Answered step by step

Verified Expert Solution

Question

1 Approved Answer

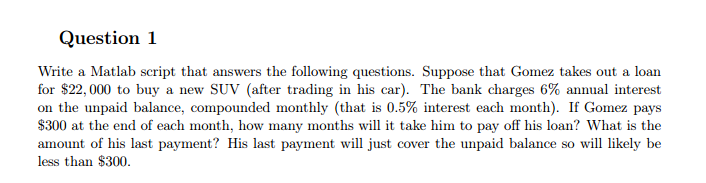

Write a Matlab script that answers the following questions. Suppose that Gomez takes out a loan for $22, 000 to buy a new SUV (after

Write a Matlab script that answers the following questions. Suppose that Gomez takes out a loan for $22, 000 to buy a new SUV (after trading in his car). The bank charges 6% annual interest on the unpaid balance, compounded monthly (that is 0.5% interest each month). If Gomez pays $300 at the end of each month, how many months will it take him to pay off his loan? What is the amount of his last payment? His last payment will just cover the unpaid balance so will likely be less than $300.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started