Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wu, a member, is an audit manager at the firm of Winn & Lite, CPAs. Wu is employed by North State University (an audit client

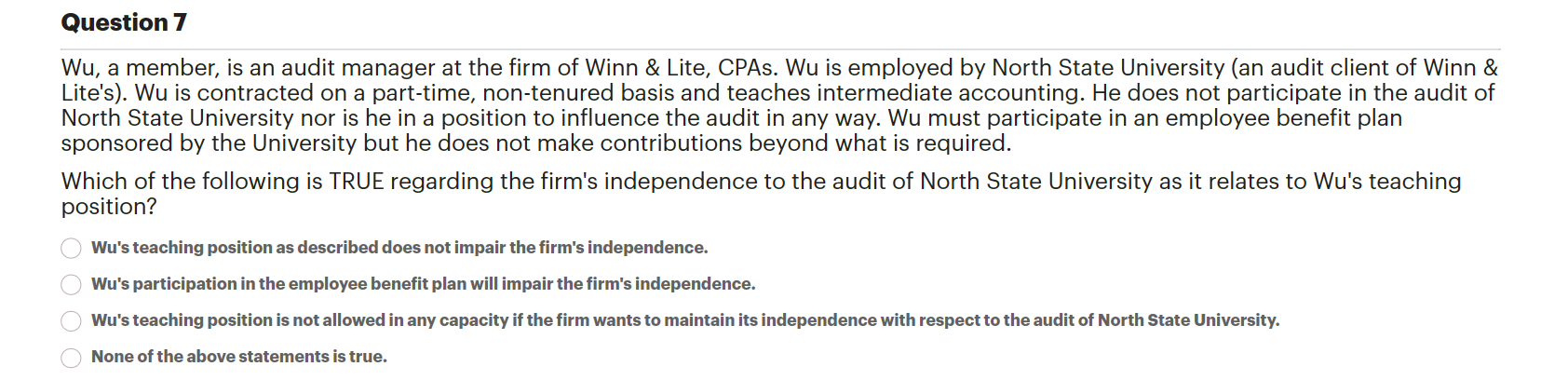

Wu, a member, is an audit manager at the firm of Winn \& Lite, CPAs. Wu is employed by North State University (an audit client of Winn \& Lite's). Wu is contracted on a part-time, non-tenured basis and teaches intermediate accounting. He does not participate in the audit of North State University nor is he in a position to influence the audit in any way. Wu must participate in an employee benefit plan sponsored by the University but he does not make contributions beyond what is required. Which of the following is TRUE regarding the firm's independence to the audit of North State University as it relates to Wu's teaching position? Wu's teaching position as described does not impair the firm's independence. Wu's participation in the employee benefit plan will impair the firm's independence. Wu's teaching position is not allowed in any capacity if the firm wants to maintain its independence with respect to the audit of North State University. None of the above statements is true

Wu, a member, is an audit manager at the firm of Winn \& Lite, CPAs. Wu is employed by North State University (an audit client of Winn \& Lite's). Wu is contracted on a part-time, non-tenured basis and teaches intermediate accounting. He does not participate in the audit of North State University nor is he in a position to influence the audit in any way. Wu must participate in an employee benefit plan sponsored by the University but he does not make contributions beyond what is required. Which of the following is TRUE regarding the firm's independence to the audit of North State University as it relates to Wu's teaching position? Wu's teaching position as described does not impair the firm's independence. Wu's participation in the employee benefit plan will impair the firm's independence. Wu's teaching position is not allowed in any capacity if the firm wants to maintain its independence with respect to the audit of North State University. None of the above statements is true Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started