Answered step by step

Verified Expert Solution

Question

1 Approved Answer

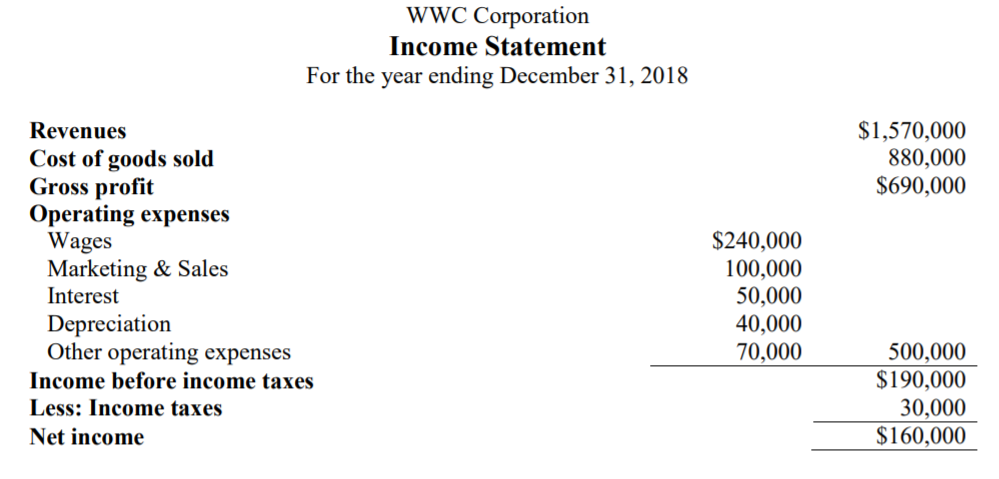

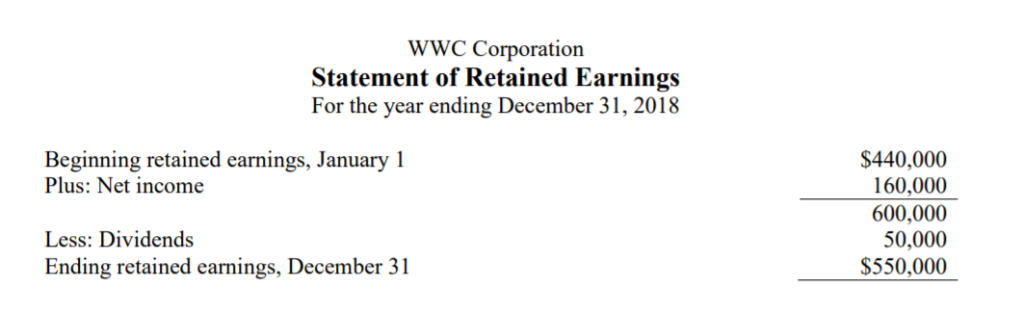

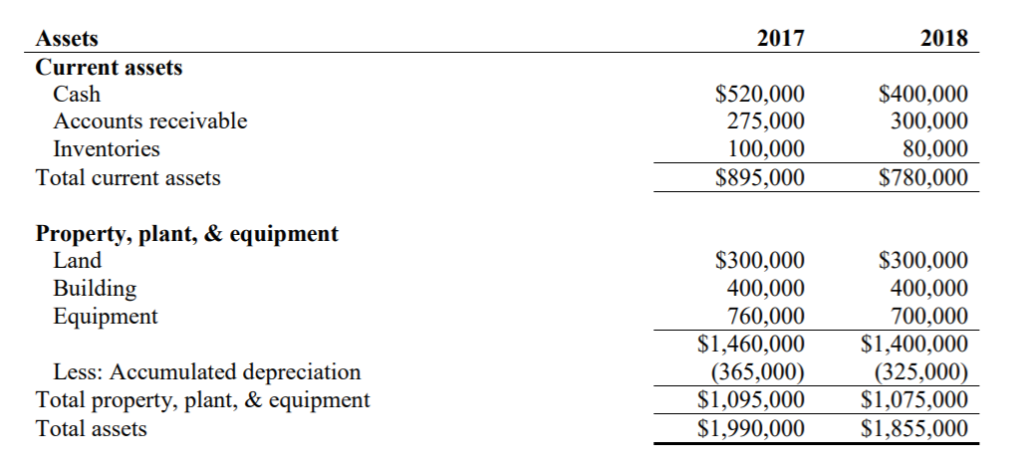

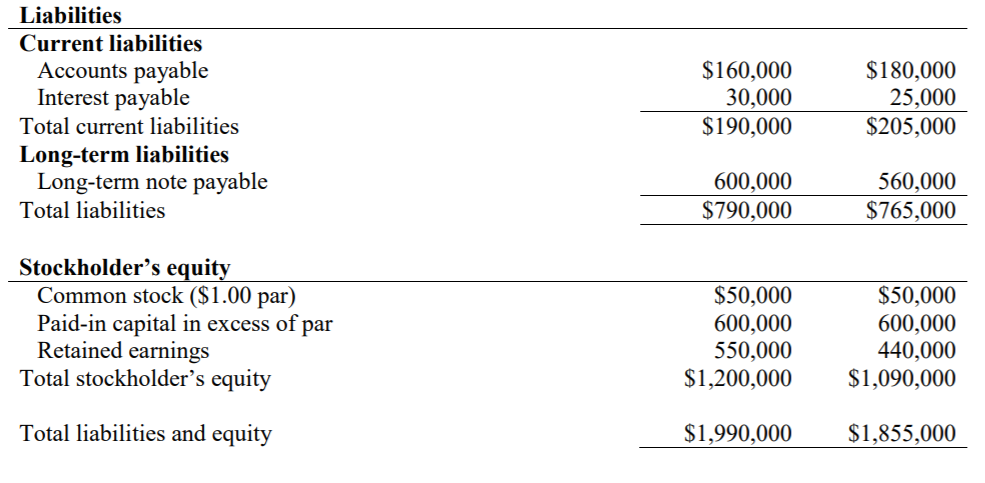

WWC provided the following financial statements below. WWC Corporation's stock is selling for $15 per share. Use these statements to prepare the following profitability ratios

WWC provided the following financial statements below. WWC Corporation's stock is selling for $15 per share. Use these statements to prepare the following profitability ratios for the year ending December 31, 2018. Use the Financial Ratios document to complete this assignment.

WWC provided the following financial statements below. WWC Corporation's stock is selling for $15 per share. Use these statements to prepare the following profitability ratios for the year ending December 31, 2018. Use the Financial Ratios document to complete this assignment.

| Ratio | Your Solution (show your calculations) |

|---|---|

| Gross Profit Margin Percentage | |

| Operating Profit Margin (Return on Sales) | |

| Net Profit Margin (Net Return on Sales) | |

| Return on Assets (after taxes) | |

| Return on Equity (after taxes) | |

| Earnings Per Share | |

| Dividend Yield | |

| Price Earnings Ratio |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started