Answered step by step

Verified Expert Solution

Question

1 Approved Answer

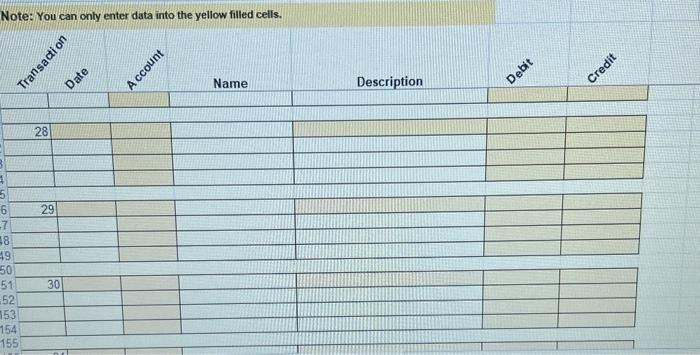

write the information into the template Enter transaction data into the yellow Fields. A A physical miventory showed that only $270.00 worth of oftice supplies

write the information into the template

Enter transaction data into the yellow Fields.

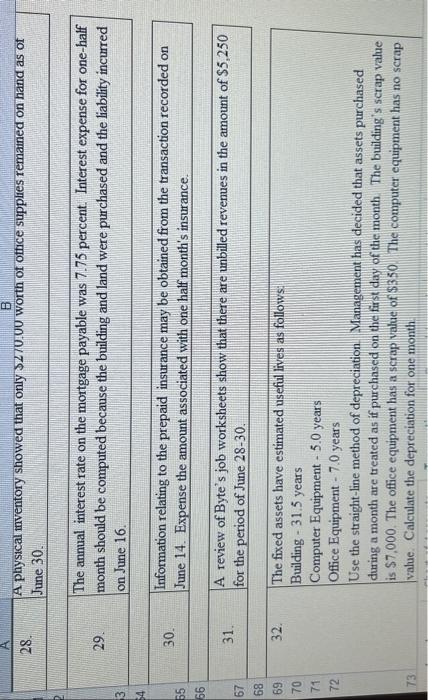

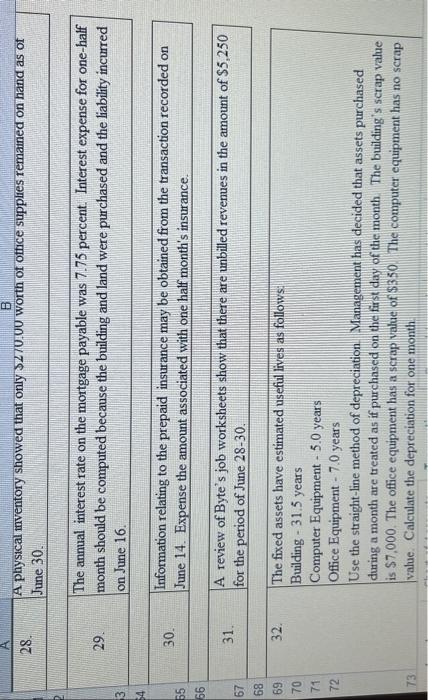

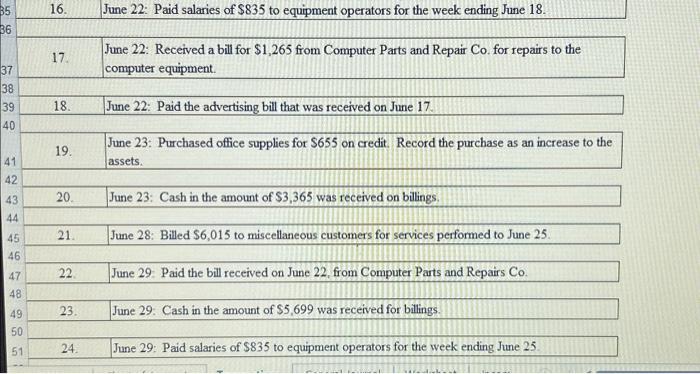

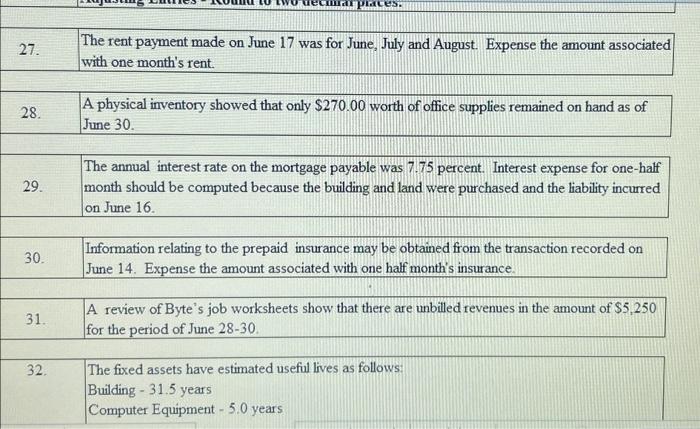

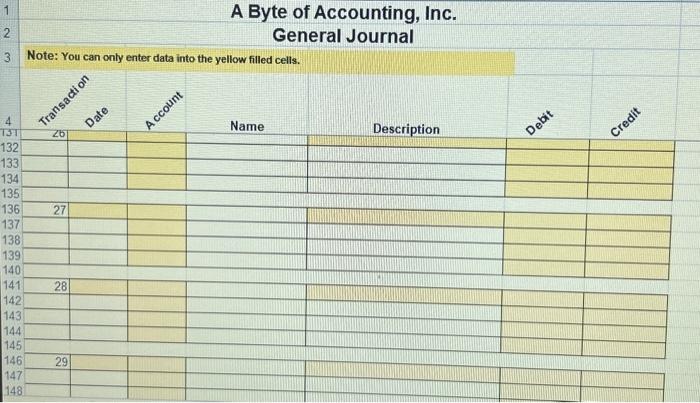

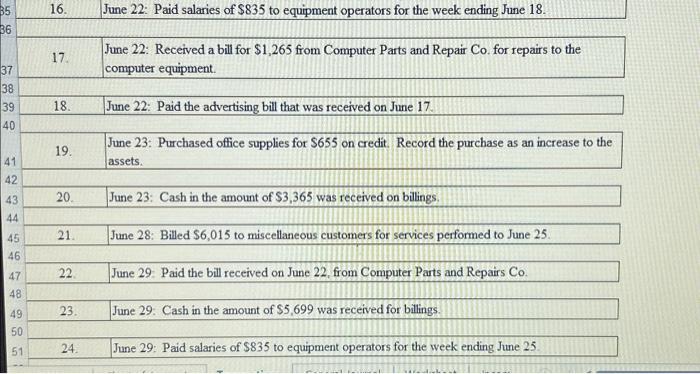

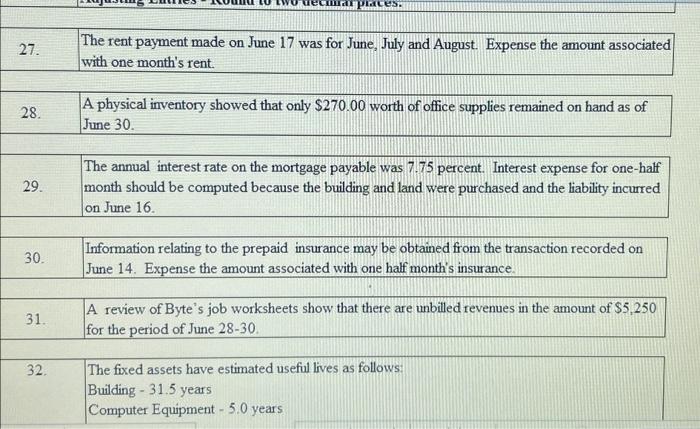

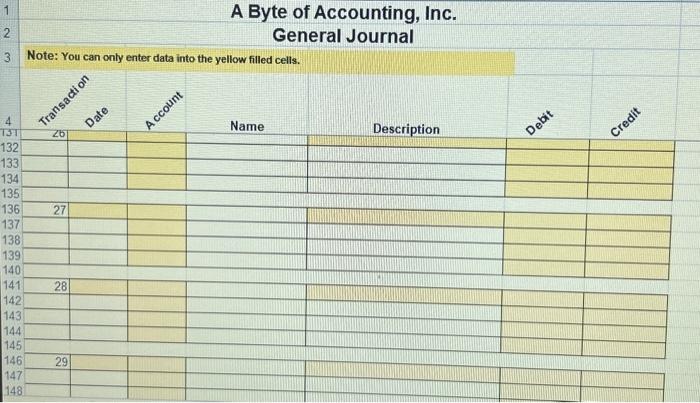

A A physical miventory showed that only $270.00 worth of oftice supplies remained on hand as of June 30. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half 29. month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,250 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Nanagement has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,000. The office equipment has a scrap value of $350. The computer equipment has no scrap 73 value. Calculate the depreciation for one month Note: You can only enter data into the yellow filled cells. 16. June 22: Paid salaries of $835 to equipment operators for the week ending June 18. 17. June 22: Received a bill for $1,265 from Computer Parts and Repair Co. for repairs to the computer equipment. 18. June 22: Paid the advertising bill that was received on June 17. 19. June 23: Purchased office supplies for $655 on credit. Record the purchase as an increase to the assets. 20. June 23: Cash in the amount of $3,365 was received on billings. 21. June 28: Billed $6,015 to miscellaneous customers for services performed to June 25 . 22. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 23. June 29: Cash in the amount of $5,699 was received for billings. 24. June 29: Paid salaries of $835 to equipment operators for the week ending June 25. 27. The rent payment made on June 17 was for June, July and August. Expense the amount associated with one month's rent. 28. A physical inventory showed that only $270.00 worth of office supplies remained on hand as of June 30 . The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half 29. month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,250 for the period of June 2830. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years A Byte of Accounting, Inc. General Journal A A physical miventory showed that only $270.00 worth of oftice supplies remained on hand as of June 30. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half 29. month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,250 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Nanagement has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,000. The office equipment has a scrap value of $350. The computer equipment has no scrap 73 value. Calculate the depreciation for one month Note: You can only enter data into the yellow filled cells. 16. June 22: Paid salaries of $835 to equipment operators for the week ending June 18. 17. June 22: Received a bill for $1,265 from Computer Parts and Repair Co. for repairs to the computer equipment. 18. June 22: Paid the advertising bill that was received on June 17. 19. June 23: Purchased office supplies for $655 on credit. Record the purchase as an increase to the assets. 20. June 23: Cash in the amount of $3,365 was received on billings. 21. June 28: Billed $6,015 to miscellaneous customers for services performed to June 25 . 22. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 23. June 29: Cash in the amount of $5,699 was received for billings. 24. June 29: Paid salaries of $835 to equipment operators for the week ending June 25. 27. The rent payment made on June 17 was for June, July and August. Expense the amount associated with one month's rent. 28. A physical inventory showed that only $270.00 worth of office supplies remained on hand as of June 30 . The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half 29. month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,250 for the period of June 2830. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years A Byte of Accounting, Inc. General Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started