Question: WTI Oil futures contract specifications Contract Size = z = 1000 barrels n = N/z = 160000 total number of futures contracts required but spread

WTI Oil futures contract specifications

Contract Size = z = 1000 barrels

n = N/z = 160000 total number of futures contracts required but spread across all contract maturities

p= 25% maximum percentage of open interest MG wishes to hold for any given maturity

Open Interest

a.) Construct a stack strategy and not exceed 25% of open interest in any chosen maturity contract.

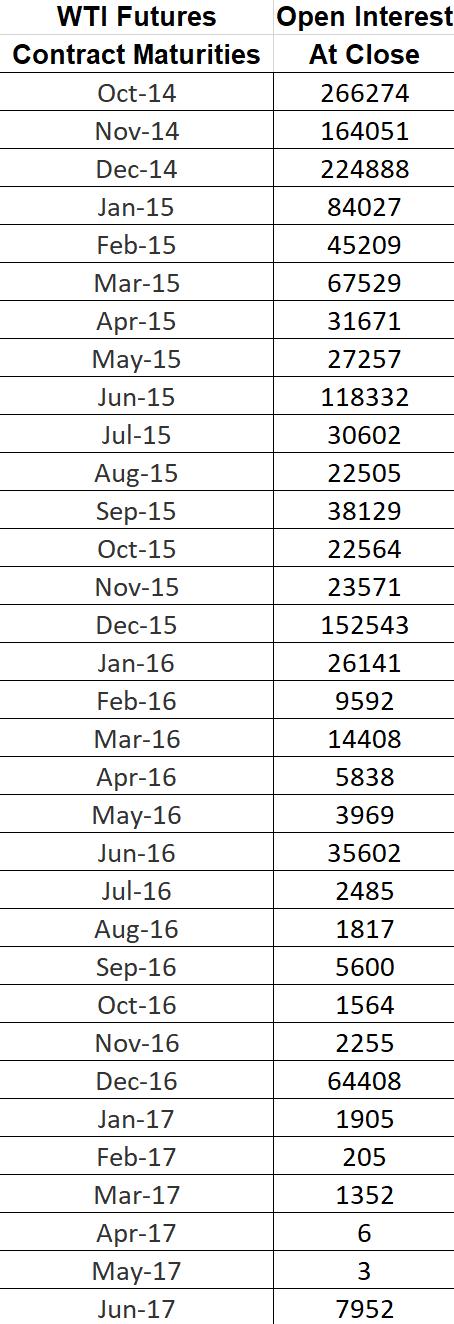

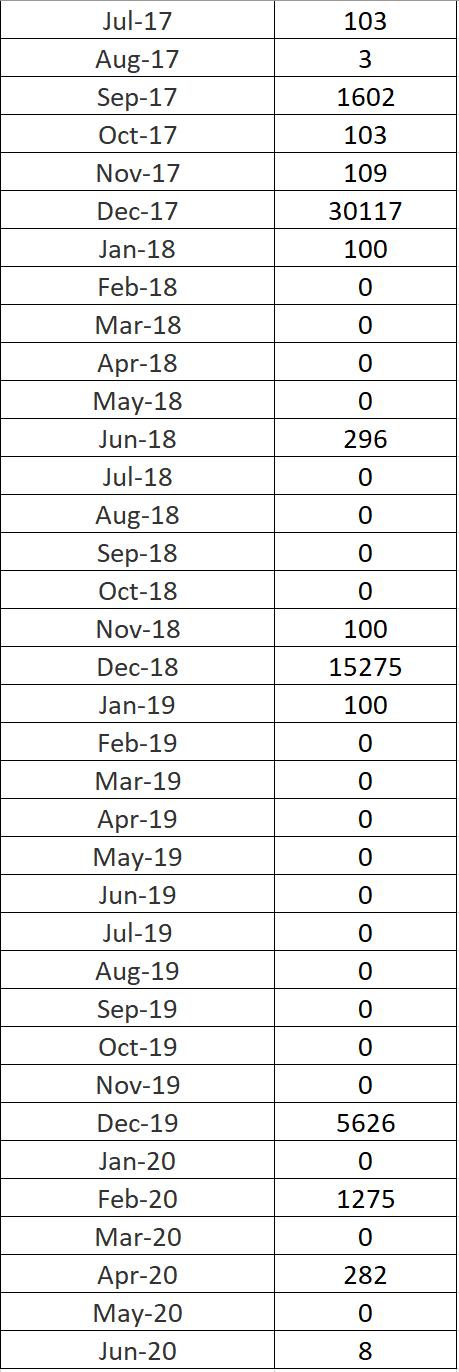

b.) Devise a Strip strategy that employs a maximum of 160,000 WTI futures at any given contract maturity without exceeding 25% of any maturity's open interest? and without permitting more than 10% of the total required futures to have the same expiration date? using following data.

WTI Futures Contract Maturities Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Open Interest At Close 266274 164051 224888 84027 45209 67529 31671 27257 118332 30602 22505 38129 22564 23571 152543 26141 9592 14408 5838 3969 35602 2485 1817 5600 1564 2255 64408 1905 205 1352 6 3 7952

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Answer a Stack Strategy In order to construct a stack strategy that does not exceed 25 of open interest in any chosen maturity contract MG will need to spread out its open interest on the WTI futures ... View full answer

Get step-by-step solutions from verified subject matter experts