Write the journal entries for the following transactions

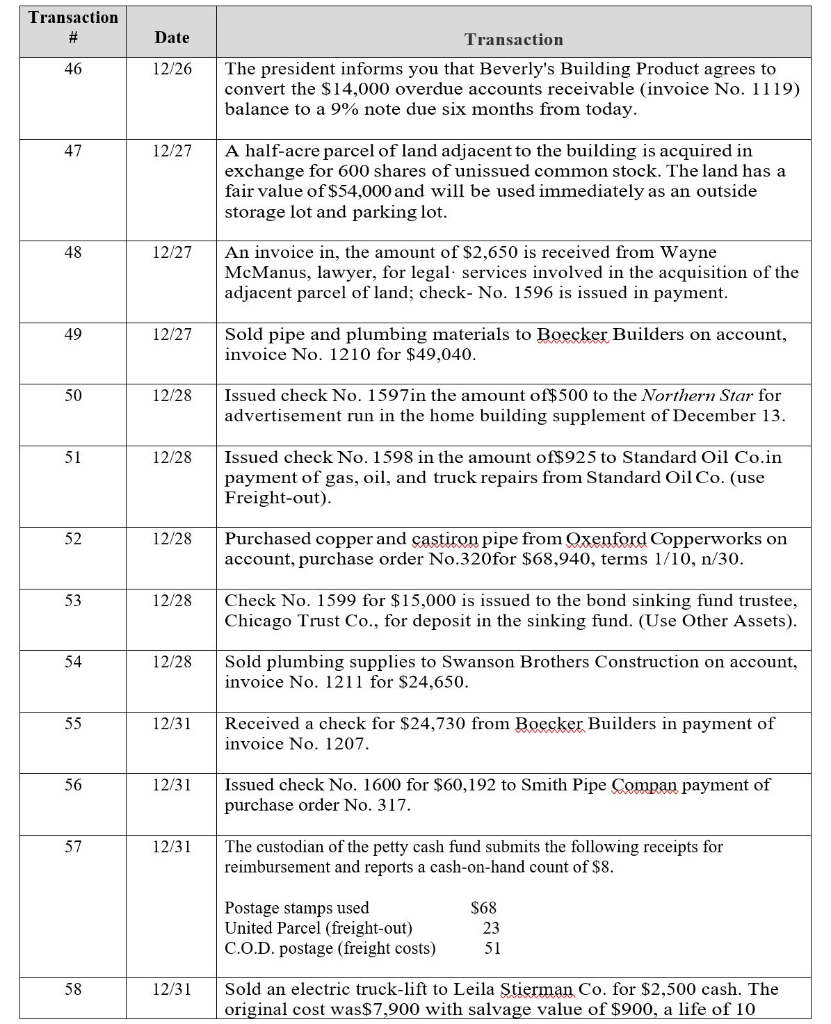

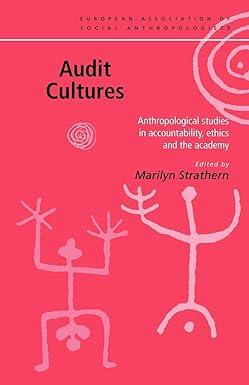

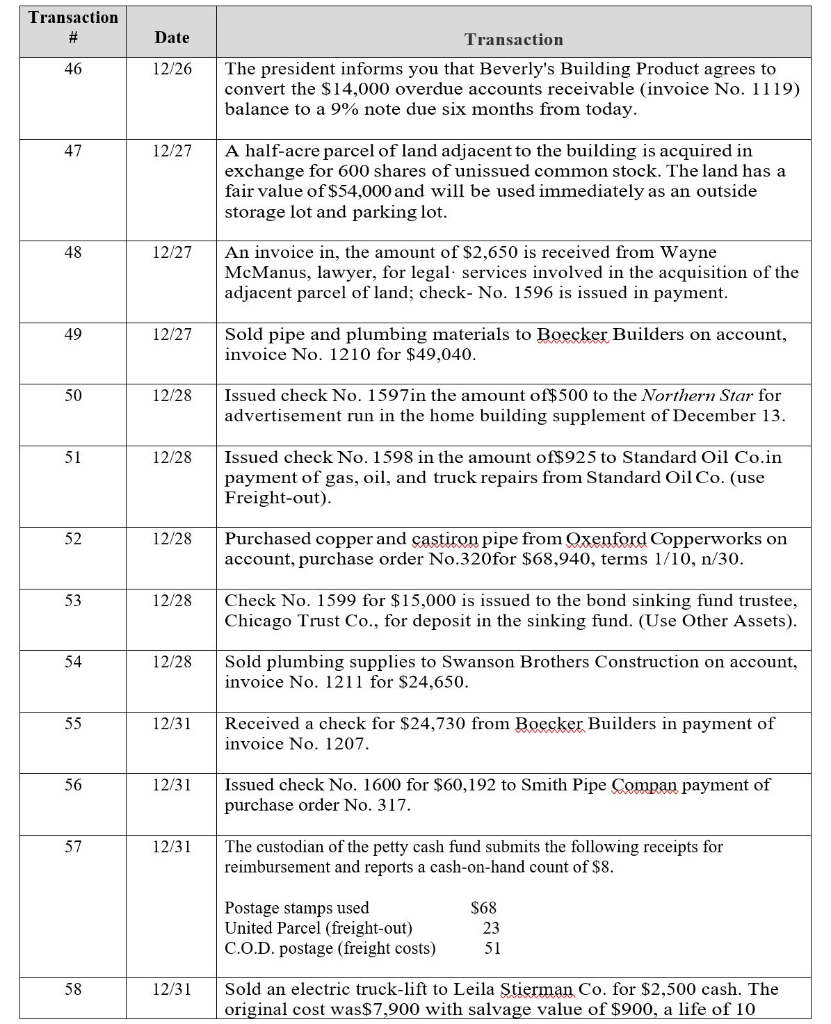

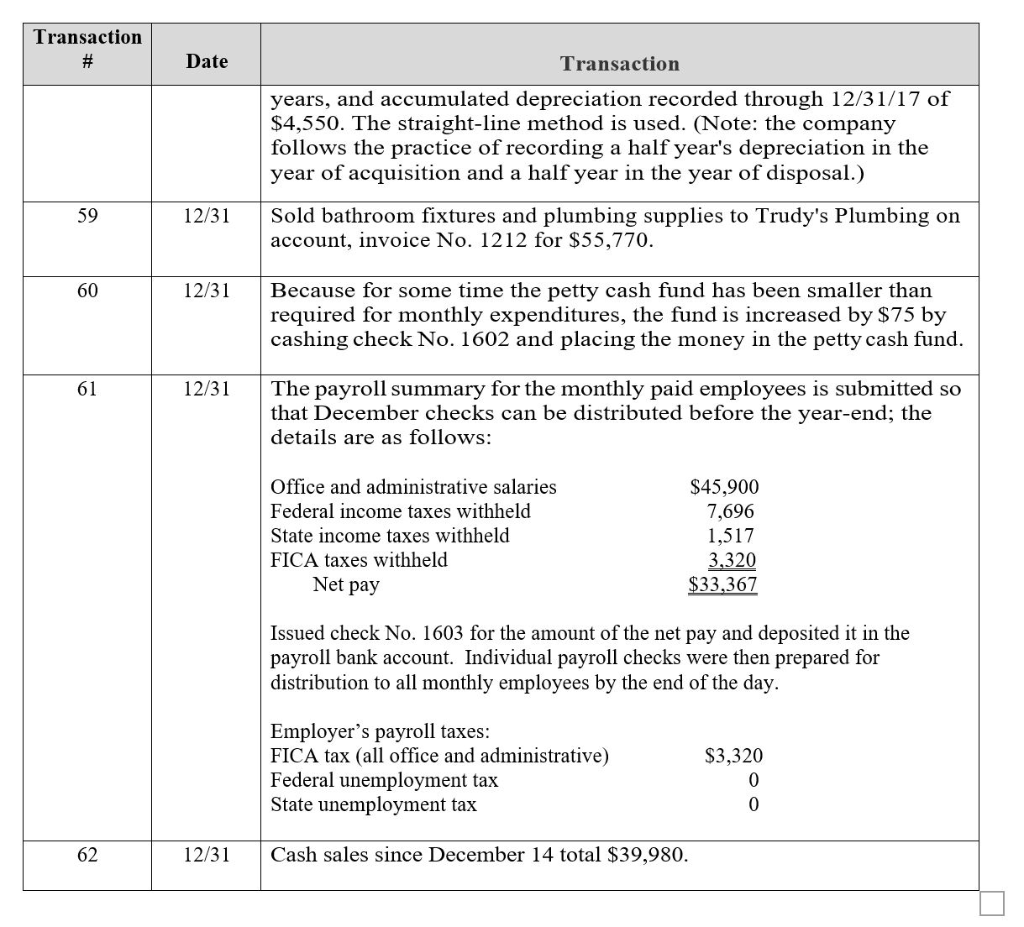

Transaction Date Transaction 46 12/26 The president informs you that Beverly's Building Product agrees to convert the $14,000 overdue accounts receivable (invoice No. 1119) balance to a 9% note due six months from today. 47 12/27 A half-acre parcel of land adjacent to the building is acquired in exchange for 600 shares of unissued common stock. The land has a fair value of $54,000 and will be used immediately as an outside storage lot and parking lot 48 12/27An invoice in, the amount of $2,650 is received from Wayne McManus, lawyer, for legal services involved in the acquisition of the adjacent parcel of land; check- No. 1596 is issued in payment 49 12/27Sold pipe and plumbing materials to Boecker Builders on account, invoice No. 1210 for $49,040 50 12/28 Issued check No. 1597in the amount of$500 to the Northern Star for advertisement run in the home building supplement of December 13 51 12/28 Issued check No. 1598 in the amount ofS925 to Standard Oil Co.in payment of gas, oil, and truck repairs from Standard Oil Co. (use Freight-out) 52 12/28 Purchased copper and castiron pipe from Qxenford Copperworks on account, purchase order No.320for $68,940, terms 1/10, n/30 53 12/28Check No. 1599 for $15,000 is issued to the bond sinking fund trustee, Chicago Trust Co., for deposit in the sinking fund. (Use Other Assets) 54 12/28 Sold plumbing supplies to Swanson Brothers Construction on account, invoice No. 1211 for $24,650 12/31Received a check for $24,730 from Boecker Builders in payment of invoice No. 1207. 56 12/31 Issued check No. 1600 for $60,192 to Smith Pipe Compan payment of purchase order No. 317. 57 12/31The custodian of the petty cash fund submits the following receipts for reimbursement and reports a cash-on-hand count of $8 Postage stamps used United Parcel (freight-out) C.O.D. postage (freight costs)51 S68 23 58 12/31Sold an electric truck-lift to Leila Stierman Co. for $2,500 cash. The original cost was$7,900 with salvage value of $900, a life of 10 Transaction Date Transaction years, and accumulated depreciation recorded through 12/31/17 of $4,550. The straight-line method is used. (Note: the company follows the practice of recording a half year's depreciation in the year of acquisition and a half year in the year of disposal.) 59 12/3Sold bathroom fixtures and plumbing supplies to Trudy's Plumbing on account, invoice No. 1212 for $55,770. 12/31 Because for some time the petty cash fund has been smaller than required for monthly expenditures, the fund is increased by $75 by cashing check No. 1602 and placing the money in the petty cash fund. 60 12/31 The payroll summary for the monthly paid employees is submitted so that December checks can be distributed before the year-end; the details are as follows: Office and administrative salarie:s Federal income taxes withheld State income taxes withheld FICA taxes withheld $45,900 7,696 1,517 3.320 $33.367 Net pay Issued check No. 1603 for the amount of the net pay and deposited it in the payroll bank account. Individual payroll checks were then prepared for distribution to all monthly employees by the end of the day. Employer's payroll taxes: FICA tax (all office and administrative) Federal unemployment tax State unemployment tax $3,320 0 62 12/31 Cash sales since December 14 total $39,980