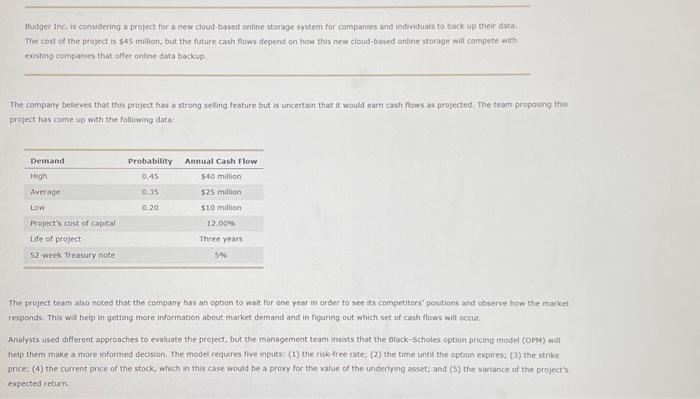

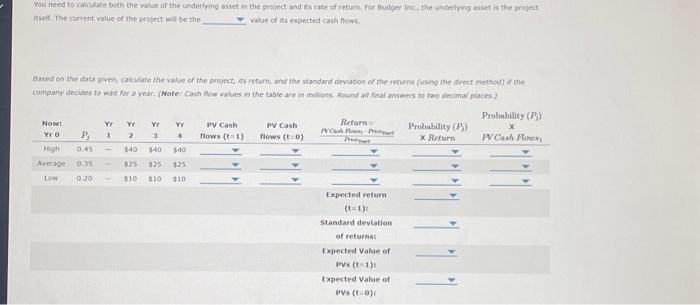

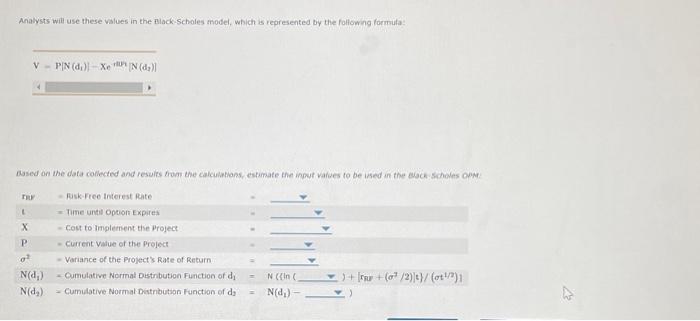

Wudget inc is considering a project for a new clogd based online: storage system for companies and individuals to bsck up their data. The cost of the project is 545 multion, but the future cash flows depend on how this new cioud-based online stornge will compete with existing companses that offer online data bockup. The company bebeves that this project has a strong seling feahure buc is uncertain that it bould earm cash flows is projected. The team proposing this project has coene up with the following data! The project team also noted that the company has an option to wait for one yeat ia order to see its competitors posations and obserye hoe the market. responds. This will help in getting more information about market demand and in figuring out which set of cash flows will occut, Analysts used different apgroaches to evaluate the groject, but the-management team insists that the alack-Scholes option pricing model (opM) will help them make a more informed deoson. The model requires five inputs: (1) the risk-tree rate; (2) the time until the option expires: (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiymo asset: and (5) the variance of the project's expected return. You need to calcolate both the walue af the cinderlying asset in the project and its rate of refurn for Budger Ime, the underlying asset is the propent itseir. The current value of the prosect wilt be the value of ita evpected cash fiowi. Aralysts will use these values in the flack-Scholes model, which is represented by the following formula: V=PN(d1)]X1tu1[N(d2)] Based on the data collected and resulis trom the calculathons, estimate the input values to be ised in the gach scholes oved. Wudget inc is considering a project for a new clogd based online: storage system for companies and individuals to bsck up their data. The cost of the project is 545 multion, but the future cash flows depend on how this new cioud-based online stornge will compete with existing companses that offer online data bockup. The company bebeves that this project has a strong seling feahure buc is uncertain that it bould earm cash flows is projected. The team proposing this project has coene up with the following data! The project team also noted that the company has an option to wait for one yeat ia order to see its competitors posations and obserye hoe the market. responds. This will help in getting more information about market demand and in figuring out which set of cash flows will occut, Analysts used different apgroaches to evaluate the groject, but the-management team insists that the alack-Scholes option pricing model (opM) will help them make a more informed deoson. The model requires five inputs: (1) the risk-tree rate; (2) the time until the option expires: (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiymo asset: and (5) the variance of the project's expected return. You need to calcolate both the walue af the cinderlying asset in the project and its rate of refurn for Budger Ime, the underlying asset is the propent itseir. The current value of the prosect wilt be the value of ita evpected cash fiowi. Aralysts will use these values in the flack-Scholes model, which is represented by the following formula: V=PN(d1)]X1tu1[N(d2)] Based on the data collected and resulis trom the calculathons, estimate the input values to be ised in the gach scholes oved