Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wrong answer will fetch you a downvote incomplete answer will fetch you a downvote Sava Tour Ltd was founded in 2015, scoring as one of

wrong answer will fetch you a downvote incomplete answer will fetch you a downvote

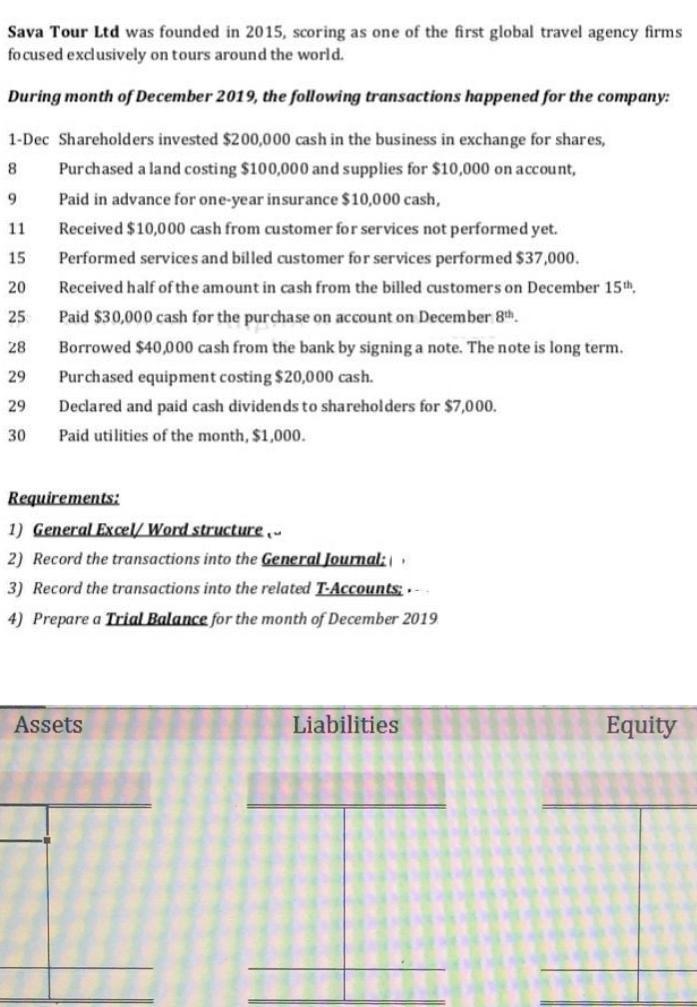

Sava Tour Ltd was founded in 2015, scoring as one of the first global travel agency firms focused exclusively on tours around the world. During month of December 2019, the following transactions happened for the company: 9 1-Dec Shareholders invested $200,000 cash in the business in exchange for shares, 8 Purchased a land costing $100,000 and supplies for $10,000 on account, Paid in advance for one-year insurance $10,000 cash, 11 Received $10,000 cash from customer for services not performed yet. 15 Performed services and billed customer for services performed $37,000. 20 Received half of the amount in cash from the billed customers on December 15th, 25 Paid $30,000 cash for the purchase on account on December 8th. 28 Borrowed $40,000 cash from the bank by signing a note. The note is long term. 29 Purchased equipment costing $20,000 cash. 29 Declared and paid cash dividends to shareholders for $7,000. 30 Paid utilities of the month, $1,000. Requirements: 1) General Excel/Word structure 2) Record the transactions into the General Journal: 3) Record the transactions into the related T-Accounts - 4) Prepare a Trial Balance for the month of December 2019 Assets Liabilities Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started