Answered step by step

Verified Expert Solution

Question

1 Approved Answer

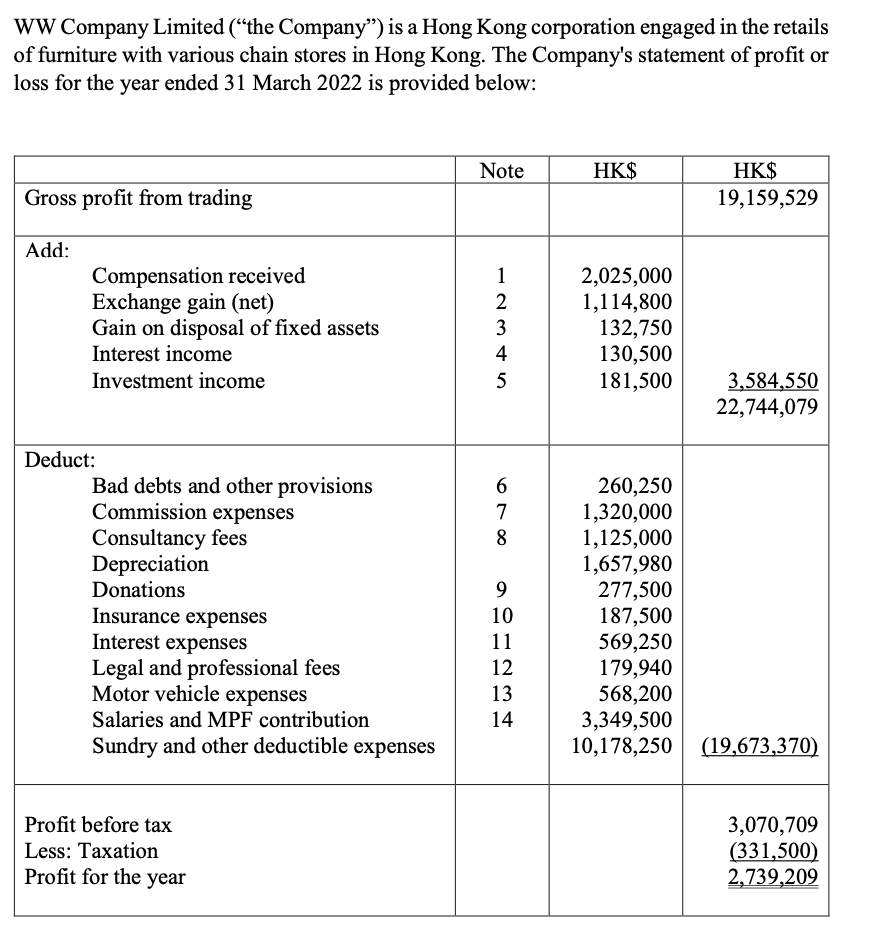

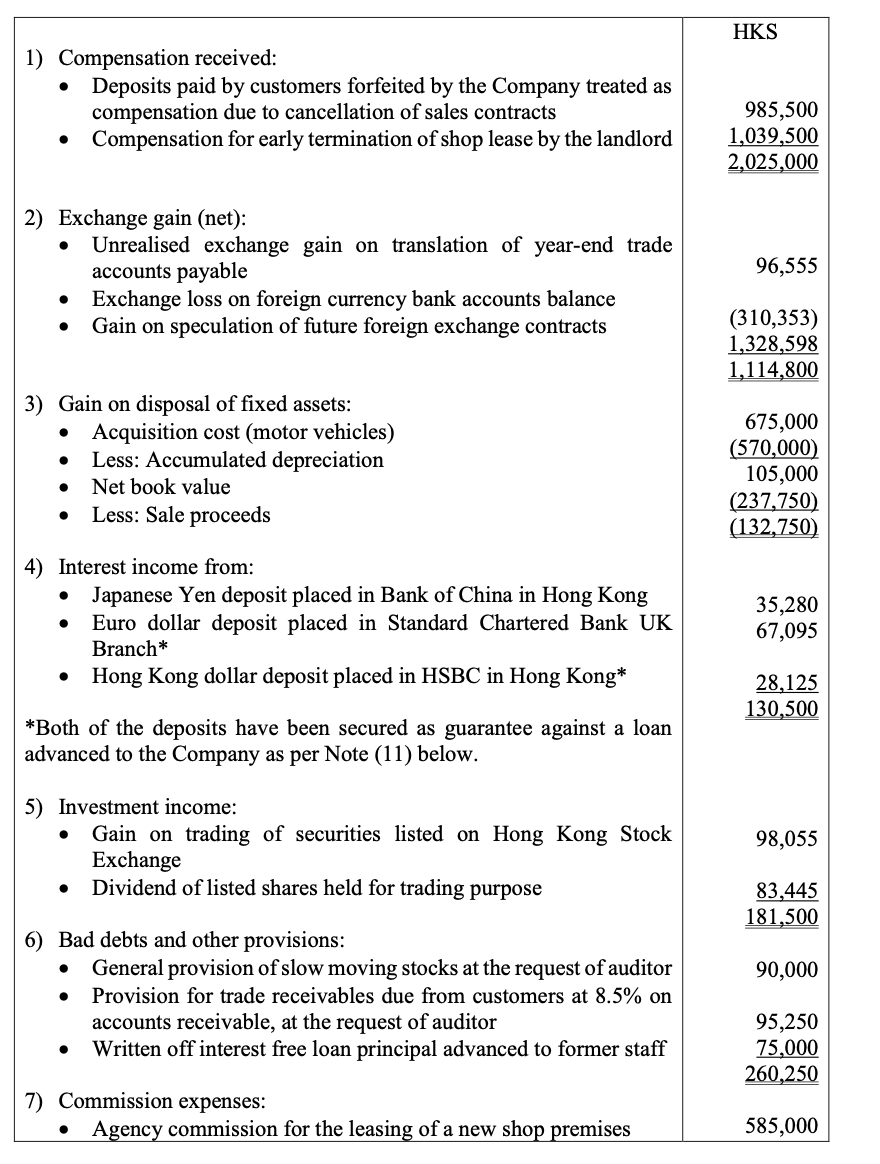

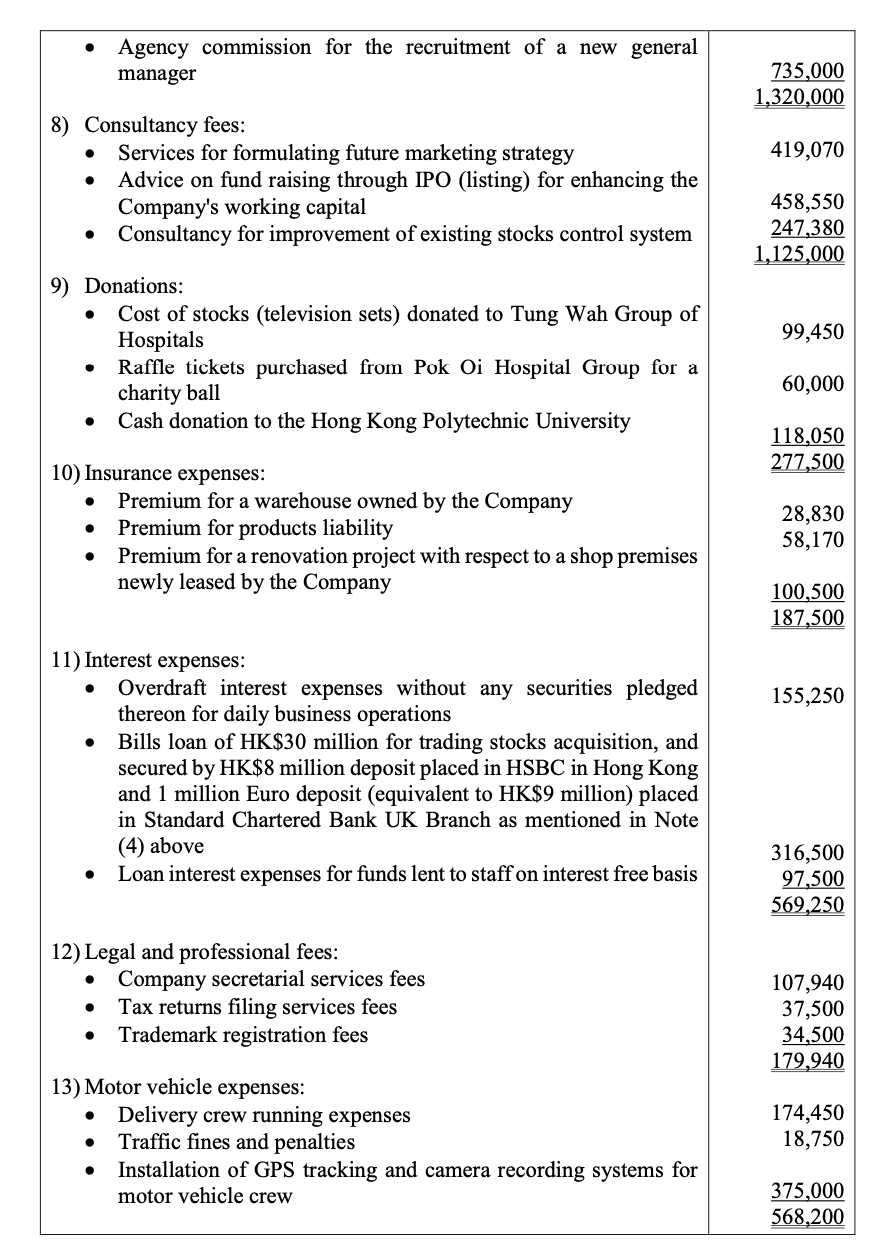

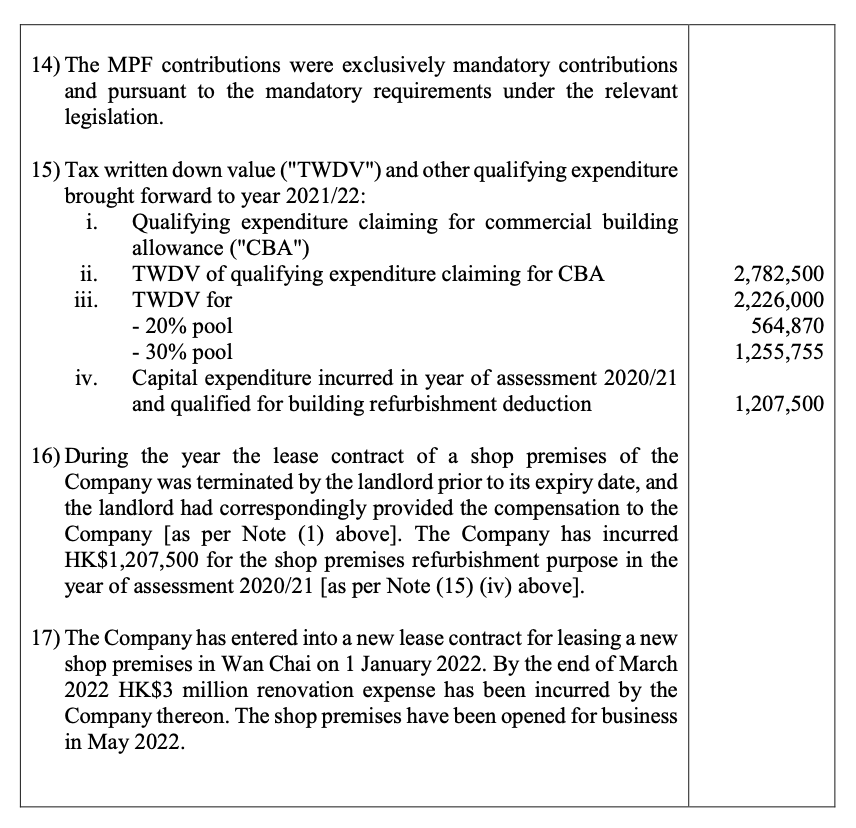

WW Company Limited (the Company) is a Hong Kong corporation engaged in the retails of furniture with various chain stores in Hong Kong. The

WW Company Limited ("the Company") is a Hong Kong corporation engaged in the retails of furniture with various chain stores in Hong Kong. The Company's statement of profit or loss for the year ended 31 March 2022 is provided below: Gross profit from trading Add: Compensation received Exchange gain (net) Deduct: Gain on disposal of fixed assets Interest income Investment income Note HK$ HK$ 19,159,529 12345 2,025,000 2 1,114,800 3 132,750 4 130,500 5 181,500 3,584,550 22,744,079 Bad debts and other provisions Commission expenses Consultancy fees Depreciation Donations Insurance expenses 879 6 260,250 1,320,000 1,125,000 1,657,980 Interest expenses 11 Legal and professional fees 12 Motor vehicle expenses Salaries and MPF contribution 90=234 277,500 10 187,500 569,250 179,940 13 568,200 14 3,349,500 Sundry and other deductible expenses 10,178,250 (19,673,370) Profit before tax Less: Taxation Profit for the year 3,070,709 (331,500) 2,739,209 HKS 1) Compensation received: Deposits paid by customers forfeited by the Company treated as compensation due to cancellation of sales contracts Compensation for early termination of shop lease by the landlord 985,500 1,039,500 2,025,000 2) Exchange gain (net): Unrealised exchange gain on translation of year-end trade accounts payable Exchange loss on foreign currency bank accounts balance Gain on speculation of future foreign exchange contracts 3) Gain on disposal of fixed assets: Acquisition cost (motor vehicles) Less: Accumulated depreciation Net book value Less: Sale proceeds 4) Interest income from: 96,555 (310,353) 1,328,598 1,114,800 675,000 (570,000) 105,000 (237,750) (132,750) Japanese Yen deposit placed in Bank of China in Hong Kong Euro dollar deposit placed in Standard Chartered Bank UK Branch* 35,280 67,095 Hong Kong dollar deposit placed in HSBC in Hong Kong* 28,125 130,500 *Both of the deposits have been secured as guarantee against a loan advanced to the Company as per Note (11) below. 5) Investment income: Gain on trading of securities listed on Hong Kong Stock Exchange 98,055 Dividend of listed shares held for trading purpose 6) Bad debts and other provisions: 83,445 181,500 General provision of slow moving stocks at the request of auditor 90,000 Provision for trade receivables due from customers at 8.5% on accounts receivable, at the request of auditor 95,250 Written off interest free loan principal advanced to former staff 75,000 260,250 7) Commission expenses: Agency commission for the leasing of a new shop premises 585,000 Agency commission for the recruitment of a new general manager 8) Consultancy fees: 735,000 1,320,000 Services for formulating future marketing strategy 419,070 Advice on fund raising through IPO (listing) for enhancing the Company's working capital 458,550 Consultancy for improvement of existing stocks control system 247,380 1,125,000 9) Donations: Cost of stocks (television sets) donated to Tung Wah Group of Hospitals 99,450 Raffle tickets purchased from Pok Oi Hospital Group for a charity ball 60,000 Cash donation to the Hong Kong Polytechnic University 118,050 277,500 10) Insurance expenses: Premium for a warehouse owned by the Company 28,830 Premium for products liability 58,170 Premium for a renovation project with respect to a shop premises newly leased by the Company 100,500 187,500 11) Interest expenses: Overdraft interest expenses without any securities pledged thereon for daily business operations 155,250 Bills loan of HK$30 million for trading stocks acquisition, and secured by HK$8 million deposit placed in HSBC in Hong Kong and 1 million Euro deposit (equivalent to HK$9 million) placed in Standard Chartered Bank UK Branch as mentioned in Note (4) above 316,500 Loan interest expenses for funds lent to staff on interest free basis 97,500 569,250 12) Legal and professional fees: Company secretarial services fees Tax returns filing services fees . Trademark registration fees 13) Motor vehicle expenses: Delivery crew running expenses Traffic fines and penalties Installation of GPS tracking and camera recording systems for motor vehicle crew 107,940 37,500 34,500 179,940 174,450 18,750 375,000 568,200 14) The MPF contributions were exclusively mandatory contributions and pursuant to the mandatory requirements under the relevant legislation. 15) Tax written down value ("TWDV") and other qualifying expenditure brought forward to year 2021/22: Qualifying expenditure claiming for commercial building allowance ("CBA") i. ii. TWDV of qualifying expenditure claiming for CBA iii. TWDV for - 20% pool 2,782,500 2,226,000 564,870 1,255,755 -30% pool iv. Capital expenditure incurred in year of assessment 2020/21 and qualified for building refurbishment deduction 16) During the year the lease contract of a shop premises of the Company was terminated by the landlord prior to its expiry date, and the landlord had correspondingly provided the compensation to the Company [as per Note (1) above]. The Company has incurred HK$1,207,500 for the shop premises refurbishment purpose in the year of assessment 2020/21 [as per Note (15) (iv) above]. 17) The Company has entered into a new lease contract for leasing a new shop premises in Wan Chai on 1 January 2022. By the end of March 2022 HK$3 million renovation expense has been incurred by the Company thereon. The shop premises have been opened for business in May 2022. 1,207,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Breakdown of WW Company Limiteds Financial Statements for the Year Ended March 31 2022 This document provides a breakdown of WW Company Limiteds profi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started