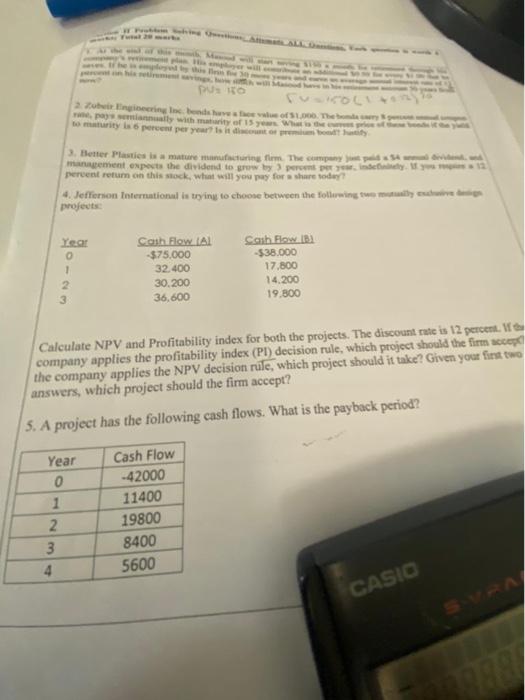

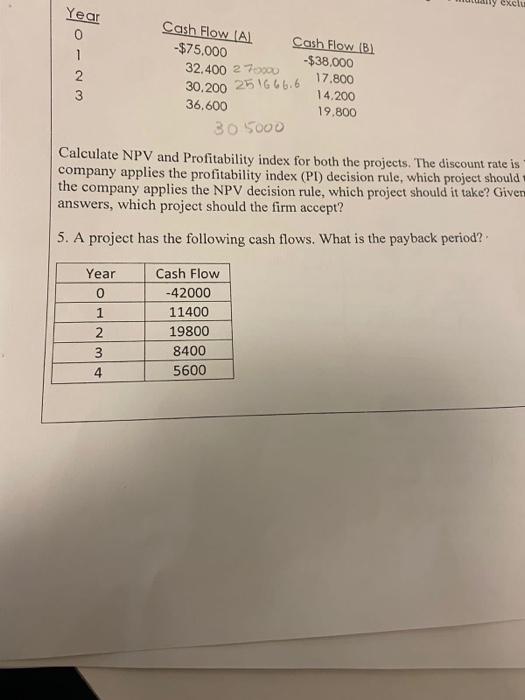

www Pus Engineering in bed of the may with many of you maturity is 6 percent per year is it by 3. Better Plastics is a mature manufacturing them. The 54 management expects the dividend to grow by property percent return on this stock, what will you pay for share today! 4. Jefferson International is trying to choose between the following they have projects Year 1 2 3 Cash Flow Al -$75.000 32.400 30.200 36,600 Cash Flow -$38.000 17.800 14.200 19.800 Calculate NPV and Profitability index for both the projects. The discount rate is 12 percent. company applies the profitability index (Pl) decision rule, which project should the firm the company applies the NPV decision rule, which project should it take? Given your fins two answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 2 3 4 Cash Flow - 42000 11400 19800 8400 5600 CASIO exclu Year O- Cash Flow (A) -$75,000 WNO Cash Flow (B) -$38.000 32.400 270000 2 17.800 30.200 25 1666.6 3 14.200 36,600 19.800 30 Sooo Calculate NPV and Profitability index for both the projects. The discount rate is company applies the profitability index (Pl) decision rule, which project should the company applies the NPV decision rule, which project should it take? Given answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 Cash Flow -42000 11400 19800 8400 5600 2 3 4 www Pus Engineering in bed of the may with many of you maturity is 6 percent per year is it by 3. Better Plastics is a mature manufacturing them. The 54 management expects the dividend to grow by property percent return on this stock, what will you pay for share today! 4. Jefferson International is trying to choose between the following they have projects Year 1 2 3 Cash Flow Al -$75.000 32.400 30.200 36,600 Cash Flow -$38.000 17.800 14.200 19.800 Calculate NPV and Profitability index for both the projects. The discount rate is 12 percent. company applies the profitability index (Pl) decision rule, which project should the firm the company applies the NPV decision rule, which project should it take? Given your fins two answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 2 3 4 Cash Flow - 42000 11400 19800 8400 5600 CASIO exclu Year O- Cash Flow (A) -$75,000 WNO Cash Flow (B) -$38.000 32.400 270000 2 17.800 30.200 25 1666.6 3 14.200 36,600 19.800 30 Sooo Calculate NPV and Profitability index for both the projects. The discount rate is company applies the profitability index (Pl) decision rule, which project should the company applies the NPV decision rule, which project should it take? Given answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 Cash Flow -42000 11400 19800 8400 5600 2 3 4