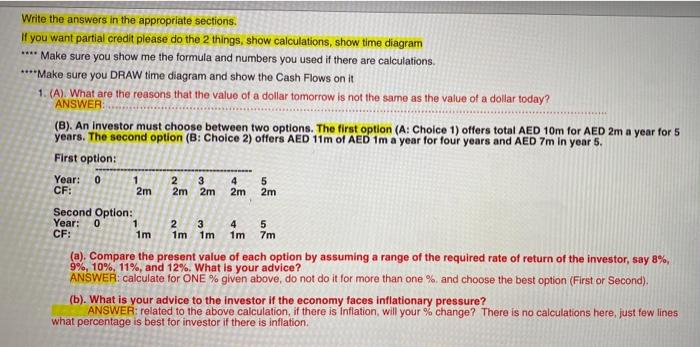

Write the answers in the appropriate sections. If you want partial credit please do the 2 things, show calculations, show time diagram **** Make sure you show me the formula and numbers you used if there are calculations. ****Make sure you DRAW time diagram and show the Cash Flows on it 1. (A) What are the reasons that the value of a dollar tomorrow is not the same as the value of a dollar today? ANSWER: (B). An Investor must choose between two options. The first option (A: Choice 1) offers total AED 10m for AED 2m a year for 5 years. The second option (B: Choice 2) offers AED 11m of AED 1m a year for four years and AED 7m in year 5. First option: Year: 0 2 3 5 CF: 2m 2m 2m 2m 2m Second Option: Year: 0 2 3 5 1m 1m 1m 1m 7m (a). Compare the present value of each option by assuming a range of the required rate of return of the investor, say 8%, 9%, 10%, 11%, and 12%. What is your advice? ANSWER: calculate for ONE % given above, do not do it for more than one % and choose the best option (First or Second) (b). What is your advice to the investor if the economy faces Inflationary pressure? ANSWER:related to the above calculation, if there is Inflation, will your % change? There is no calculations here, just few lines what percentage is best for investor if there is inflation. 1 4 1 4 CF: Write the answers in the appropriate sections. If you want partial credit please do the 2 things, show calculations, show time diagram **** Make sure you show me the formula and numbers you used if there are calculations. ****Make sure you DRAW time diagram and show the Cash Flows on it 1. (A) What are the reasons that the value of a dollar tomorrow is not the same as the value of a dollar today? ANSWER: (B). An Investor must choose between two options. The first option (A: Choice 1) offers total AED 10m for AED 2m a year for 5 years. The second option (B: Choice 2) offers AED 11m of AED 1m a year for four years and AED 7m in year 5. First option: Year: 0 2 3 5 CF: 2m 2m 2m 2m 2m Second Option: Year: 0 2 3 5 1m 1m 1m 1m 7m (a). Compare the present value of each option by assuming a range of the required rate of return of the investor, say 8%, 9%, 10%, 11%, and 12%. What is your advice? ANSWER: calculate for ONE % given above, do not do it for more than one % and choose the best option (First or Second) (b). What is your advice to the investor if the economy faces Inflationary pressure? ANSWER:related to the above calculation, if there is Inflation, will your % change? There is no calculations here, just few lines what percentage is best for investor if there is inflation. 1 4 1 4 CF