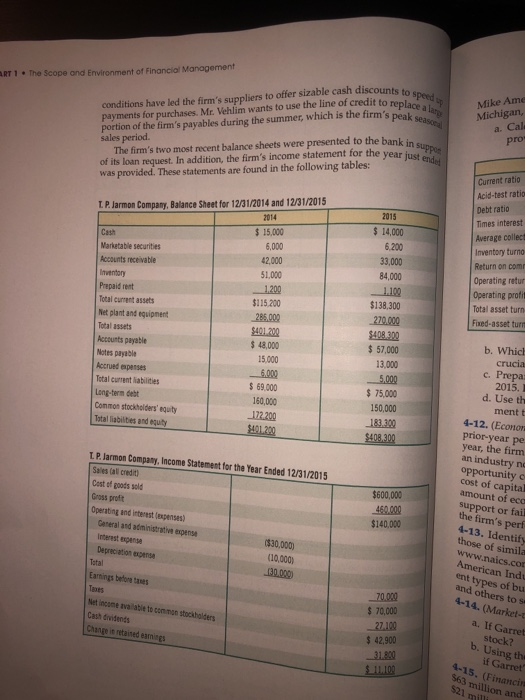

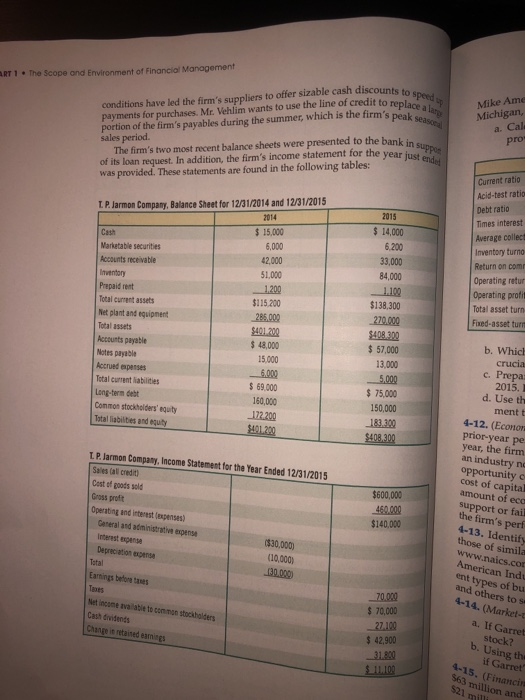

Wut uld earned before the Tenuvalul. 17. (Financial analysis) The T. P. Jarmon Company manufactures and sells a line of velusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets exceeded $400,000. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception. The chief financial officer for the firm, Brent Vehlim, has decided to seek a line of credit totaling $80,000 from the firm's bank. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money ART 1. The scope ond Environment of Financial Management scounts to speed to replace a la speak seascal Mike Ame Michigan, a. Cal conditions have led the firm's suppliers to offer sizable cash discounts to payments for purchases. Mr. Vehlim wants to use the line of credit to her portion of the firm's payables during the summer, which is the firm's peal sales period. The firm's two most recent balance sheets were presented to the bank in of its loan request. In addition, the firm's income statement for the year just was provided. These statements are found in the following tables: ank in suppor pro 2015 Cash $ 14,000 L P Jarmon Company, Balance Sheet for 12/31/2014 and 12/31/2015 2014 $ 15,000 Marketable securities 6,000 Accounts receivable 42,000 Inwentary 51,000 Prepaid rent 1,200 Total current assets $115 200 Met plant and equipment 285.000 Total assets $401 200 Accounts payable $ 48,000 Notes payable 15.000 Accrued apetes 6.000 Total current liabilities $ 69.000 Long-term debt 160,000 Conmon stockholders' equity 172.200 Total abilities and equity $401.200 Current ratio Acid-test ratio Debt ratio Times interest Average collect Inventory turno Return on com Operating retur Operating profil Total asset turn Fixed-asset tum 6.200 33,000 84,000 1.100 $138,300 270.000 $408.200 $ 57,000 13,000 5.000 $ 75,000 150,000 182.300 b. Which crucia c. Prepa: 2015. d. Use th mentt $408.200 L. P. Jarmon Company, Income Statement for the Year Ended 12/31/2015 4-12. (Econor prior-year pe year, the firm an industry ng opportunity cost of capital amount of eco support or fail Sales all credit) $600.000 Cost of goods sold Gross proft Operating and interest expenses) General and administrative expense 460.000 $140.000 ($30,000) (10.000) 30.000) Earnings before tas the firm's perf 4-13. Identify those of simila www.naics.co American Indu ent types of bu and others to se 4-14. (Markel- a. If Garret stock? b. Using the Garret Net income available to come stockholders Cash dividends Change it retained camins 70.000 $ 70,000 27.100 $ 42,900 31.800 $ 1100 4-15. (Financi 563 million and 521 mil