Question

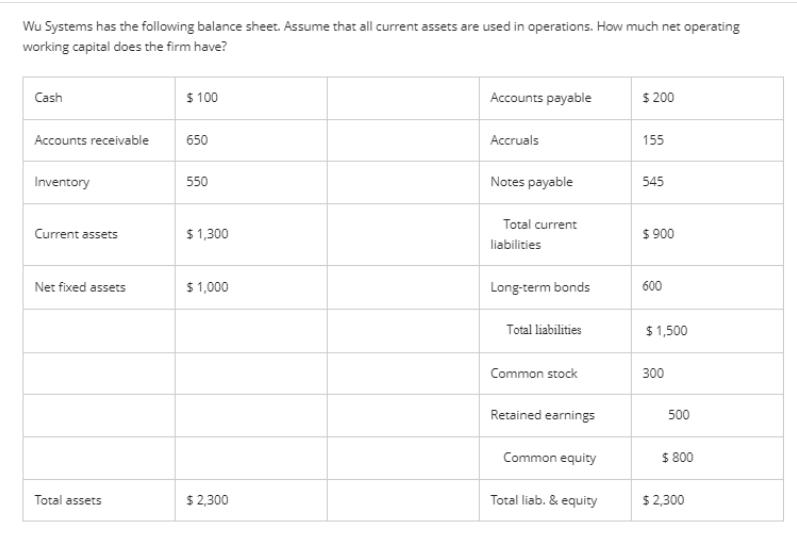

Wu Systems has the following balance sheet. Assume that all current assets are used in operations. How much net operating working capital does the

Wu Systems has the following balance sheet. Assume that all current assets are used in operations. How much net operating working capital does the firm have? Cash Accounts receivable Inventory Current assets Net fixed assets Total assets $100 650 550 $1,300 $ 1,000 $ 2,300 Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Common equity Total liab. & equity $200 155 545 $900 600 $1,500 300 500 $ 800 $2,300

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate net operating working capital we use the fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App