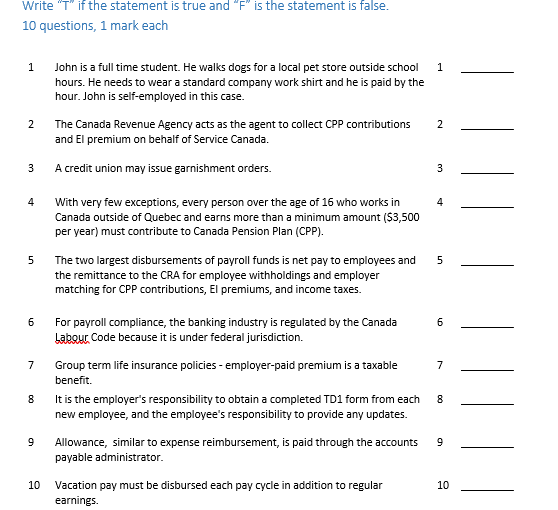

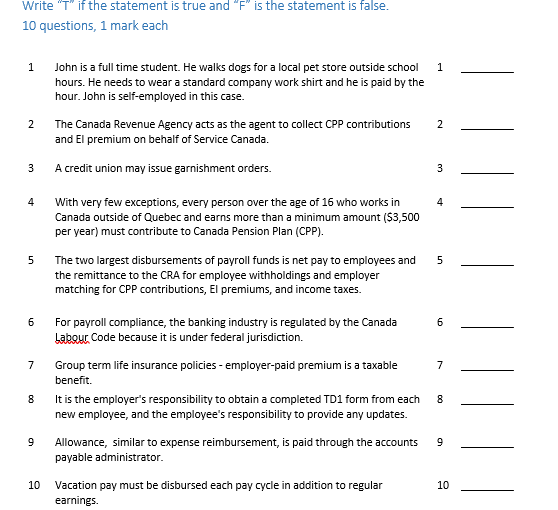

Write "T" if the statement is true and "F" is the statement is false. 10 questions, 1 mark each 1 John is a full time student. He walks dogs for a local pet store outside school 1 hours. He needs to wear a standard company work shirt and he is paid by the hour. John is self-employed in this case. 2 2 The Canada Revenue Agency acts as the agent to collect CPP contributions and El premium on behalf of Service Canada. 3 A credit union may issue garnishment orders. 3 4 With very few exceptions, every person over the age of 16 who works in Canada outside of Quebec and earns more than a minimum amount ($3,500 per year) must contribute to Canada Pension Plan (CPP). 5 The two largest disbursements of payroll funds is net pay to employees and 5 the remittance to the CRA for employee withholdings and employer matching for CPP contributions, El premiums, and income taxes. 6 6 For payroll compliance, the banking industry is regulated by the Canada Labour Code because it is under federal jurisdiction. 7 7 Group term life insurance policies - employer-paid premium is a taxable benefit. 8 It is the employer's responsibility to obtain a completed TD1 form from each 8 new employee, and the employee's responsibility to provide any updates. 9 9 Allowance, similar to expense reimbursement, is paid through the accounts payable administrator. 10 10 Vacation pay must be disbursed each pay cycle in addition to regular earnings. Write "T" if the statement is true and "F" is the statement is false. 10 questions, 1 mark each 1 John is a full time student. He walks dogs for a local pet store outside school 1 hours. He needs to wear a standard company work shirt and he is paid by the hour. John is self-employed in this case. 2 2 The Canada Revenue Agency acts as the agent to collect CPP contributions and El premium on behalf of Service Canada. 3 A credit union may issue garnishment orders. 3 4 With very few exceptions, every person over the age of 16 who works in Canada outside of Quebec and earns more than a minimum amount ($3,500 per year) must contribute to Canada Pension Plan (CPP). 5 The two largest disbursements of payroll funds is net pay to employees and 5 the remittance to the CRA for employee withholdings and employer matching for CPP contributions, El premiums, and income taxes. 6 6 For payroll compliance, the banking industry is regulated by the Canada Labour Code because it is under federal jurisdiction. 7 7 Group term life insurance policies - employer-paid premium is a taxable benefit. 8 It is the employer's responsibility to obtain a completed TD1 form from each 8 new employee, and the employee's responsibility to provide any updates. 9 9 Allowance, similar to expense reimbursement, is paid through the accounts payable administrator. 10 10 Vacation pay must be disbursed each pay cycle in addition to regular earnings