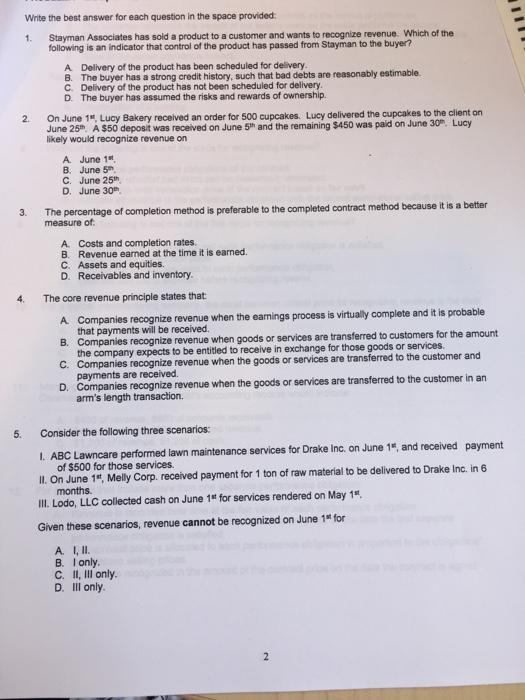

Write the best answer for each question in the space provided: 1. Stayman Associates has sold a product to a customer and wants to recognize revenue. Which of the following is an indicator that control of the product has passed from Stayman to the buyer? A Delivery of the product has been scheduled for delivery. B. The buyer has a strong credit history, such that bad debts are reasonably estimable. C. Delivery of the product has not been scheduled for delivery. D. The buyer has assumed the risks and rewards of ownership. 2. On June 1st Lucy Bakery received an order for 500 cupcakes. Lucy delivered the cupcakes to the client on June 25th. A $50 deposit was received on June 5th and the remaining was paid on June 30th. Lucy likely would recognize revenue on A. June 1 B. June 5th. C. June 25th. D, June 30th. 3. percentage of completion method is preferable to the completed contract method because itis a better measure A. Costs and completion rates. B. Revenue earned at the time it is earned. C. Assets and equities. D. Receivables and inventory. 4. The core revenue principle states that A companies recognize revenue when the earnings process is virtually complete and it is probable that payments will be received. customers for the amount B. Companies when or services are transferred to or services the company expects to be entitled to receive in exchange for those goods C. panies recognize revenue when the goods or services are transferred to the customer and D. payments are received. goods or services are transferred to the customer in an recognize revenue when the arm's length transaction. 5. Consider the following three scenarios: l. ABC Lawncare performed lawn maintenance services for Drake Inc. on June 1., and received payment ll. of $500 for those services. ton of raw material to be delivered to Drake Inc. in 6 On June 1st, Melly Corp. received payment for 1 Ill. months. services rendered on May 1st. Lodo, LLC collected cash on June 1 for Given these scenarios, revenue cannot be recognized on June 1 for An I, II. B, only. C, II, III only. D. Ill only