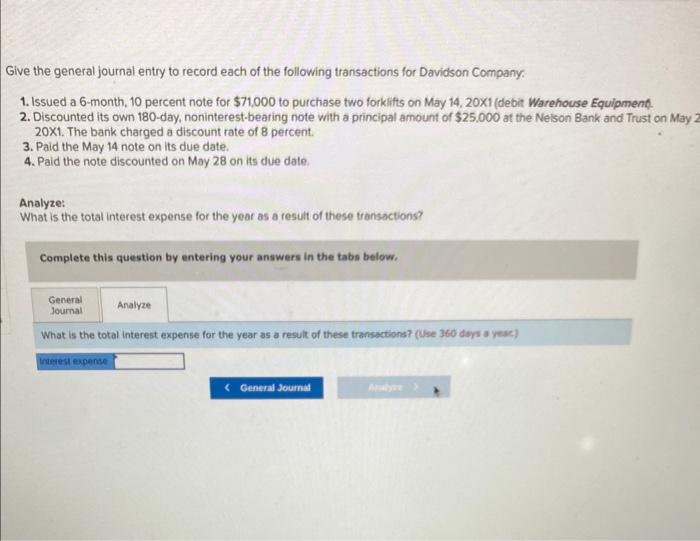

Wrigley Company issued the following notes during 201. Find the interest due on each of the notes, using the interest formula method. Analyze: What is the balance in Notes Payable on December 31, 20X1, assuming that all notes were paid when due? Complete this question by entering your answers in the tabs below. Find the interest due on each of the notes, using the interest formula method. (Use 360 doys a year.) Wrigley Company issued the following notes during 201. Find the interest due on each of the notes, using the interest formula method. Analyze: What is the balance in Notes Payable on December 31, 20x1, assuming that all notes were paid when due? Complete this question by entering your answers in the tabs below. What is the balance in Notes Payable on December 31, 20X1, assuming that all notes were paid when due? Give the general journal entry to record each of the following transactions for Davidson Company: 1. Issued a 6-month, 10 percent note for $71,000 to purchase two forklifts on May 14, 201 (debit Warehouse Equipment. 2. Discounted its own 180-day, noninterest-bearing note with a principal amount of $25,000 at the Nelson Bank and Trust on May 28 201. The bank charged a discount rate of 8 percent. 3. Paid the May 14 note on its due date. 4. Paid the note discounted on May 28 on its due date. Analyze: What is the total interest expense for the year as o resuit of these transoctions? Complete this question by entering your answers in the tabs below. Give the general journal entry to record each of the above transnctions for Davidson Company: (Use 360 dars a mar) Journal entry worksheet Record entry for 6 -month, 10 w note issued for warehouse equipment. Wotei Enter dehns before credite Give the general journal entry to record each of the following transactions for Davidson Company: 1. Issued a 6-month, 10 percent note for $71,000 to purchase two forklifts on May 14, 20X1 (debit Warehouse Equipment. 2. Discounted its own 180-day, noninterest-bearing note with a principal amount of $25.000 at the Nelson Bank and Trust on May 20X1. The bank charged a discount rate of 8 percent. 3. Paid the May 14 note on its due date. 4. Paid the note discounted on May 28 on its due date. Analyze: What is the total interest expense for the year as a result of these transactions? Complete this question by entering your answers in the tabs below. What is the total interest expense for the year as a resuit of these transections? (Use 360 doys a yeac)