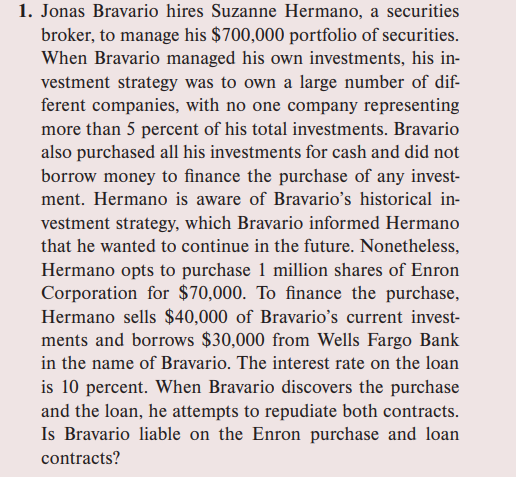

Question

written response to problem 1 For the written response to the problem, I would encourage you to try to show that you can identify and

written response to problem 1

For the written response to the problem, I would encourage you to try to show that you can identify and explain the legal issue in the problem, tell me (briefly) what the relevant rule is (or factors that a court might consider), and apply the rule to the facts in the problem to arrive at a conclusion. As mentioned in class, I am not looking for the "correct" answer - there may not be a correct answer - but rather an explanation of how you would respond to the problem and then support your answer by referring to relevant legal principles and facts in the problem.

One way to think about this is via the "IRAC" method: Issue, Rule, Analysis, Conclusion - meaning try to identify the legal issue, explain the general rule applicable to the legal issue, analyze the facts in light of the issue and rule, and then reach and support your conclusion based on the foregoing.

For most problems you should be able to answer in a page or less, e.g. I don't need you to restate the facts and I don't need you to copy the textbook - instead I want you to develop comfort with the legal issues and try to reach a conclusion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started