Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WRITTEN ASSIGNMENT Study: Learning units 1 to 6 of tutorial letters 102 to 104; and > Chapters 1 to 8 of Group Statements - Volume

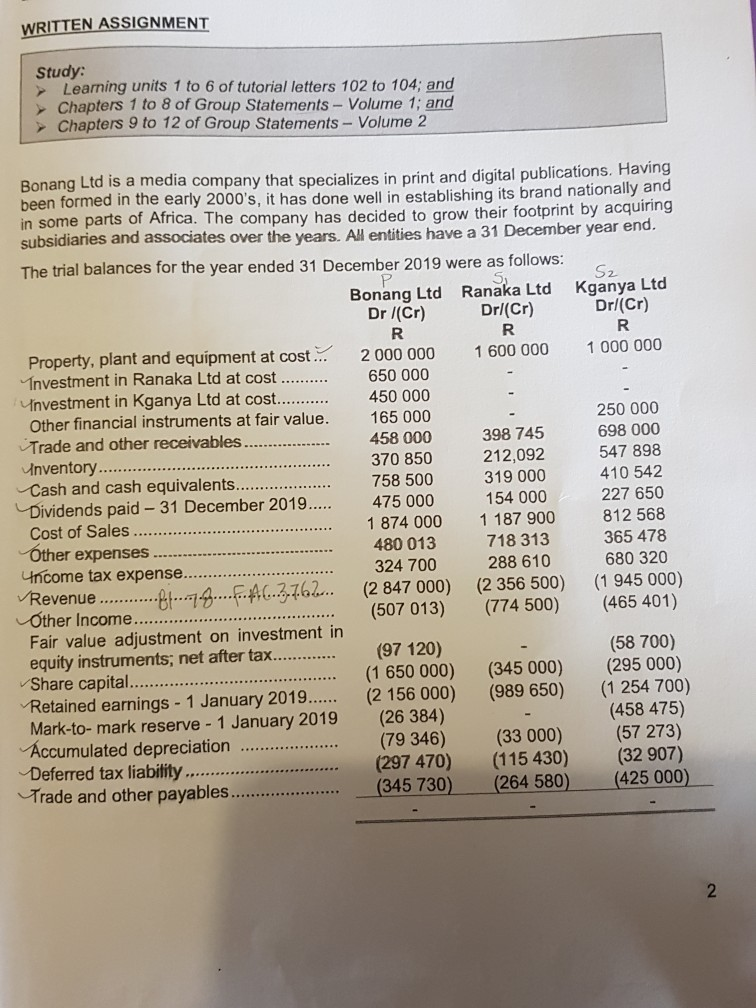

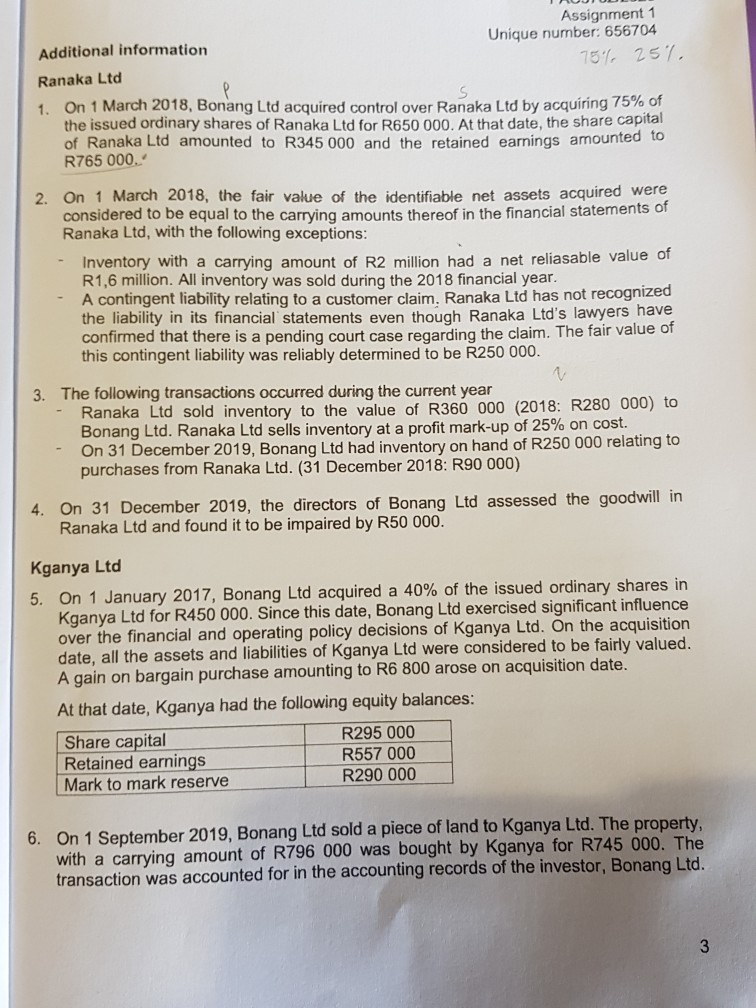

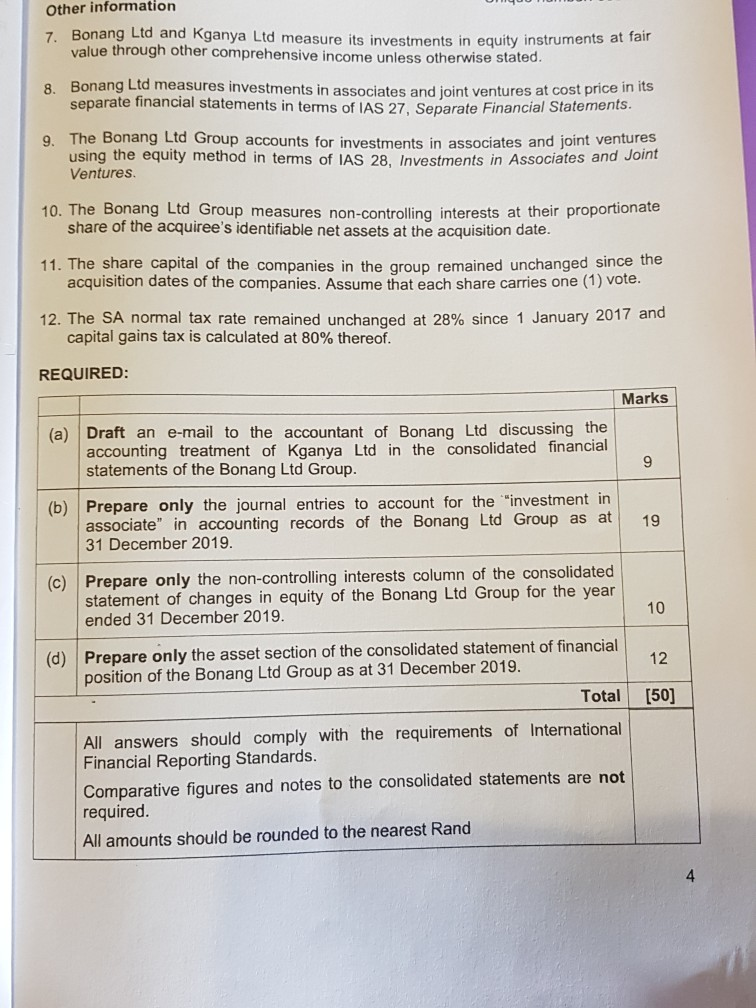

WRITTEN ASSIGNMENT Study: Learning units 1 to 6 of tutorial letters 102 to 104; and > Chapters 1 to 8 of Group Statements - Volume 1; and Chapters 9 to 12 of Group Statements - Volume 2 Bonang Ltd is a media company that specializes in print and digital publications. Having been formed in the early 2000's, it has done well in establishing its brand nationally and in some parts of Africa. The company has decided to grow their footprint by acquiring subsidiaries and associates over the years. All entities have a 31 December year end. The trial balances for the year ended 31 December 2019 were as follows: - S2 Bonang Ltd Ranaka Ltd Kganya Ltd Dr /(Cr) Drl(Cr) Dri(Cr) R Property, plant and equipment at cost... 2 000 000 1 600 000 1 000 000 Investment in Ranaka Ltd at cost .......... 650 000 Unvestment in kganya Ltd at cost........... 450 000 Other financial instruments at fair value. 165 000 250 000 Trade and other receivables ...... 458 000 398 745 698 000 Unventory............................. ........... 370 850 212,092 547 898 Cash and cash equivalents.................. 758 500 319 000 410 542 Dividends paid - 31 December 2019..... 475 000 154 000 227 650 Cost of Sales ........... 1 874 000 1 187 900 812 568 Other expenses...-- 480 013 718 313 365 478 Uncome tax expense... 324 700 288 610 680 320 Revenue .........................446.3.762... (2 847 000) (2 356 500) (1 945 000) Other Income........... (507 013) (774 500) (465 401) Fair value adjustment on investment in equity instruments, net after tax. (97 120) (58 700) Share capital.................. (1 650 000) (345 000) (295 000) Retained earnings - 1 January 2019...... (2 156 000) (989 650) (1 254 700) Mark-to-mark reserve - 1 January 2019 (26 384) (458 475) Accumulated depreciation (79 346) (33 000) (57 273) Deferred tax liability ............... (297 470) (115 430) (32 907) Trade and other payables ......... (345 730) (264 580) (425000) Assignment 1 Unique number: 656704 Additional information 75%, 25%. Ranaka Ltd 1 On 1 March 2018, Bonang Ltd acquired control over Ranaka Ltd by acquiring 75% of the issued ordinary shares of Ranaka Ltd for R650 000. At that date, the share capital of Ranaka Ltd amounted to R345 000 and the retained earnings amounted to R765 000.- 2 On 1 March 2018, the fair value of the identifiable net assets acquired were considered to be equal to the carrying amounts thereof in the financial statements or Ranaka Ltd, with the following exceptions: - Inventory with a carrying amount of R2 million had a net reliasable value o R1,6 million. All inventory was sold during the 2018 financial year. A contingent liability relating to a customer claim. Ranaka Ltd has not recognized the liability in its financial statements even though Ranaka Ltd's lawyers have confirmed that there is a pending court case regarding the claim. The fair value of this contingent liability was reliably determined to be R250 000. 3. The following transactions occurred during the current year - Ranaka Ltd sold inventory to the value of R360 000 (2018: R280 000) to Bonang Ltd. Ranaka Ltd sells inventory at a profit mark-up of 25% on cost. On 31 December 2019, Bonang Ltd had inventory on hand of R250 000 relating to purchases from Ranaka Ltd. (31 December 2018: R90 000) 4. On 31 December 2019, the directors of Bonang Ltd assessed the goodwill in Ranaka Ltd and found it to be impaired by R50 000. Kganya Ltd 5. On 1 January 2017, Bonang Ltd acquired a 40% of the issued ordinary shares in Kganya Ltd for R450 000. Since this date, Bonang Ltd exercised significant influence over the financial and operating policy decisions of Kganya Ltd. On the acquisition date, all the assets and liabilities of Kganya Ltd were considered to be fairly valued. A gain on bargain purchase amounting to R6 800 arose on acquisition date. At that date, Kganya had the following equity balances: Share capital R295 000 Retained earnings R557 000 Mark to mark reserve R290 000 6. On 1 September 2019, Bonang Ltd sold a piece of land to Kganya Ltd. The property. with a carrying amount of R796 000 was bought by Kganya for R745 000. The transaction was accounted for in the accounting records of the investor, Bonang Ltd Other information 7. Bonang Ltd and Kganya Ltd measure its investments in equity instruments at all value through other comprehensive income unless otherwise stated. 8. Bonang Ltd measures investments in associates and joint ventures at cost price in separate financial statements in terms of IAS 27, Separate Financial Statements. 9. The Bonang Ltd Group accounts for investments in associates and joint ventures using the equity method in terms of IAS 28, Investments in Associates and Jone Ventures 10. The Bonang Ltd Group measures non-controlling interests at their proportionate share of the acquiree's identifiable net assets at the acquisition date. 11. The share capital of the companies in the group remained unchanged since the acquisition dates of the companies. Assume that each share carries one (1) vote. 12. The SA normal tax rate remained unchanged at 28% since 1 January 2017 and capital gains tax is calculated at 80% thereof. REQUIRED: Marks (a) Draft an e-mail to the accountant of Bonang Ltd discussing the accounting treatment of Kganya Ltd in the consolidated financial statements of the Bonang Ltd Group. (b) Prepare only the journal entries to account for the investment in associate" in accounting records of the Bonang Ltd Group as at 31 December 2019. 19 (c) Prepare only the non-controlling interests column of the consolidated statement of changes in equity of the Bonang Ltd Group for the year ended 31 December 2019. 10 (d) 12 Prepare only the asset section of the consolidated statement of financial position of the Bonang Ltd Group as at 31 December 2019. Total [50] All answers should comply with the requirements of International Financial Reporting Standards. Comparative figures and notes to the consolidated statements are not required. All amounts should be rounded to the nearest Rand WRITTEN ASSIGNMENT Study: Learning units 1 to 6 of tutorial letters 102 to 104; and > Chapters 1 to 8 of Group Statements - Volume 1; and Chapters 9 to 12 of Group Statements - Volume 2 Bonang Ltd is a media company that specializes in print and digital publications. Having been formed in the early 2000's, it has done well in establishing its brand nationally and in some parts of Africa. The company has decided to grow their footprint by acquiring subsidiaries and associates over the years. All entities have a 31 December year end. The trial balances for the year ended 31 December 2019 were as follows: - S2 Bonang Ltd Ranaka Ltd Kganya Ltd Dr /(Cr) Drl(Cr) Dri(Cr) R Property, plant and equipment at cost... 2 000 000 1 600 000 1 000 000 Investment in Ranaka Ltd at cost .......... 650 000 Unvestment in kganya Ltd at cost........... 450 000 Other financial instruments at fair value. 165 000 250 000 Trade and other receivables ...... 458 000 398 745 698 000 Unventory............................. ........... 370 850 212,092 547 898 Cash and cash equivalents.................. 758 500 319 000 410 542 Dividends paid - 31 December 2019..... 475 000 154 000 227 650 Cost of Sales ........... 1 874 000 1 187 900 812 568 Other expenses...-- 480 013 718 313 365 478 Uncome tax expense... 324 700 288 610 680 320 Revenue .........................446.3.762... (2 847 000) (2 356 500) (1 945 000) Other Income........... (507 013) (774 500) (465 401) Fair value adjustment on investment in equity instruments, net after tax. (97 120) (58 700) Share capital.................. (1 650 000) (345 000) (295 000) Retained earnings - 1 January 2019...... (2 156 000) (989 650) (1 254 700) Mark-to-mark reserve - 1 January 2019 (26 384) (458 475) Accumulated depreciation (79 346) (33 000) (57 273) Deferred tax liability ............... (297 470) (115 430) (32 907) Trade and other payables ......... (345 730) (264 580) (425000) Assignment 1 Unique number: 656704 Additional information 75%, 25%. Ranaka Ltd 1 On 1 March 2018, Bonang Ltd acquired control over Ranaka Ltd by acquiring 75% of the issued ordinary shares of Ranaka Ltd for R650 000. At that date, the share capital of Ranaka Ltd amounted to R345 000 and the retained earnings amounted to R765 000.- 2 On 1 March 2018, the fair value of the identifiable net assets acquired were considered to be equal to the carrying amounts thereof in the financial statements or Ranaka Ltd, with the following exceptions: - Inventory with a carrying amount of R2 million had a net reliasable value o R1,6 million. All inventory was sold during the 2018 financial year. A contingent liability relating to a customer claim. Ranaka Ltd has not recognized the liability in its financial statements even though Ranaka Ltd's lawyers have confirmed that there is a pending court case regarding the claim. The fair value of this contingent liability was reliably determined to be R250 000. 3. The following transactions occurred during the current year - Ranaka Ltd sold inventory to the value of R360 000 (2018: R280 000) to Bonang Ltd. Ranaka Ltd sells inventory at a profit mark-up of 25% on cost. On 31 December 2019, Bonang Ltd had inventory on hand of R250 000 relating to purchases from Ranaka Ltd. (31 December 2018: R90 000) 4. On 31 December 2019, the directors of Bonang Ltd assessed the goodwill in Ranaka Ltd and found it to be impaired by R50 000. Kganya Ltd 5. On 1 January 2017, Bonang Ltd acquired a 40% of the issued ordinary shares in Kganya Ltd for R450 000. Since this date, Bonang Ltd exercised significant influence over the financial and operating policy decisions of Kganya Ltd. On the acquisition date, all the assets and liabilities of Kganya Ltd were considered to be fairly valued. A gain on bargain purchase amounting to R6 800 arose on acquisition date. At that date, Kganya had the following equity balances: Share capital R295 000 Retained earnings R557 000 Mark to mark reserve R290 000 6. On 1 September 2019, Bonang Ltd sold a piece of land to Kganya Ltd. The property. with a carrying amount of R796 000 was bought by Kganya for R745 000. The transaction was accounted for in the accounting records of the investor, Bonang Ltd Other information 7. Bonang Ltd and Kganya Ltd measure its investments in equity instruments at all value through other comprehensive income unless otherwise stated. 8. Bonang Ltd measures investments in associates and joint ventures at cost price in separate financial statements in terms of IAS 27, Separate Financial Statements. 9. The Bonang Ltd Group accounts for investments in associates and joint ventures using the equity method in terms of IAS 28, Investments in Associates and Jone Ventures 10. The Bonang Ltd Group measures non-controlling interests at their proportionate share of the acquiree's identifiable net assets at the acquisition date. 11. The share capital of the companies in the group remained unchanged since the acquisition dates of the companies. Assume that each share carries one (1) vote. 12. The SA normal tax rate remained unchanged at 28% since 1 January 2017 and capital gains tax is calculated at 80% thereof. REQUIRED: Marks (a) Draft an e-mail to the accountant of Bonang Ltd discussing the accounting treatment of Kganya Ltd in the consolidated financial statements of the Bonang Ltd Group. (b) Prepare only the journal entries to account for the investment in associate" in accounting records of the Bonang Ltd Group as at 31 December 2019. 19 (c) Prepare only the non-controlling interests column of the consolidated statement of changes in equity of the Bonang Ltd Group for the year ended 31 December 2019. 10 (d) 12 Prepare only the asset section of the consolidated statement of financial position of the Bonang Ltd Group as at 31 December 2019. Total [50] All answers should comply with the requirements of International Financial Reporting Standards. Comparative figures and notes to the consolidated statements are not required. All amounts should be rounded to the nearest Rand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started