Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Write an analysis of the liquidity ratios, asset management ratios, debt management ratios and profitability ratios. Each group must conduct this analysis on any

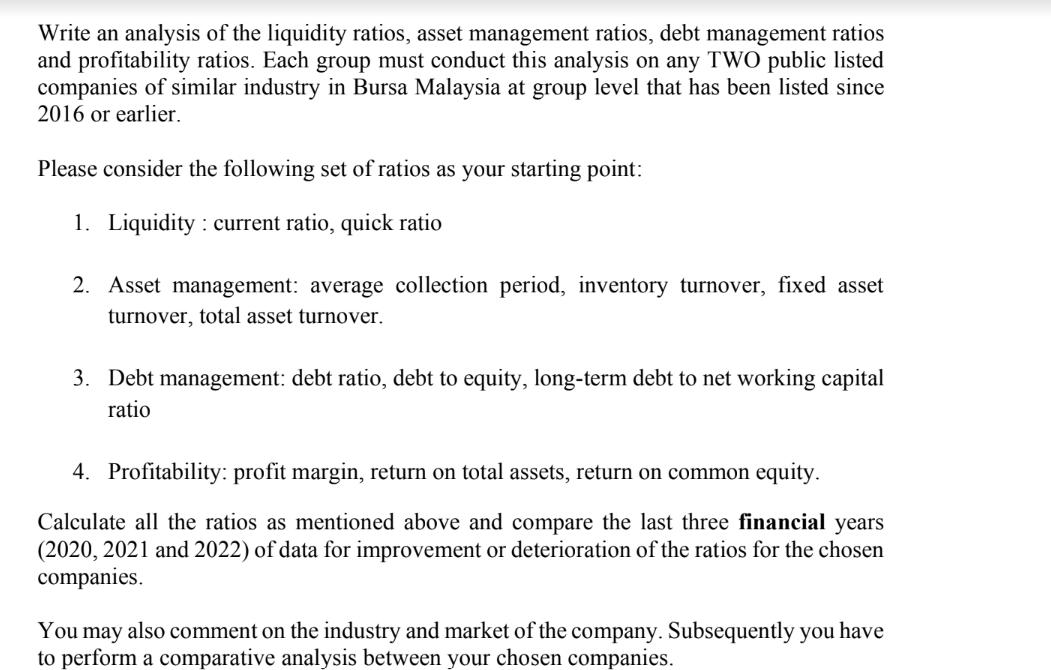

Write an analysis of the liquidity ratios, asset management ratios, debt management ratios and profitability ratios. Each group must conduct this analysis on any TWO public listed companies of similar industry in Bursa Malaysia at group level that has been listed since 2016 or earlier. Please consider the following set of ratios as your starting point: 1. Liquidity: current ratio, quick ratio 2. Asset management: average collection period, inventory turnover, fixed asset turnover, total asset turnover. 3. Debt management: debt ratio, debt to equity, long-term debt to net working capital ratio 4. Profitability: profit margin, return on total assets, return on common equity. Calculate all the ratios as mentioned above and compare the last three financial years (2020, 2021 and 2022) of data for improvement or deterioration of the ratios for the chosen companies. You may also comment on the industry and market of the company. Subsequently you have to perform a comparative analysis between your chosen companies.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started