Answered step by step

Verified Expert Solution

Question

1 Approved Answer

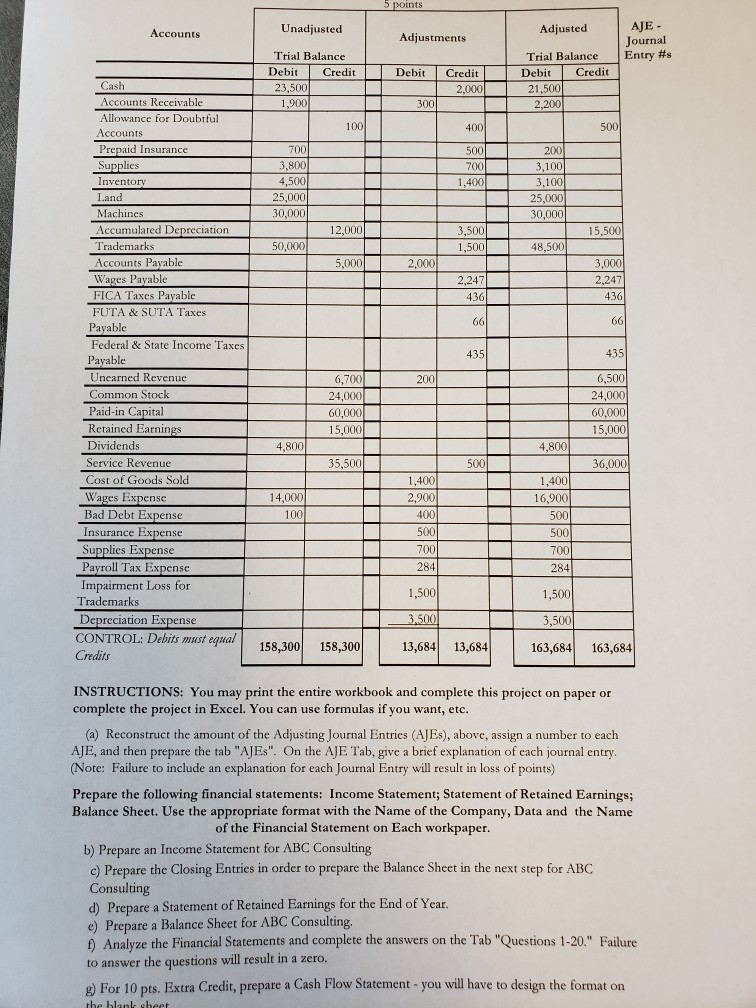

Write the closing entries using the information below. points AJE Unadjusted Trial Balance Debit Credit Adjustecd Accounts Adjustments Journal Trial Balance Entry #s ebit Credit

Write the closing entries using the information below.

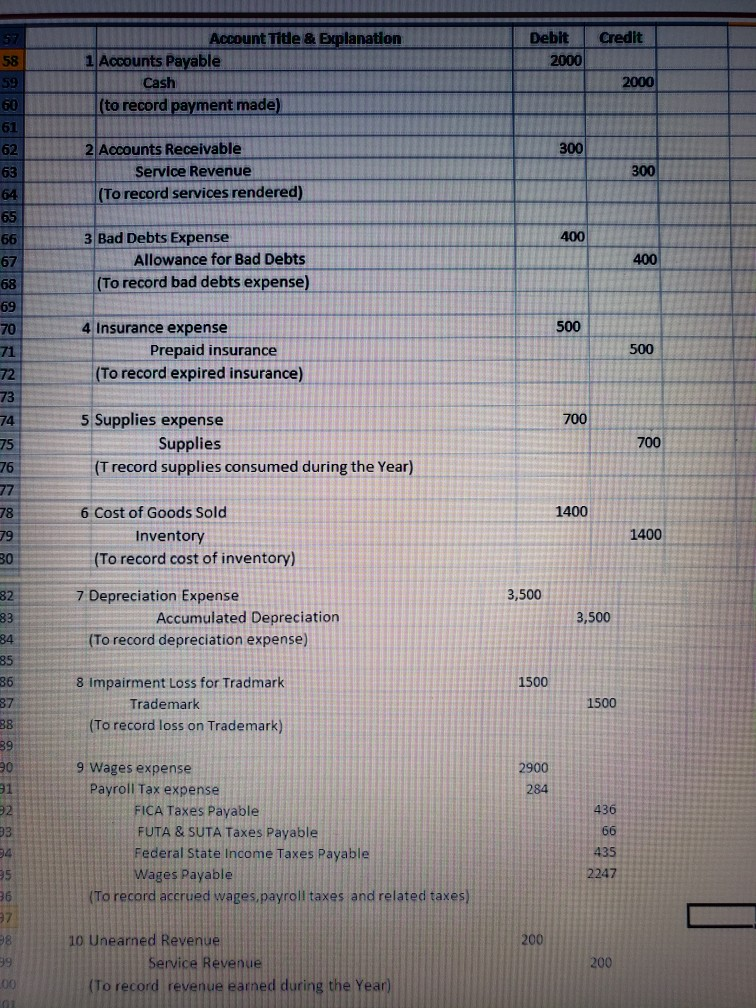

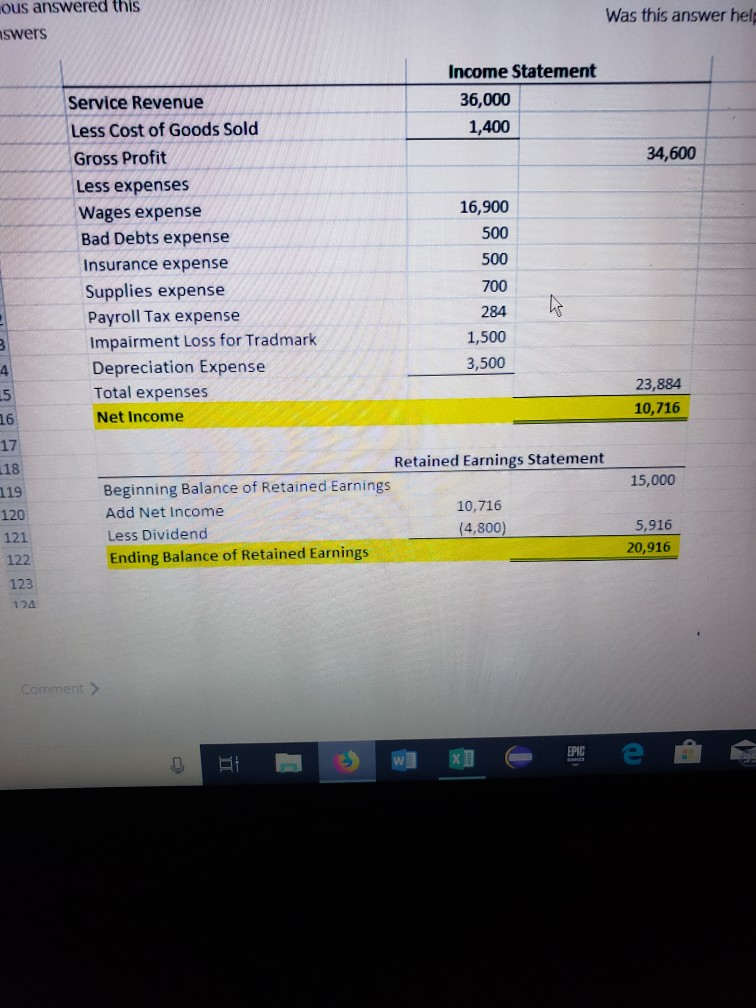

points AJE Unadjusted Trial Balance Debit Credit Adjustecd Accounts Adjustments Journal Trial Balance Entry #s ebit Credit Debit Credit 2,000 Accounts Receivable Allowance for Doubtful 2,200 500 400 Prepaid Insurance Inventorv 4,500 25,000 30,000 1,400 25,000 30,000 Accumulated Depreciation 15,500 Trademarks 50,000 48,500 Accounts Pavable 5,000 2,000 Wages Payable FICA Taxes Payable FUTA & SUTA Taxes Payable Federal & State Income Taxes Payable Unearned Revenue Common Stock Paid-in Capital Retained Earnings Dividends Service Revenue Cost of Goods Sold 2,247 435 6,500 6,700 24,000 24,000 15,000 36,000 15,000 4,800 14,0 16,900 500 Bad Debt Expense nsurance Expense Supplies Expense Payroll Tax Expense 700 284 Impairment Loss for 1,500 Trademarks Depreciation Expense CONTROL: Debits must equal Credits 13,684 13,684 158,3001 158,300 163,684163,684 INSTRUCTIONS: You may print the entire workbook and complete this project on paper or complete the project in Excel. You can use formulas if you want, etc. (a) Reconstruct the amount of the Adjusting Journal Entries (AJEs), above, assign a number to each AJE, and then prepare the tab "AJEs". On the AJE Tab, give a brief explanation of cach journal entry (Note: Failure to include an explanation for each Journal Entry will result in loss of points) Prepare the following financial statements: Income Statement; Statement of Retained Earnings; Balance Sheet. Use the appropriate format with the Name of the Company, Data and the Name of the Financial Statement on Each workpaper b) Prepare an Income Statement for ABC Consulting c) Prepare the Closing Entries in order to prepare the Balance Sheet in the next step for ABC Consulting d) Prepare a Statement of Retained Earnings for the End of Year. e) Prepare a Balance Sheet for ABC Consulting f) Analyze the Financial Statements and complete the answers on the Tab "Questions 1-20." Failure to answer the questions will result in a zero. g) For 10 pts. Extra Credit, prepare a Cash Flow Statement - you will have to design the format on Debit Credit AccountTide & Explanation 1 Accounts Payable Cash to record 61 62 e3 2 Accounts Receivable 300 Service Revenue To record services rendered) 3 Bad Debts Expense Allowance for Bad Debts (To record bad debts expense) 400 67 69 70 71 72 73 74 75 76 500 4 Insurance expense Prepaid insurance (To record expired insurance) 5 Supplies expense Supplies (T record supplies consumed during the Year) 6 Cost of Goods Sold 1400 78 1400 Inventory (To record cost of inventory) 30 82 7 Depreciation Expense 3,500 Accumulated Depreciation 3,500 84 To record depreciation expense 85 8 impairment Loss for Tradmark 1500 Trademarlk (To record loss on Trademark) 2900 284 9 Wages expense Payroll Tax expense 43 FICA Taxes Payable FUTA & SUTA Taxes Payable Federal State Income Taxes Payable Wages Payable 93 435 2247 (To record accrued wages,payroll taxes and related taxes) 10 Unearned Revenue 200 200 Service Revenue (To record revenue earned during the Year) ous answered this Was this answer hel swers Income Statement 36,000 Service Revenue 1,400 Less Cost of Goods Sold Gross Profit Less expenses Wages expense Bad Debts expense Insurance expense Supplies expense 34,600 16,900 500 500 700 284 1,500 3,500 Payroll Tax expense Impairment Loss for Tradmark Depreciation Expense Total expenses Net Income 23,884 10,716 5 16 17 L18 119 120 121 122 Retained Earnings Statement 15,000 Beginning Balance of Retained Earnings Add Net Income Less Dividend Ending Balance of Retained Earnings 10,716 (4,800) 5,916 20,916 123 14 EPIC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started