Answered step by step

Verified Expert Solution

Question

1 Approved Answer

write an introduction summarizing the understanding of this prompt FX, Inc. is a volume manufacturer of high technology automotive mirrors (including cell link and voice

write an introduction summarizing the understanding of this prompt

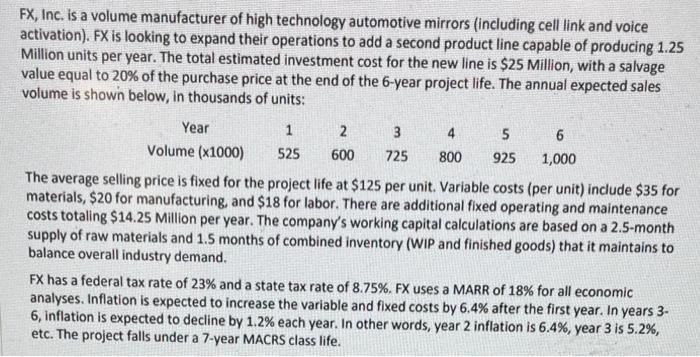

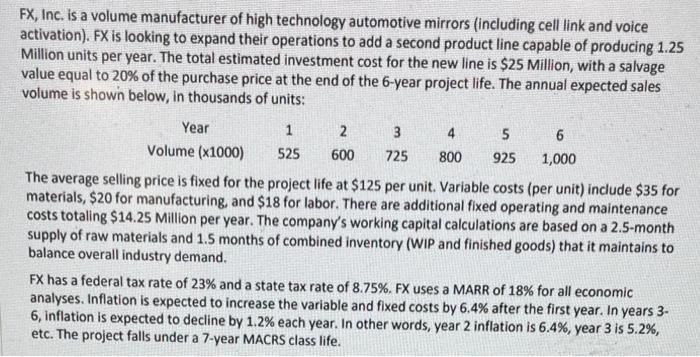

FX, Inc. is a volume manufacturer of high technology automotive mirrors (including cell link and voice activation). FX is looking to expand their operations to add a second product line capable of producing 1.25 Million units per year. The total estimated investment cost for the new line is $25Million, with a salvage value equal to 20% of the purchase price at the end of the 6-year project life. The annual expected sales volume is shown below, in thousands of units: The average selling price is fixed for the project life at $125 per unit. Variable costs (per unit) include $35 for materials, \$20 for manufacturing, and \$18 for labor. There are additional fixed operating and maintenance costs totaling $14.25 Million per year. The company's working capital calculations are based on a 2.5 -month supply of raw materials and 1.5 months of combined inventory (WIP and finished goods) that it maintains to balance overall industry demand. FX has a federal tax rate of 23% and a state tax rate of 8.75%. FX uses a MARR of 18% for all economic analyses. Inflation is expected to increase the variable and fixed costs by 6.4% after the first year. In years 3 6 , inflation is expected to decline by 1.2% each year. In other words, year 2 inflation is 6.4%, year 3 is 5.2%, etc. The project falls under a 7-year MACRS class life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started