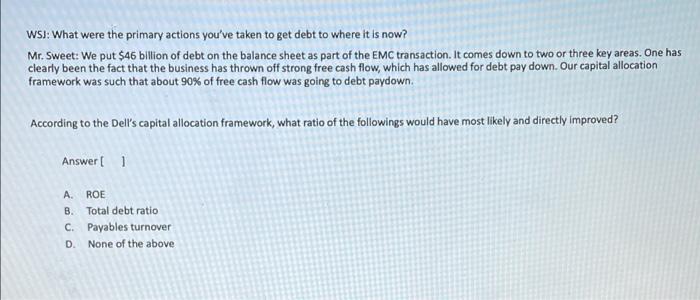

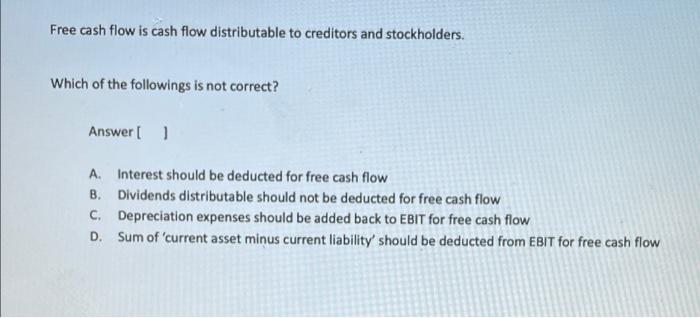

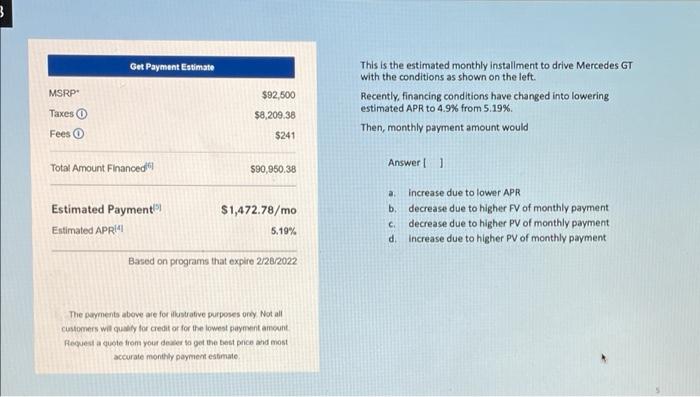

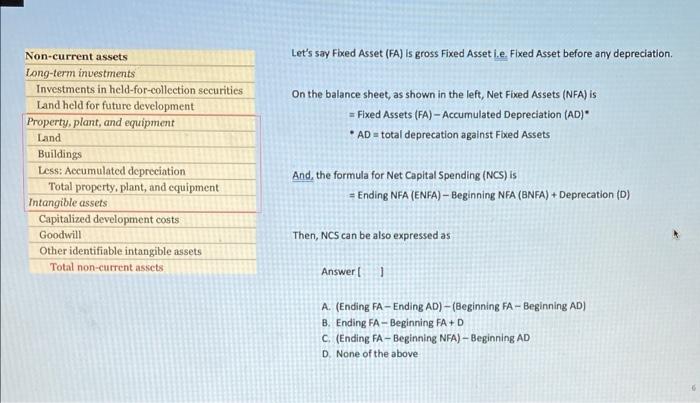

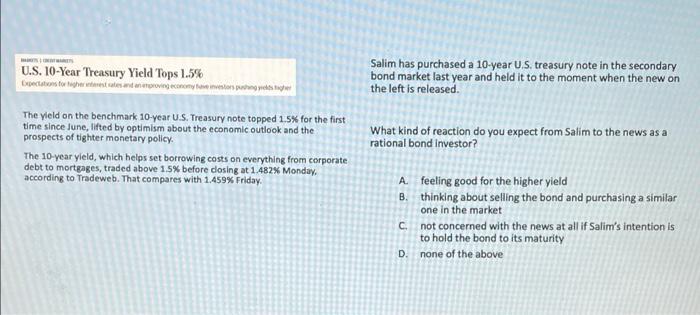

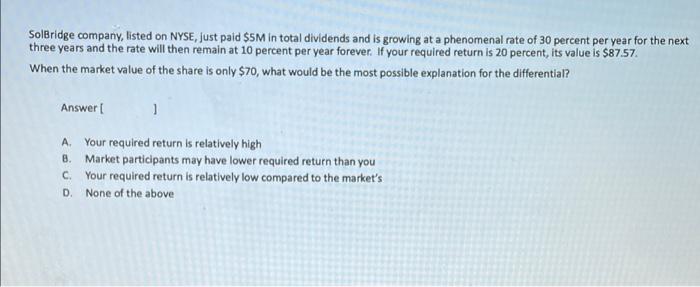

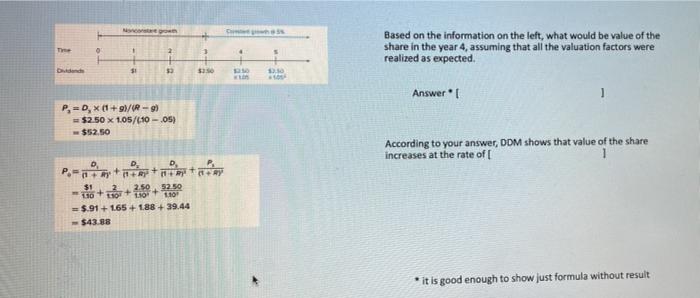

WS: What were the primary actions you've taken to get debt to where it is now? Mr. Sweet: We put $46 billion of debt on the balance sheet as part of the EMC transaction. It comes down to two or three key areas. One has clearly been the fact that the business has thrown off strong free cash flow, which has allowed for debt pay down. Our capital allocation framework was such that about 90% of free cash flow was going to debt paydown. According to the Dell's capital allocation framework, what ratio of the followings would have most likely and directly improved? Answer: 1 A ROE 8. Total debt ratio C. Payables turnover D. None of the above Free cash flow is cash flow distributable to creditors and stockholders. Which of the followings is not correct? Answer [] A. Interest should be deducted for free cash flow B. Dividends distributable should not be deducted for free cash flow C. Depreciation expenses should be added back to EBIT for free cash flow D. Sum of current asset minus current liability' should be deducted from EBIT for free cash flow 3 Get Payment Estimate MSRP: Taxes Fees 0 $92,500 $8,209.38 This is the estimated monthly installment to drive Mercedes GT with the conditions as shown on the left. Recently, financing conditions have changed into lowering estimated APR to 4.9% from 5.19% Then, monthly payment amount would $241 Answer] Total Amount Financed 590,950.38 a. b. $1,472.78/mo Estimated Payment Estimated APRI increase due to lower APR decrease due to higher FV of monthly payment decrease due to higher PV of monthly payment Increase due to higher PV of monthly payment 5.19% C d Based on programs that expire 2/26/2022 The payments above are for illustrative purposes only. Not all customers will quality for creditor for the lowest payment amount Request a quote from your de to get the best price and most accurate monthly payment estimate Let's say Fixed Asset (FA) is gross Fixed Asset i.e. Fixed Asset before any depreciation On the balance sheet, as shown in the left, Net Fixed Assets (NFA) is = Fixed Assets (FA) - Accumulated Depreciation (AD)" * AD = total deprecation against Fixed Assets Non-current assets Long-term investments Investments in held-for-collection securities Land held for future development Property, plant, and equipment Land Buildings Less: Accumulated depreciation Total property, plant, and equipment Intangible assets Capitalized development costs Goodwill Other identifiable intangible assets Total non-current assets And, the formula for Net Capital Spending (NCS) IS Ending NEA ENFA) - Beginning NEA (BNFA) + Deprecation (D) Then, NCS can be also expressed as Answer1 A. (Ending FA-Ending AD) - (Beginning FA - Beginning AD) B. Ending FA - Beginning FA+D C (Ending FA - Beginning NFA) Beginning AD D. None of the above 05 Beca... 1. According to the latest news on the left, term structure of interest rate isely to be similar to Answer A II. Hit 2. Which of the following is most likely to be appropriate to say? Answer 1 A Mary bond investors are buying long-term bonds to secure relatively high YTM @ Given the economic environment, many bond investors are more attracted to short-term bonds rather than long term bonds Clong-term coupon rate must be lower than thort-term couponsrate D. None of the above What bond term should be most appropriate to fill the blanks? 1 is/are forward looking opinion(s) about an issuer's relative creditworthiness. They/It provides common and transparent global language for investors to form a view on and compare the relative likelihood of whether an issuer may repay its debts on time and in full. 1 is/are just one of many inputs that investors and other market participants can consider as part of their decision-making processes Answert 1 A Indenture B Covenant C. Credit ratings D. Collateral U.S. 10-Year Treasury Yield Tops 1.5% Salim has purchased a 10-year U.S. treasury note in the secondary bond market last year and held it to the moment when the new on the left is released. The yield on the benchmark 10-year U.S. Treasury note topped 1.5% for the first time since June, lifted by optimism about the economic outlook and the prospects of tighter monetary policy. The 10 year yield, which helps set borrowing costs on everything from corporate debt to mortgages, traded above 1.5% before dosing at 1.482% Monday. according to Tradeweb. That compares with 1.459% Friday. What kind of reaction do you expect from Salim to the news as a rational bond investor? A feeling good for the higher yield B. thinking about selling the bond and purchasing a similar one in the market not concerned with the news at all if Salim's intention is to hold the bond to its maturity none of the above C. D. One if equity valuation models is to estimate the intrinsic value of a security as the present value of the future benefits expected to be received from the security Given that primary sources of future benefits are cash dividends and price changes in the market value of the equity, Jis an stock valuation model based on those sources. As an equity valuation model, Gordon growth model assumes that both dividend growth rate and required rate of return are perpetually constant and growth rate is always than required rate of return. Solbridge company, listed on NYSE, just paid $SM in total dividends and is growing at a phenomenal rate of 30 percent per year for the next three years and the rate will then remain at 10 percent per year forever. If your required return is 20 percent, its value is $87.57. When the market value of the share is only $70, what would be the most possible explanation for the differential? Answert 2 B A. Your required return is relatively high Market participants may have lower required return than you C. Your required return is relatively low compared to the market's D. None of the above Ne Based on the information on the left, what would be value of the share in the year 4, assuming that all the valuation factors realized as expected. The . 2 s were Dudende 31 . Answert 1 P=0, x 1+1/R-9) = $2.50 x 1.05/610-05) $52.50 According to your answer, DDM shows that value of the share increases at the rate of [ 1 D P.-++++ +389 +9280 $1 52 50 10+ 110 110 = $.91 +165 +1.88 +39.44 $43.88 * it is good enough to show just formula without result WS: What were the primary actions you've taken to get debt to where it is now? Mr. Sweet: We put $46 billion of debt on the balance sheet as part of the EMC transaction. It comes down to two or three key areas. One has clearly been the fact that the business has thrown off strong free cash flow, which has allowed for debt pay down. Our capital allocation framework was such that about 90% of free cash flow was going to debt paydown. According to the Dell's capital allocation framework, what ratio of the followings would have most likely and directly improved? Answer: 1 A ROE 8. Total debt ratio C. Payables turnover D. None of the above Free cash flow is cash flow distributable to creditors and stockholders. Which of the followings is not correct? Answer [] A. Interest should be deducted for free cash flow B. Dividends distributable should not be deducted for free cash flow C. Depreciation expenses should be added back to EBIT for free cash flow D. Sum of current asset minus current liability' should be deducted from EBIT for free cash flow 3 Get Payment Estimate MSRP: Taxes Fees 0 $92,500 $8,209.38 This is the estimated monthly installment to drive Mercedes GT with the conditions as shown on the left. Recently, financing conditions have changed into lowering estimated APR to 4.9% from 5.19% Then, monthly payment amount would $241 Answer] Total Amount Financed 590,950.38 a. b. $1,472.78/mo Estimated Payment Estimated APRI increase due to lower APR decrease due to higher FV of monthly payment decrease due to higher PV of monthly payment Increase due to higher PV of monthly payment 5.19% C d Based on programs that expire 2/26/2022 The payments above are for illustrative purposes only. Not all customers will quality for creditor for the lowest payment amount Request a quote from your de to get the best price and most accurate monthly payment estimate Let's say Fixed Asset (FA) is gross Fixed Asset i.e. Fixed Asset before any depreciation On the balance sheet, as shown in the left, Net Fixed Assets (NFA) is = Fixed Assets (FA) - Accumulated Depreciation (AD)" * AD = total deprecation against Fixed Assets Non-current assets Long-term investments Investments in held-for-collection securities Land held for future development Property, plant, and equipment Land Buildings Less: Accumulated depreciation Total property, plant, and equipment Intangible assets Capitalized development costs Goodwill Other identifiable intangible assets Total non-current assets And, the formula for Net Capital Spending (NCS) IS Ending NEA ENFA) - Beginning NEA (BNFA) + Deprecation (D) Then, NCS can be also expressed as Answer1 A. (Ending FA-Ending AD) - (Beginning FA - Beginning AD) B. Ending FA - Beginning FA+D C (Ending FA - Beginning NFA) Beginning AD D. None of the above 05 Beca... 1. According to the latest news on the left, term structure of interest rate isely to be similar to Answer A II. Hit 2. Which of the following is most likely to be appropriate to say? Answer 1 A Mary bond investors are buying long-term bonds to secure relatively high YTM @ Given the economic environment, many bond investors are more attracted to short-term bonds rather than long term bonds Clong-term coupon rate must be lower than thort-term couponsrate D. None of the above What bond term should be most appropriate to fill the blanks? 1 is/are forward looking opinion(s) about an issuer's relative creditworthiness. They/It provides common and transparent global language for investors to form a view on and compare the relative likelihood of whether an issuer may repay its debts on time and in full. 1 is/are just one of many inputs that investors and other market participants can consider as part of their decision-making processes Answert 1 A Indenture B Covenant C. Credit ratings D. Collateral U.S. 10-Year Treasury Yield Tops 1.5% Salim has purchased a 10-year U.S. treasury note in the secondary bond market last year and held it to the moment when the new on the left is released. The yield on the benchmark 10-year U.S. Treasury note topped 1.5% for the first time since June, lifted by optimism about the economic outlook and the prospects of tighter monetary policy. The 10 year yield, which helps set borrowing costs on everything from corporate debt to mortgages, traded above 1.5% before dosing at 1.482% Monday. according to Tradeweb. That compares with 1.459% Friday. What kind of reaction do you expect from Salim to the news as a rational bond investor? A feeling good for the higher yield B. thinking about selling the bond and purchasing a similar one in the market not concerned with the news at all if Salim's intention is to hold the bond to its maturity none of the above C. D. One if equity valuation models is to estimate the intrinsic value of a security as the present value of the future benefits expected to be received from the security Given that primary sources of future benefits are cash dividends and price changes in the market value of the equity, Jis an stock valuation model based on those sources. As an equity valuation model, Gordon growth model assumes that both dividend growth rate and required rate of return are perpetually constant and growth rate is always than required rate of return. Solbridge company, listed on NYSE, just paid $SM in total dividends and is growing at a phenomenal rate of 30 percent per year for the next three years and the rate will then remain at 10 percent per year forever. If your required return is 20 percent, its value is $87.57. When the market value of the share is only $70, what would be the most possible explanation for the differential? Answert 2 B A. Your required return is relatively high Market participants may have lower required return than you C. Your required return is relatively low compared to the market's D. None of the above Ne Based on the information on the left, what would be value of the share in the year 4, assuming that all the valuation factors realized as expected. The . 2 s were Dudende 31 . Answert 1 P=0, x 1+1/R-9) = $2.50 x 1.05/610-05) $52.50 According to your answer, DDM shows that value of the share increases at the rate of [ 1 D P.-++++ +389 +9280 $1 52 50 10+ 110 110 = $.91 +165 +1.88 +39.44 $43.88 * it is good enough to show just formula without result