Answered step by step

Verified Expert Solution

Question

1 Approved Answer

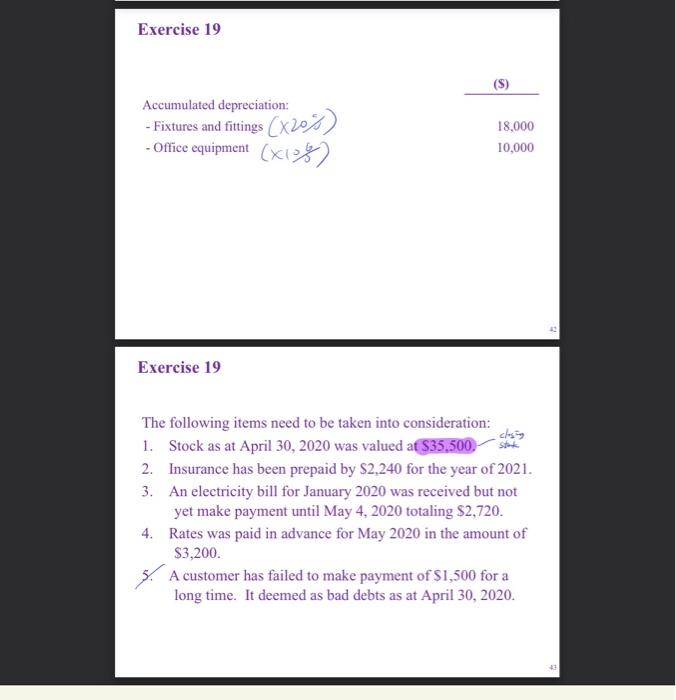

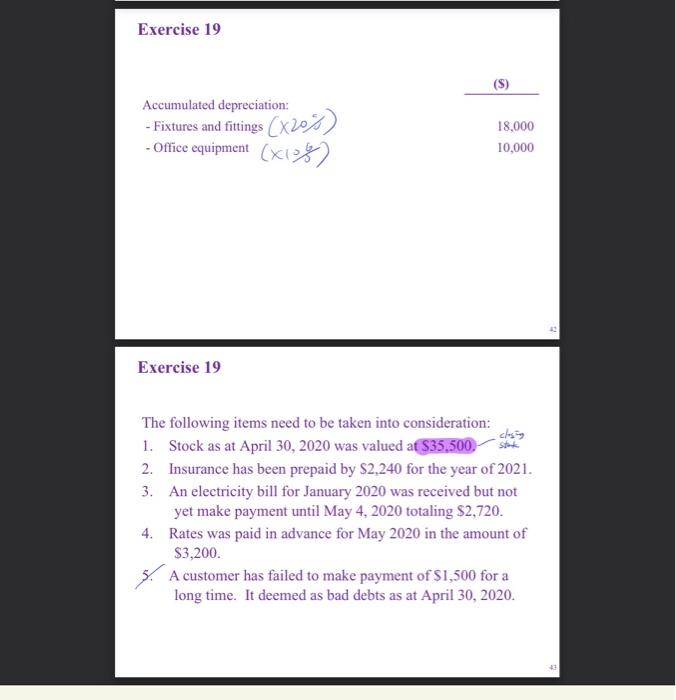

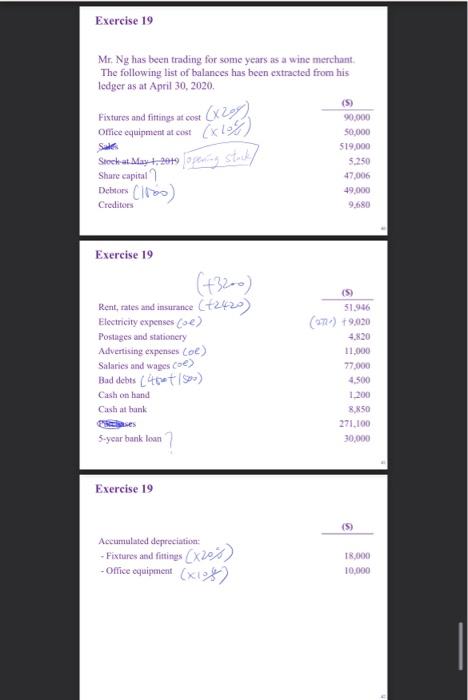

write the balance sheet and the profit and loss account Exercise 19 Accumulated depreciation: - Fixtures and fittings (x203) - Office equipment (x1082 18,000 10,000

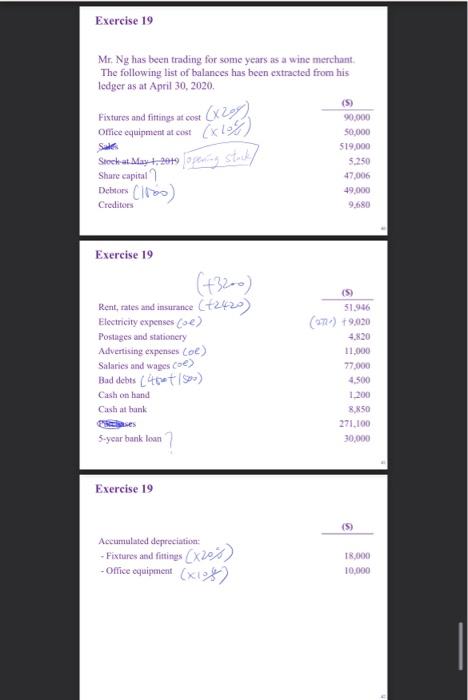

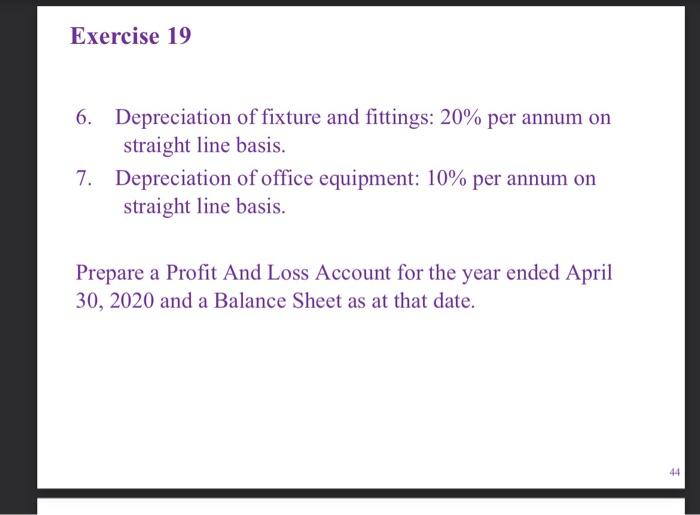

write the balance sheet and the profit and loss account

Exercise 19 Accumulated depreciation: - Fixtures and fittings (x203) - Office equipment (x1082 18,000 10,000 Exercise 19 The following items need to be taken into consideration: closing 1. Stock as at April 30, 2020 was valued at $35.500. 2. Insurance has been prepaid by $2,240 for the year of 2021. 3. An electricity bill for January 2020 was received but not yet make payment until May 4, 2020 totaling $2,720. 4. Rates was paid in advance for May 2020 in the amount of $3,200. A customer has failed to make payment of $1,500 for a long time. It deemed as bad debts as at April 30, 2020. 23 Exercise 19 Mr. Ng has been trading for some years as a wine merchant The following list of balances has been extracted from his ledger as at April 30, 2020 (5) Fixtures and fittings at cost 90.000 Office equipment at cost 50,000 Sales $19,000 Stockat Sayt.2019 gengsted 5.250 Shure capital 47.006 49,000 9.680 1. (X207) ( Detes (1100) Creditos 51.946 Exercise 19 (+320) Rent, rates and insurance (+2420) Electricity expenses (e) Postages and stationery Advertising expenses coe) Salaries and wages coe) Bad debts (46150) Cash on hand (22) +9020 4.820 11.000 77.000 4.500 1.200 8.850 271,100 30,000 Cash at hank Cases 5.your bank loan Exercise 19 Accumulated depreciation: - Fixtures and findings (x20%) Office equipment (x108 18.000 10,000 Exercise 19 6. Depreciation of fixture and fittings: 20% per annum on straight line basis. 7. Depreciation of office equipment: 10% per annum on straight line basis. Prepare a Profit And Loss Account for the year ended April 30, 2020 and a Balance Sheet as at that date. 44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started